The entire auto industry is in turmoil. Every automaker is facing diminishing sales and lowered market share with no respite in sight. Sales of passenger vehicles have registered the steepest decline in the past 18 years to the extent that top automakers like Maruti, Hyundai, Tata, Honda, Mahindra etc have been forced to shut factories temporarily so as to reduce piling stocks.

SIAM has reported the 7th consecutive month of falling domestic passenger vehicle sales. Vehicle sales in India are counted as factory dispatches and not on retail sales. These diminishing sales come at a time when automakers have been investing heavily into R&D especially with new safety and emission norms coming into effect.

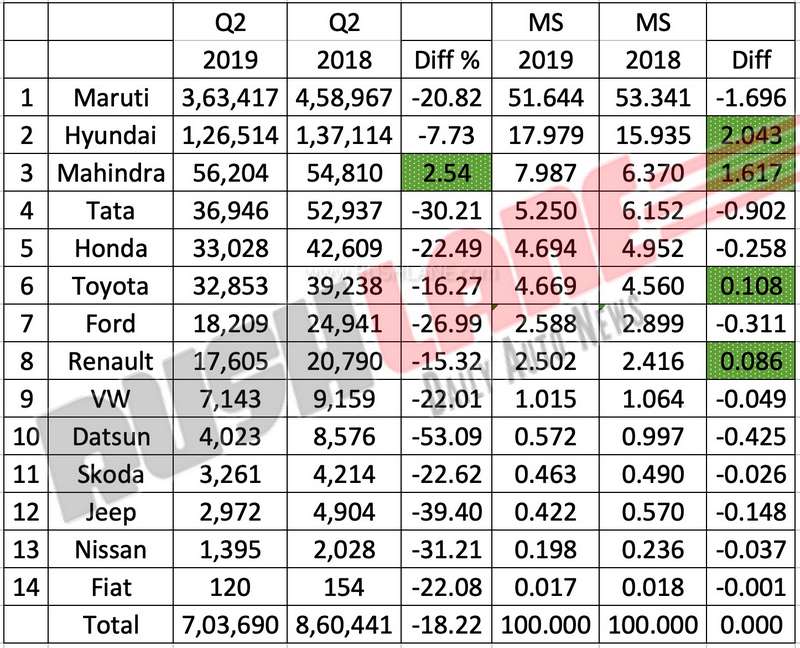

We compare sales of 14 automakers in India taking into account sales in Q2 19 as compared to sales in Q2 18 and can see therein that each of these automakers, with the exception of Mahindra and Mahindra have experienced both negative sales and a majority have also seen a dip in market share.

Starting with the leading automaker in India, Maruti Suzuki India Limited, sales in Q2 19 dipped 20.82 percent to 3,63,417 units as compared to sales of 4,58,967 units in Q2 18. Market share of the company also fell from 53.341 % to 51.644 % (highest decline in market share). Despite these falling sales, the company still managed to command more than 50 percent of total sales in the passenger vehicle segment in Q2 19.

Hyundai Motors came in second on the list with sales dipping 7.73 period in the Q2 19 period with 1,26,514 units sold as against 1,37,114 units sold in the Q2 18 period. However, despite these lower sales, market share increased 2.043% in Q2 19, with Hyundai Venue contributing primarily to this increase.

Posting encouraging results both in terms of Q2 19 sales and in market share was Mahindra; with a 2.54 percent increase in sales to 56,204 units in Q2 19 as against sales of 54,810 in Q2 18. Market share also increased 1.617 %. It was Mahindra’s new launches of XUV300 and Marazzo that aided the company to post positive growth even when other major automakers are struggling with sales.

Tata Motors has seen a 30.21% dip in sales in Q2 19 over Q2 18. Sales which stood at 52,937 units in the Q218 period, went down to 36,946 units in the Q2 19. Market share also dipped marginally by 0.902 %. The company’s upcoming Altroz premium hatchback could help it gain in terms of sales in the months ahead.

Toyota Kirloskar Motors also reported de-growth. Sales dipped 16.27 percent from 39,238 units in Q2 18 to 32,853 units in Q2 19. However market share increased marginally by 0.108 %. Honda Cars India sales dipped 22.49 percent in Q219 to 33,028 units as against 42,609 units sold in the same period of the previous year. Market share also fell 0.258 %.

Renault India sales in the Q2 19 period fell 15.32 percent. Sales which had stood at 20,790 units in Q2 18 dipped to 17,605 units in the Q2 19 period while market share increased 0.086 %. Renault is all set to launch the Triber 7 seater in August 2019. It is based on a modified version of the Renault Kwid’s CMF-A platform and will be positioned above the Kwid in the company line up.

Ford sales dipped 26.99 percent to 18,209 units in Q2 19 as compared to 24,941 units sold in the same period of the previous year. Market share dipped marginally by 0.311 %. Volkswagen India also saw lower sales in the past quarter to 7,143 units, down 22.01 percent as compared to sales of 9,152 units in the Q2 18 period. Datsun brand experienced the highest percentage fall by as much as 53.09 percent to 4,023 units in Q2 19 as compared to sales of 8,576 units in Q2 18. Market share dipped 0.425 %.

Skoda, Jeep, Nissan and Fiat India also reported de-growth both in terms of sales and market share in the past quarter. Skoda sales dipped 22.62 percent to 3,261 units while market share fell 0.026 %. Jeep sales fell 39.40 % to 2,972 units while market share dipped 0.148 %.

Nissan India is currently on a job cutting spree in the country with 1,700 jobs likely to be cut. Sales in the past quarter dipped 31.21 percent to 1,395 units as against 2,028 units sold in the same period of the previous year. Their market share fell 0.037 %. Fiat India sales fell 22.08 percent to just 120 units in the past quarter as compared to 154 units sold in Q2 18. Fiat car sales will end by Oct 2019 as the cars do not meet safety norms.