As has been seen over the past several months, auto sales continued to remain under pressure. The festive season, large scale discounts and benefits offered by automakers and good monsoons failed to bring in any respite company sales.

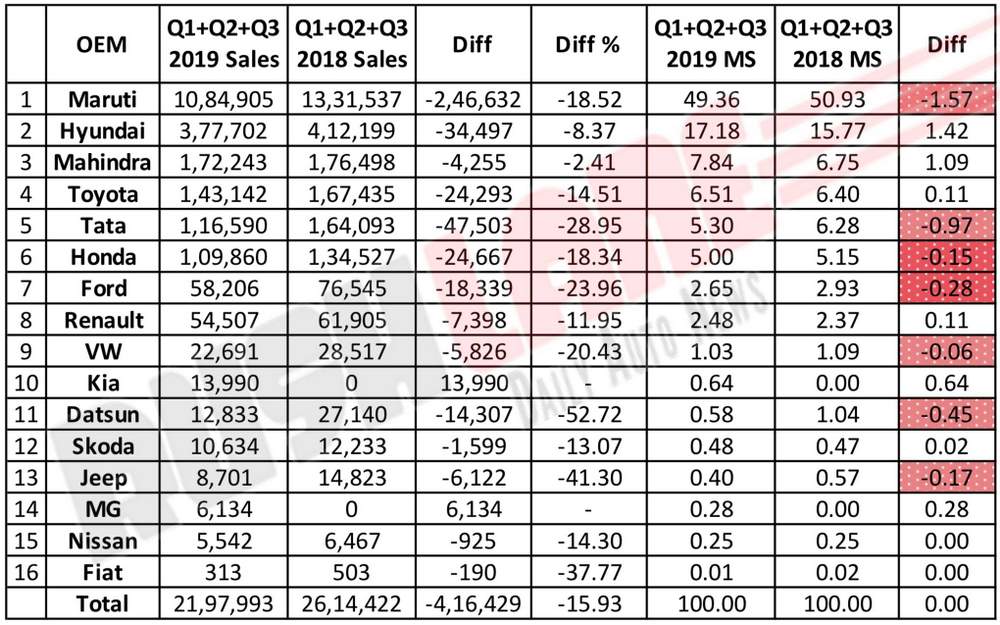

This prolonged slowdown can be seen in the accompanying table wherein we compare Q1, Q2 and Q3 sales (Jan-Sep) in 2019 as against sales in the corresponding periods of the previous year. It can be noted from the table that every automaker in the book has noted negative sales with the exception of new entrants such as Kia Motors and MG Motors. These two automakers have been noting outstanding sales where the Kia Seltos and MG Hector are concerned.

Total sales in the first three quarter of 2019 stood at 21,97,993 units as against sales of 26,14,422 units sold in 2018 period, a different of 4,16,429 units or 15.93 percent. Analysts are of the opinion, that this will be the scenario for the coming months as well with no rebound anticipated anytime soon.

Maruti Suzuki India Limited continued to rule the list as the top automaker with sales of 10,84,905 units in the first three quarters of 2019 as against 13,31,537 units sold in the same period of the previous year relating to an 18.52 percent decline. Market share also dipped 1.57 percent to 49.36 percent as against 50.93 percent in the 2018 period.

Hyundai Motors at No. 2 on the list experienced de-growth of 8.37 percent when taking into account sales of 3,77,702 units in the first three quarters of 2019 as against sales of 4,12,199 units sold in the same period of 2018. Market share however, increased 1.42 percent to 17.18 percent as compared to an earlier 15.77 percent.

Mahindra and Toyota too saw a marginal increase in market share by 1.09 and 0.11 percent respectively in the past 3 quarters of 2019 as against market share in the same period of 2018 even as sales dipped 2.41 percent and 14.51 percent respectively.

Speaking exclusively of market share, Renault, Kia Motors, Skoda and MG Motors also noted marginal increase in market share while market share of Tata Motors, Honda, Ford, VW Datsun and Jeep dipped to some extent.

Tata Motors was in a fifth spot on the list with sales down 28.95 percent to 1,16,590 units in the past three quarters of 2019 as compared to sales of 1,64,093 units in the same period of 2018, a difference of 47,503 units. Honda and Ford sales also dipped 18.34 percent and 23.96 percent respectively while Renault sales dipped 11.95 percent to 54,507 units in the past 3 quarters, down 7,398 units as compared to sales of 61,905 units in the same period of the previous year.

These results have caused an upheaval in the auto industry in India which is the fourth largest in the world. Large scale Job loss is feared in an industry that employs more than 3.5 crore persons both directly and indirectly. Many company dealerships are shutting shop and auto companies are declaring non working days so as to reduce production of vehicles and this also includes major players such as Maruti Suzuki, Tata Motors and Ashok Leyland.

Data as released by SIAM shows that total passenger vehicle production dipped 18 percent to 2,79,644 units in September as against 3,41,539 units produced in September last year. Data also revealed that commercial vehicle production dipped by 72.07 percent in September 2019 while exports of commercial vehicles fell 45.06 percent.