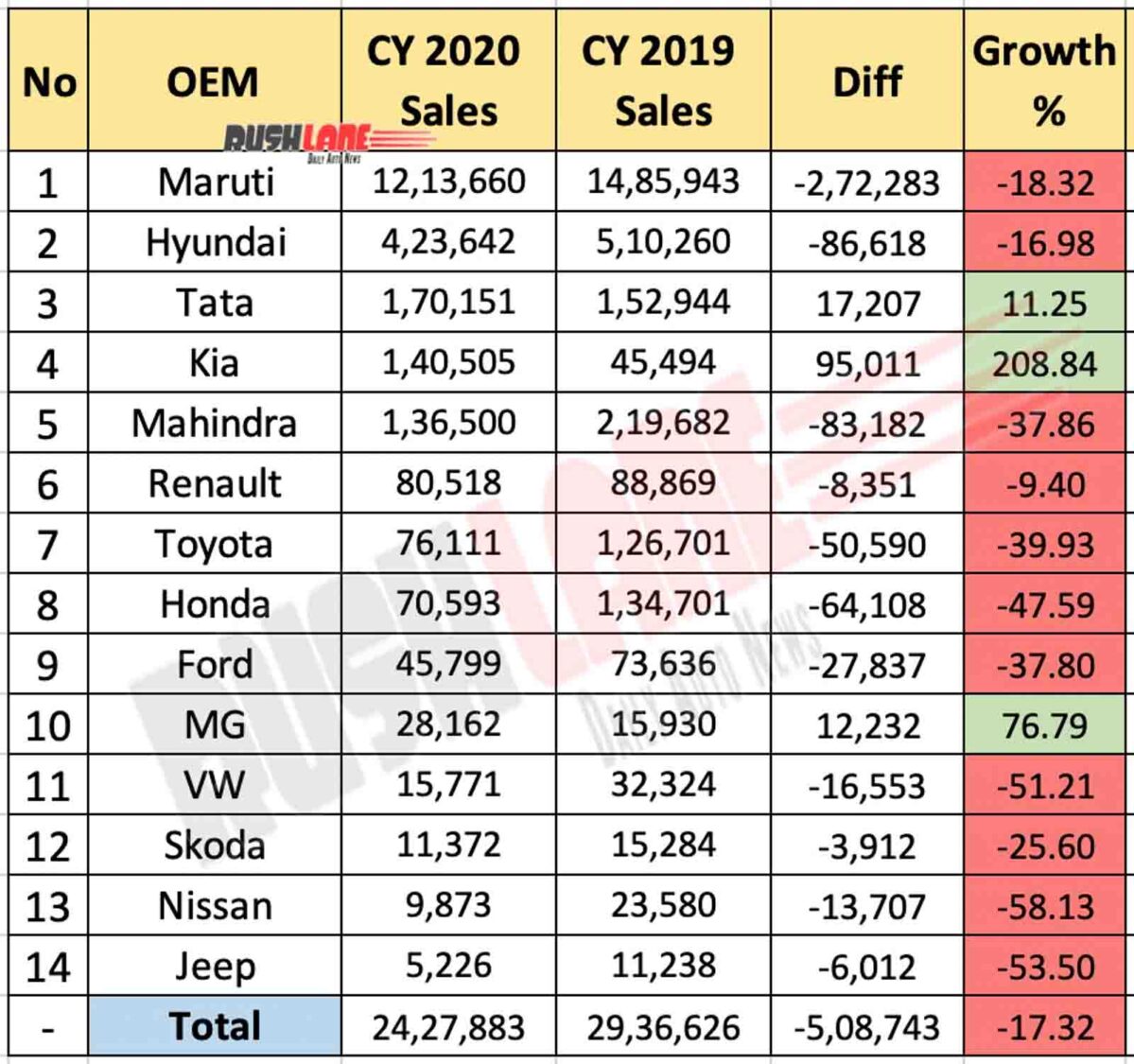

The past calendar year has seen total car sales of 24 lakh units, a de-growth of 17 percent

Even as the first half of 2020 was bogged down by slowdown and lockdown in view of the Covid-19 pandemic, the year ended on a more promising note for a few automakers in the country. When taking into account cumulative passenger vehicle sales in the past year, total sales stood at 24,27,883 cars down 17.3 percent as against 29,36,626 cars sold in CY 2019.

Maruti Suzuki Market Topper

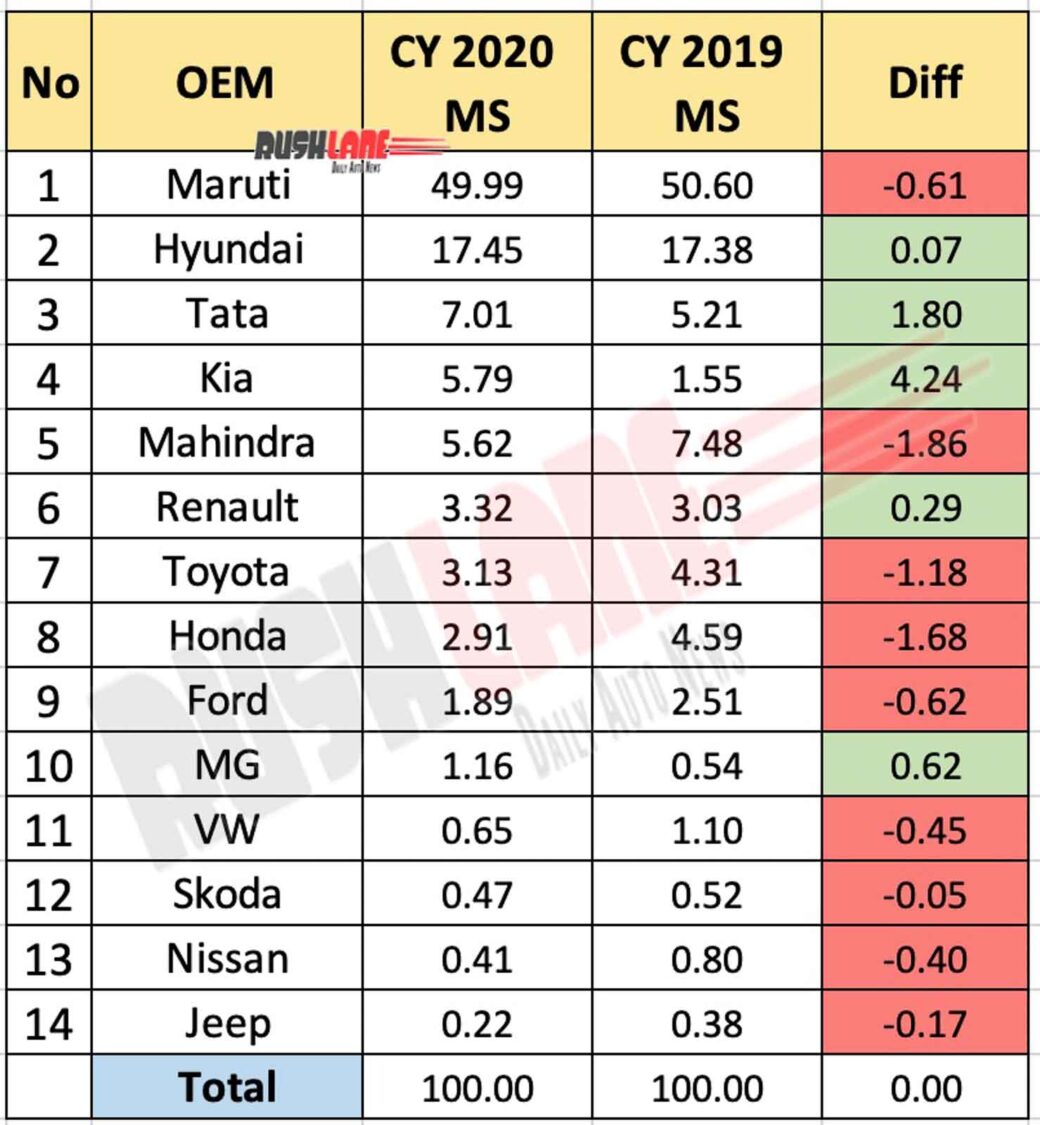

Maruti Suzuki once again topped the list of best-selling OEMs in CY2020. Total sales in CY 2020 stood at 12,13,660 units while sales in CY 2019 has stood at 14,85,943 units.

Though Maruti has maintained No 1 position, they are losing out on sales as well as market share to new rivals. In entry level segment, they are losing sales to the likes of Kwid / Triber / Tiago while in mid-segment cars like Nexon, Sonet, Venue are eating into their market share.

Hyundai Motors was in second spot with 17.4 percent de-growth with 4,23,642 units sold down from 5,10,260 units sold in the past year. Hyundai continues to command a 17.4 percent market share despite de-growth. Hyundai sales have declined, but their market share has increased.

Tata Motors emerged as the 3rd best-selling OEM in CY 2020. Total PV sales in the past year stood at 1,70,151 units. It was among the few OEMs to report positive YoY growth which stood at 11.3 percent over 1,52,944 units sold in CY2019. In fact, it was Tata Motors and new comers Kia and MG Motor that were the only OEMs to post positive growth in CY 2020.

Growth reported by Kia Motors in CY2020 was at a massive 208.84 percent with market share of 5.8 percent. Sales of 1,40,505 units were reported in CY2020, up from 45,949 units sold in the Jan-Dec 2019 period. Consistently featured among the top 5 carmakers in India each month, the Kia Seltos and Sonet have been well received in the country.

Mahindra was at No. 5 with sales de-growth of 37.9 percent with sales dipping by 83,182 units to 1,36,500 units in CY2020 as against 2,19,682 units sold in CY 2019. With new launches planned for 2021, Mahindra is likely to deliver higher sales this year.

MG Motor was another automaker to report positive growth in the past calendar year. Growth stood at 77 percent with total sales of 28,162 units, an increase by 12,232 units as against 15,930 units sold in CY 2019. The company currently commands a 1.2 percent market share and its Hector SUV has seen the most demand in the country along with the Gloster and ZS EV.

Renault, Toyota, Honda De-Growth

Renault noted the least de-growth in PV sales in CY2020 which stood at 9.40 percent with Toyota and Honda both reporting 39.93 percent and 47.61 percent de-growth respectively. Ford India was another OEM to report significant de-growth of 37.80 percent while lower down the order were Volkswagen, Skoda, Nissan and Jeep.