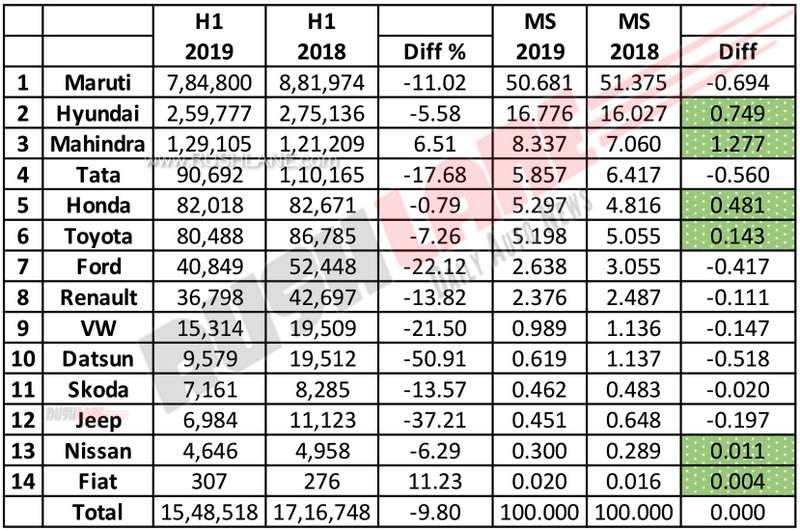

The slowdown in auto industry is getting worse with every passing day, as can be seen with plant shutdowns, production cuts, job losses and rising inventory levels. Even though new products are being lapped up in thousands within days, their overall contribution is not enough to put brakes on the slowdown. H1 2019 car sales figures tell a sad story where most carmakers have registered negative growth when compared to sales numbers of H1 2018.

With the exception of Mahindra and Fiat, all other carmakers have registered negative growth in H1 2019. India’s largest carmaker Maruti Suzuki has registered -11.02% de-growth, down from 8,81,974 units in H1 2018 to 7,84,800 units in H1 2019.

Maruti’s market share has also come down from 51.37% to 50.68% during the same period. Hyundai is the second largest carmaker in India and it too has registered negative growth of -5.58% in H1 2019. However, there’s some relief for Hyundai, as its market share has gone up by 0.74%. Hyundai has been hugely successful with some of its new launches such as Venue that has become the bestselling compact SUV in the country.

With 8.33% market share, Mahindra is the third largest carmaker in India. Mahindra has registered positive growth of 6.51% in H1 2019, up from 1,21,209 units in H1 2018 to 1,29,105 units in H1 2019. The company’s market share has also improved by 1.27%.

At number four, Tata Motors has registered de-growth of -17.68%. Sales have slid from 1,10,165 units in H1 2018 to 90,692 in H1 2019. Tata’s market share has also come down by 0.56%. Most other carmakers have registered negative growth in H1 2019.

These include Datsun (-50.91%), Jeep (-37.21%), Ford (-22.12%), Volkswagen (-21.50%), Renault (-13.82%), Skoda (-13.57%), Toyota (-7.26%), Nissan (-6.29%) and Honda (-0.79%). Fiat has registered positive growth of 11.23%, but its overall sales numbers are too small to be counted as an achievement.

To reverse the downtrend, the auto industry has made some key demands from the government such as reduction of GST from 28% to 18%, an effective solution for liquidity crunch, and prolonging the shift to electric vehicles.

The government has discussed the issues with industry stakeholders and is expected to make some announcements in the coming weeks. A revival package at this time will be most appropriate in view of the approaching festive season.