Audi India sales dips below 2k units at its lowest in 11 years

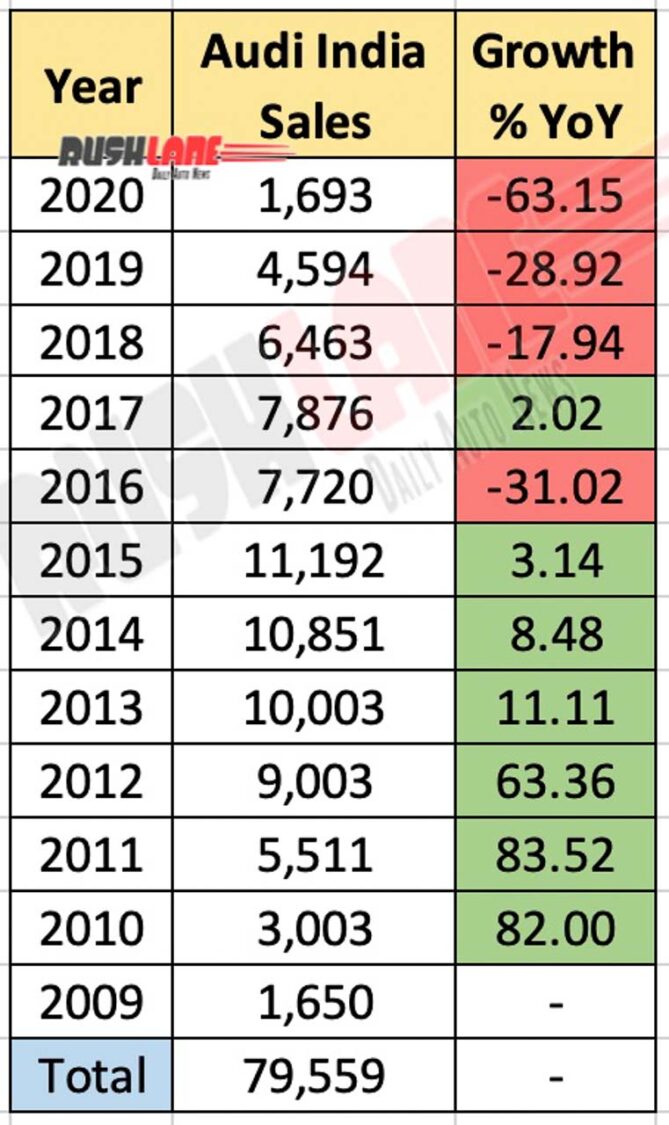

Audi India has reported 2020 sales at 1,693 units. This is the lowest since 2010 when sales was reported at 3,003 units. At the start of previous decade, Audi India saw a meteoric rise in a few short years. In 2013, the manufacturer led the table and pipped BMW India to the post by being the top seller that year.

The next year, in 2014 it maintained No 1 position, but Mercedes Benz India had almost caught up. In 2015, Audi lost the No 1 position to Mercedes Benz. Since then, sales has been on the decline. In 2018, Audi lost the No 2 position to BMW India. 2020 sales figures are the lowest ever of Audi in India since last 11 years.

To be fair, the luxury car market was already on decline in 2019. Covid-19 pandemic related business limitations and conditions further tore into the system, and ripped it. In the last 3 years Audi India has continued to report decline. Each year, the gap widens.

Back in 2018 sales fell 17.94 percent to 6,463 units. In 2019, sales decline stood at 28.92 percent down to 4,594 units. 2020 sales decline is at 63.15 percent. In 2019 itself, Audi India sales was reported at the lowest in 9 years. That number has further fallen. And 2020 sales numbers is its lowest in 11 years.

Luxury car sales total dips

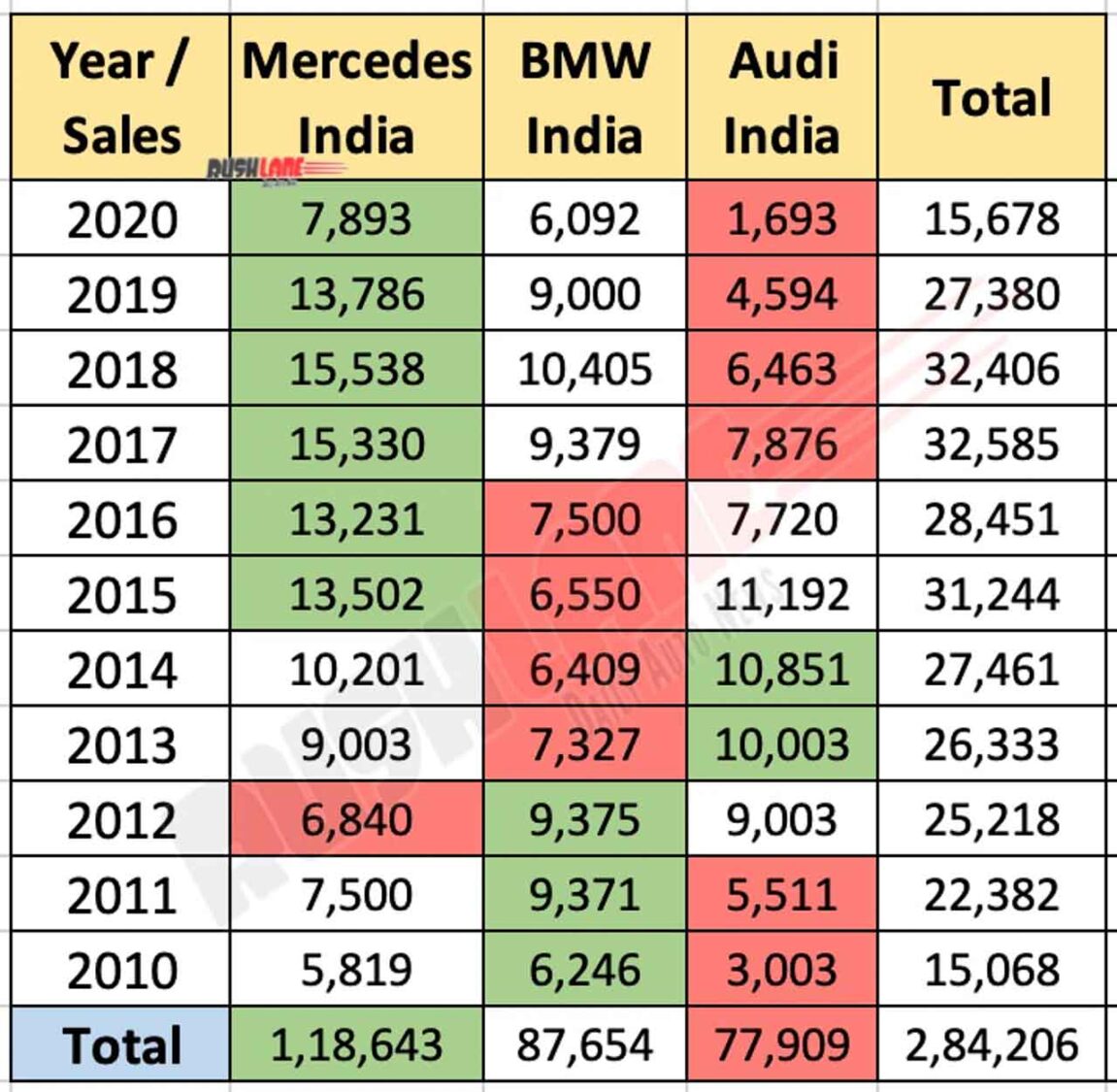

Luxury car manufacturers in India took a beating in 2020. As it stands, cumulative sales of the leading trio, Mercedes-Benz, BMW and Audi fell to 15,678 units. This is the lowest in a decade. The last time sales were in the vicinity of 15k units was back in 2010, when cumulative sales was reported at 15,068 units.

The best year being 2017 when the top three posted a total of 33,006 units. With the inclusion of JLR and Volvo’s numbers, the total had for the first time crossed 40k units. A feat that was repeated in 2018.

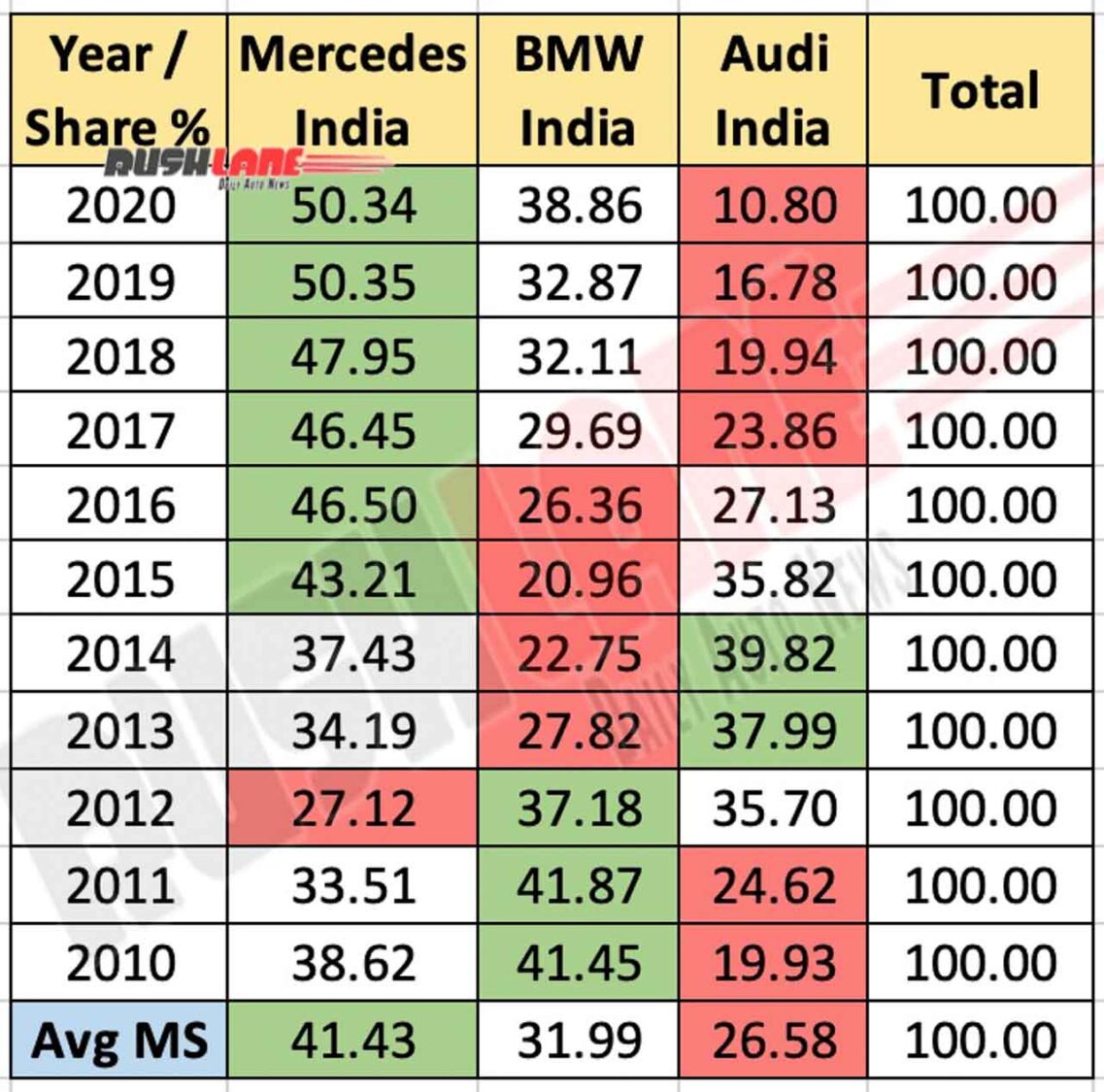

Even though the german trio sees total volumes decline, Mercedes has been consistent in claiming the lion’s share. At last count that’s at 50 percent. Audi India on the other hand is now down to just under 11 percent market share among the top three. Below table shows how the trio’s market share in India have been in the last 11 years.

Audi India on the road to 2022

In early 2019, Audi India had said sales growth wasn’t expected for 2019 and 2020. The company was focused on improving profitability at dealerships, and transitioning to BS6 emission norms. At the time, no one could have foreseen that 2020 will endure disruptions that are unheard of in the modern world.

| Year / Sales | Mercedes India | BMW India | Audi India |

|---|---|---|---|

| 2020 | 7,893 | 6,092 | 1,693 |

| 2019 | 13,786 | 9,000 | 4,594 |

| 2018 | 15,538 | 10,405 | 6,463 |

| 2017 | 15,330 | 9,800 | 7,876 |

| 2016 | 13,231 | 7,500 | 7,720 |

| 2015 | 13,502 | 6,550 | 11,192 |

| 2014 | 10,201 | 6,200 | 10,851 |

| 2013 | 9,003 | 7,327 | 10,003 |

| 2012 | 6,840 | 9,375 | 9,003 |

| 2011 | 7,500 | 9,371 | 5,511 |

| 2010 | 5,819 | 6,246 | 3,003 |

| Total | 1,18,643 | 87,866 | 77,909 |

Audi India has endured major problems at the dealership front, having to close its single largest NCR dealership in 2018. A market from where Audi secures maximum sales. Prior to 2020, Audi India was looking forward to getting back in the volumes game in 2022. However, it’s now left to be seen how quickly those plans materialise following market disruptions in 2020.