The Indian automotive industry is making a slow recovery from the two-month COVID-19 lockdown

The Society of Indian Automobile Manufacturers (SIAM) estimates an overall sales decline in the range of 26-45% by the end of FY2021, due to the ongoing COVID-19 crisis. The Indian automotive industry still suffers from depleting investments and weaker economic situations although sales charts are making a gradual recovery from the effects of lockdown.

Rajan Wadhera, President of SIAM, states that the country’s automotive scenario is witnessing considerable scepticism due to the outbreak. The number of COVID-19 positive cases are rising at or near manufacturing plants. Tractor and other agricultural machines face a held-up demand due to bumper crop (unusually productive) harvests and other remunerations.

On the other hand, the pandemic has disrupted existing supply lines and logistics. The moment when COVID-19 began to peak in its source country, Indian OEMs that depend on Chinese suppliers had notified an increase in waiting periods.

Q1 FY2021 Sales Figures

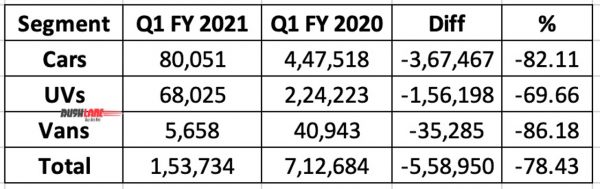

In the first quarter of FY2021, the Indian automotive market sold only 153,734 units compared to 712,684 in the previous fiscal. This is a massive slump of 78%. If we divide the sales into major categories, one can understand that OEMs are facing the worst business conditions in recent automotive history.

Q1 FY2021 saw passenger cars achieving only 80,051 units (down by 82%) compared to 447,518 units back in FY2020. Utility vehicles (in passenger and commercial categories) hit 68,025 units as against 224,223 units in Q1 FY2020. Vans faced the steepest fall (86%) after returning 5,658 units in sales in the first quarter, in comparison to 712,684 units in the same period, a year ago.

Market Shares Of Major Automakers

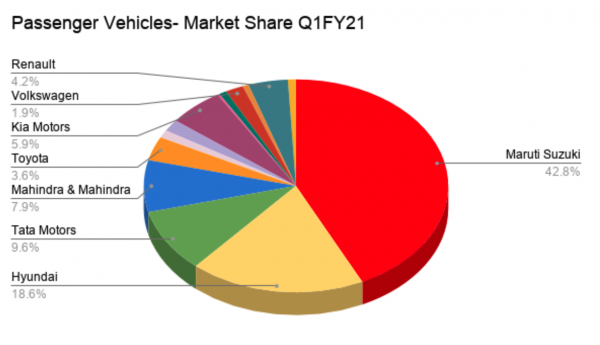

In the affordable PV (passenger vehicles) segment, Maruti Suzuki continues to dominate. The Indian automaker commands a market share of 42.8% (down from 50+ some months ago), followed by Hyundai Motor India and Tata Motors at 18.6% and 9.6%, respectively. Skoda Auto Volkswagen India contributes only 1.9%.

Meanwhile, the CV market is dominated by Mahindra & Mahindra group at a share of 49.3%. Tata Motors marks 29.3% compared to Ashok Leyland’s 10.7%. Volvo Eicher and Marui Suzuki (SuperCarry) come in at 4.9% and 3.7%, respectively.

Unsurprisingly, Hero MotoCorp stands first at a market share of 55.4%. Bajaj Auto follows at 20.7% while brands such as Honda Motorcycle India, Royal Enfield, TVS Motor Company, Yamaha Motor India and Suzuki Motorcycle showcase single-digit figures. Among scooters, Honda Motorcycle India commands 50.1%, overtaking TVS Motor Company (23.7%) and Hero MotoCorp (11.5%).

Finally, the three-wheeler market sees Piaggio Vehicles making a strong statement at 43.6%. Following close is Bajaj Auto at 41.61%.