Increasing fuel prices have worked as a catalyst to boost electric two-wheeler sales in the country

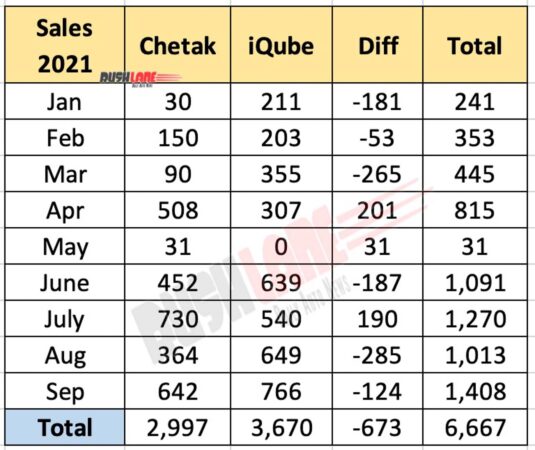

While there is no dearth of electric two-wheeler brands in the country, Chetak and iQube are currently the only ones offered by established auto companies. Barring a few months, combined sales of Chetak and iQube have consistently risen since January 2021. From 241 units in January, sales are now at 1,408 units in September.

This could be indicative of growing consumer confidence in electric two-wheelers. The shift is happening due to several reasons including rising fuel prices and subsidies announced by the government.

Prices of many electric two-wheelers are now at par with popular petrol-powered two-wheelers. With subsidies, some electric scooters are even priced lower than popular petrol scooters. Adequate range and availability of charging infrastructure are other factors contributing to increasing sales of electric vehicles.

Electric Scooter Sales – 5X YoY growth

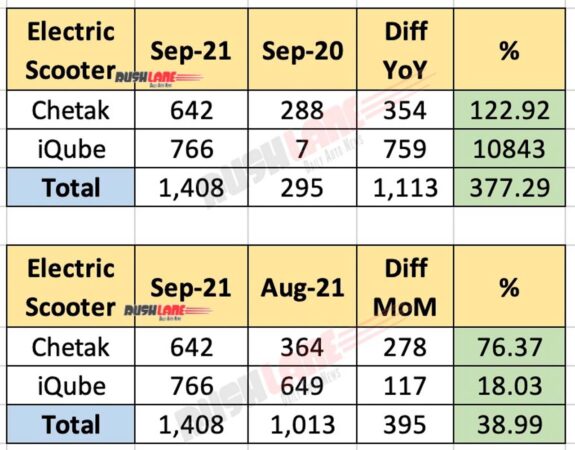

Combined sales of Chetak and iQube was 295 units in September last year. Comparing with September 2021, the numbers have risen quite close to 5X in YoY terms. Since June this year, combined sales of Chetak and iQube has been consistently above the 1k mark. Total sales during Jan-Sep period are 6,667 units. TVS iQube is ahead with 3,670 units, as compared to 2,997 units of Bajaj Chetak.

Chetak sales in September is at 642 units. YoY numbers have more than doubled, as compared to 288 units sold in September last year. Chetak MoM growth is at 76.37%, as compared to 364 units sold in August 2021. iQube sales in September is at 766 units. YoY growth is 10843%, as compared to 7 units sold in September last year. MoM growth is 18.03%, as compared to 649 units sold in August 2021.

Shortage of auto components

While global shortage of auto components has affected most OEMs, companies like Bajaj are among the ones who have been hit hardest. This is why sales are on the slower side despite getting high number of bookings. The shortage situation, especially that of semiconductors is expected to continue till next year. Tech companies worldwide are making fresh investments to open new facilities and boost production at existing units. Supply situation may take several months to return back to normal.

In the near future, other mainstream auto companies like Honda and Hero MotoCorp are expected to launch their respective electric two-wheelers. Honda Motorcycle & Scooter India (HMSI) is expected to launch their electric scooter by next fiscal year. Honda BENLY e electric scooter has already been spotted testing here. However, it’s not certain if India will get BENLY e electric scooter or some other model. The electric scooter being planned by Honda will be targeted at global markets as well.

Hero MotoCorp is expected to launch its first electric product in March 2022. Another model will be launched in second half of next year. Hero had partnered with Taiwan-based EV manufacturer Gogoro to develop its electric scooters. Gogoro will also be involved in developing battery swapping infrastructure for Hero’s upcoming electric two-wheelers. Bajaj and TVS will be observing these developments closely.