Tata Motors gains significantly in market share while leading OEMs – Maruti and Hyundai note YoY degrowth

Major pandemic-related setbacks, global semiconductor shortage, introduction of new and stringent safety standards and sudden spurt in demand for electric vehicles have all been a part of the past year’s constraints faced by leading car makers in India.

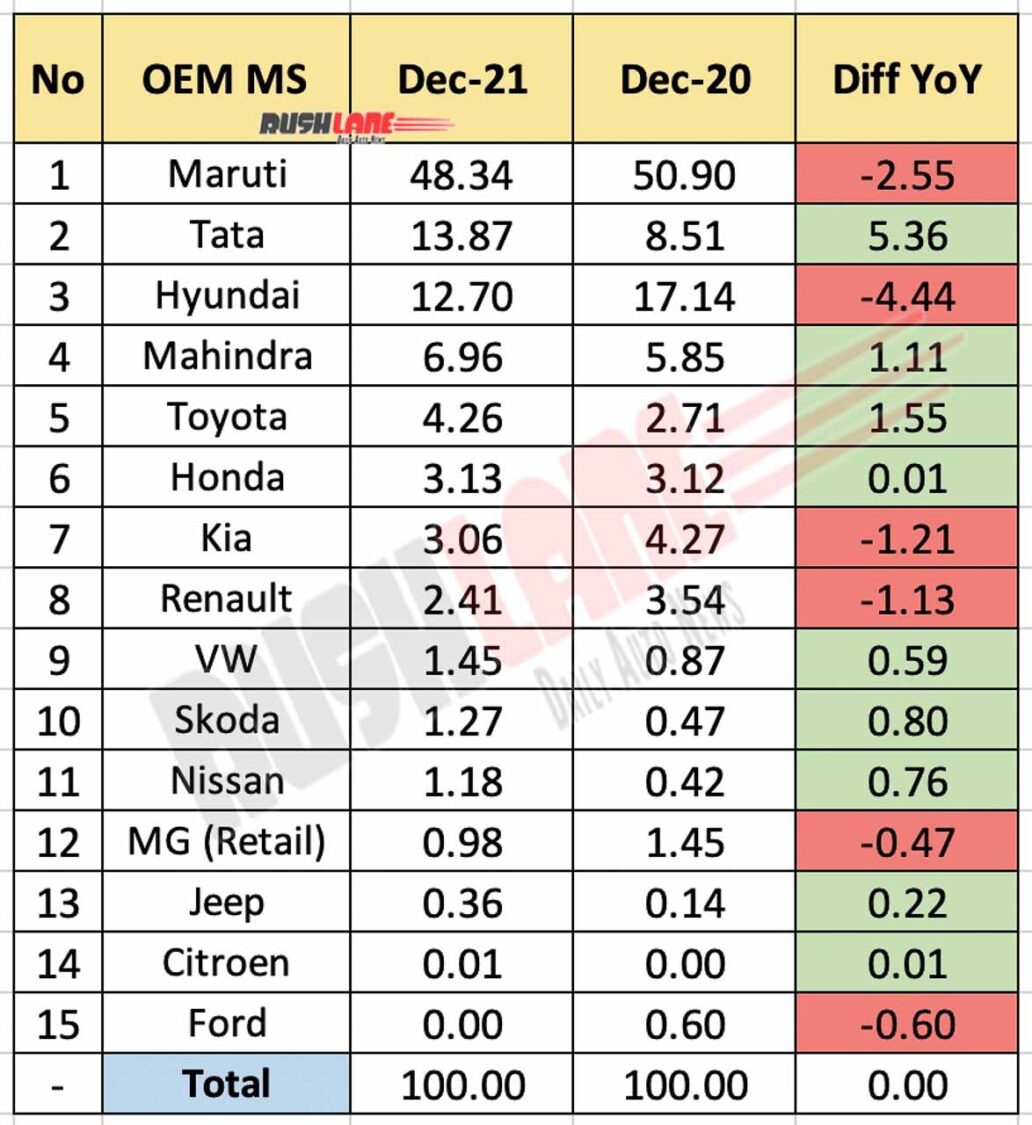

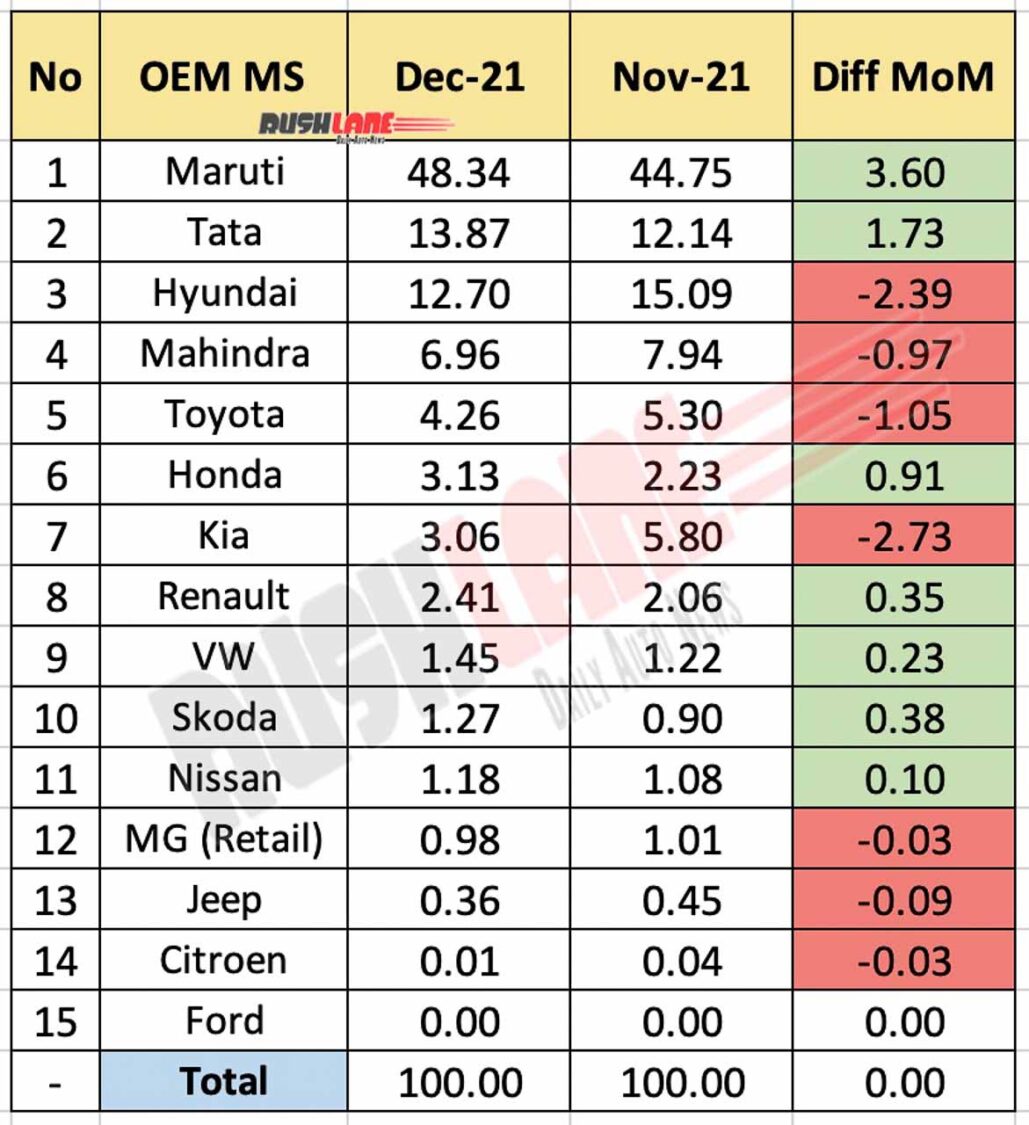

Leading three automakers, Maruti, Tata and Hyundai commanded a near 75 percent market share among top 15 OEMs in India. The past month has seen some highs and lows with Maruti, Hyundai, Kia and Renault posting a YoY dip in market share. However, MoM market share of Maruti and Tata increased considerably. Tata Motors has seen its sales surge to an all time high, thereby allowing it to become the second best-selling automaker in India, taking the place of Hyundai.

Maruti Suzuki Market Share December 2021

Once again it was Maruti Suzuki that was the holder of highest market share in India with YoY de-growth but MoM increase. Maruti’s market share which had stood at 50.90 percent in December 2020 dipped 2.55 percent to 48.34 percent in the past month. MoM share however, increased 3.60 percent over 44.75 percent share held in November 2021.

The company’s share in the mid-SUV segment is still quite low while the company has said that it will not launch an electric car in the Indian market before 2025. Maruti has stated that for the time being it will concentrate on flex-fuel vehicle development and introducing more CNG products in the Indian market.

At No. 2 was Tata Motors with a 5.36 percent YoY growth in market share to 13.87 percent last month, up from 8.51 percent held in December 2020. It was also a 1.73 percent MoM increase over 12.14 percent held in November 2021.

Hyundai Motor India at No. 3 saw its market share dip 4.44 percent, the highest in this segment to 12.70 percent in December 2021, down from 17.14 percent held in December 2020. MoM market share also fell 2.39 percent from 15.09 percent held in November 2021.

Lower down the order, Mahindra (6.96 percent), Toyota (4.26 percent) and Honda (3.13 percent) all posted a YoY growth in market share. On a MoM basis, it was only Honda market share that increased 0.91 percent from 2.23 percent in November 2021 to 3.13 percent in the past month.

Kia India has seen its YoY and MoM market share dip 1.21 percent and 2.73 percent respectively to 3.06 percent in December 2021. Kia Carens has been unveiled and is slated to be launched in India in early 2022 which could bring in more sales in the months ahead. The Carens could be priced between Rs 15 lakh to Rs 20 lakh and will rival the Hyundai Alcazar, Tata Safari, MG Hector Plus and Mahindra XUV700 in its segment.

Even as Renault India, at No. 8 noted a YoY de-growth in terms of market share by 1.13 percent to 2.41 percent from 3.54 percent held in December 2020, its MoM share grew marginally by 0.35 percent from 2.06 percent held in November 2021.

VW, Skoda and Nissan – Share Growth

Noting a growth in market share in both YoY and MoM basis was VW (1.45 percent), Skoda 1.27 percent) and Nissan (1.18 percent). Skoda sales have escalated significantly in December 2021 thanks to the introduction of Kushaq which brought about an increase in sales volumes while the upcoming Slavia is also expected to be well received in the country.

MG Motor saw its market share dip 0.47 percent on a YoY basis to 0.98 percent while MoM share also fell 0.03 percent over 1.01 percent held in November 2021. MG Motor have also confirmed plans to expand battery-powered cars in addition to the ZS EV. Its second electric model will be a crossover based on a global platform. Trailing the list was Jeep (0.36 percent) and Citroen (0.01 percent) while Ford has announced its exit from India.