Even as automakers are going ahead with new car, bike, scooter, CV launches, the story is completely different at dealership levels. Sales of two wheelers and four wheelers have been adversely affected by various factors. Rising interest rates, escalating insurance costs, shift to BS6, fuel prices along with the GST roll out have all hampered Indian automobile industry.

The end result effects have started to show up at dealership levels. This decline in sales has caused a cash crunch with company dealers, who are now sitting on inventory stock of up to 50 days, instead of the 20-25 days earlier.

Some dealers have their own yards, but those who don’t have rented space for parking the unsold stock. Apart from this added cost, dealers also have to contend with increased staff costs and rising overheads which has led to falling margins.

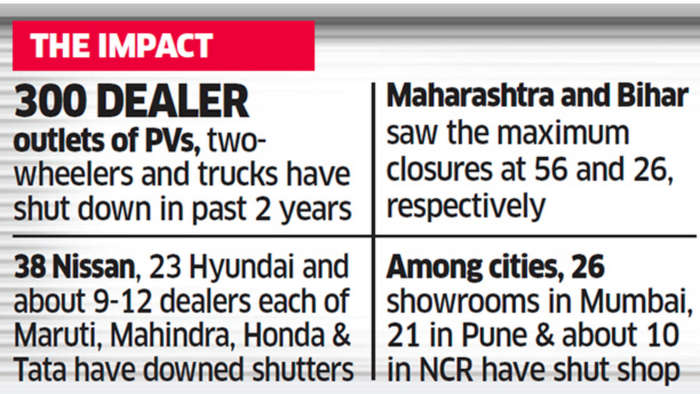

Prior to GST coming into effect in July 2017, auto dealers had time of a few months to pay sales tax and VAT. However with the introduction of GST, payment of taxes has to be done in the same month of billing and this affects working capital to a very great extent. On an average, two vehicle dealerships shut shop every week and this has been going on for the past two years. The Indian automotive retail sector faces losses of Rs.2,000 crores and over 205 dealers have wound up operations and 300 sales outlets have been shut.

As against dealers in global markets which operate on margins of 8-12 percent, automobile dealers in India have been surviving on margins as low as 2.5-5 percent. Ashish Kale, President of Federation of Automobile Dealers Association (FADA) has cited that the pace at which dealerships are closing is something that the industry has not seen before. The impact of GST along with higher inventory costs and liquidity crunch has all combined to create this negative impact.

Among all the states in India, Maharashtra and Bihar has seen the most number of automobile dealerships shut shop to the extent of 56 and 26 respectively. Of all the cities, Mumbai and Pune have been most affected. Mumbai has seen shutdown of 26 showrooms while Pune has seen shut down of 21 showrooms.

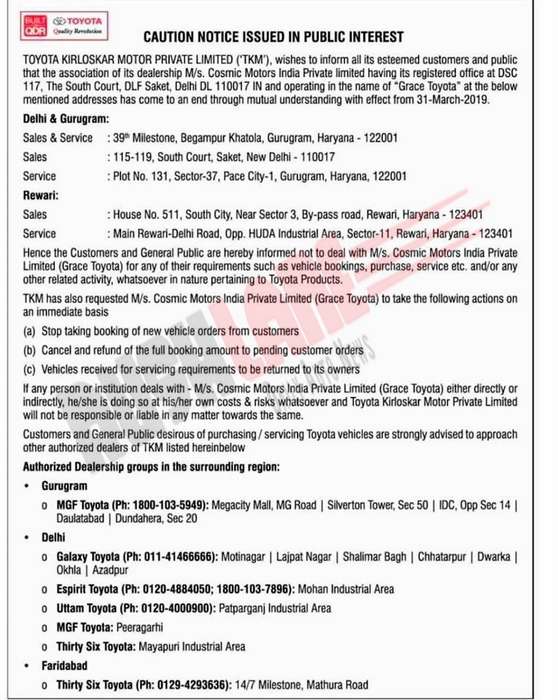

This includes 38 Nissan dealers, 23 Hyundai dealers and about 9-12 dealers of Maruti, Mahindra, Honda and Tata Motors have also shut down. Other manufacturers like Toyota, Renault, Ford, Volkswagen, Skoda, etc dealers have also shut down. This is not only noted in the passenger vehicle segment but also where two wheeler and commercial vehicle sales are concerned.

While dealers are questioning the automakers decision to expand dealership networks by 15-20 percent especially at a time when sales are down, Ashish Kale of FADA has said that the time has come to cap the number of dealers in India as is seen in international markets where dealerships are added based on the prospective car market. If this is not done, the number of dealers shutting shop will only increase.