With GDP contribution of more than 7%, auto industry deserves to get all the regulatory support it needs to keep growing at a healthy rate

With a significant percentage of its sales coming from small cars like Alto, Swift, WagonR, Ignis, Eeco, S-Presso and Celerio, Maruti has always made efforts to protect its turf. Maruti Suzuki Chairman R C Bhargava has been quite vocal about issues being faced by small car segment. He has openly expressed his views, even though it may go against the approach being followed by policymakers.

After expressing his discontent over 6-airbags being made mandatory for all cars, Bhargava has now pointed out to the issues in tax structure. He has recommended that the government should review the current tax structure and make appropriate changes that will help boost growth across all segments of auto industry.

Uniform tax structure burden for small cars

Bhargava pointed to the multiple regulatory changes introduced in the last three years for reducing emissions and improving safety of car users. As cost of compliance is largely the same for all cars, it’s the small cars that are heavily burdened. This may adversely impact the auto industry by creating a situation where the small car segment witnesses slow growth whereas larger vehicles register strong growth.

For sustainable growth of auto industry, it is necessary to consistently add new buyers. In a developing country like India, a significant chunk of auto sales comprises small cars. If prices continue to increase, overall small car sales could start to decline. Already there appears to be a situation where small car sales are not as high as earlier levels, says Bhargava. The bottom layer of the pyramid needs to be strong to be able to sustain the entire structure.

Talking about the tax structure, Bhargava said that India’s automobile taxes are highest among partly-developed countries in the world. Even though the industry has registered double-digit growth in 2022, much of the demand is being created by premium segment. Bhargava does not like the idea of a uniform tax structure where all cars big and small have to pay the same percentage of tax. High taxes may not impact premium segment, but it’s a huge burden on small cars.

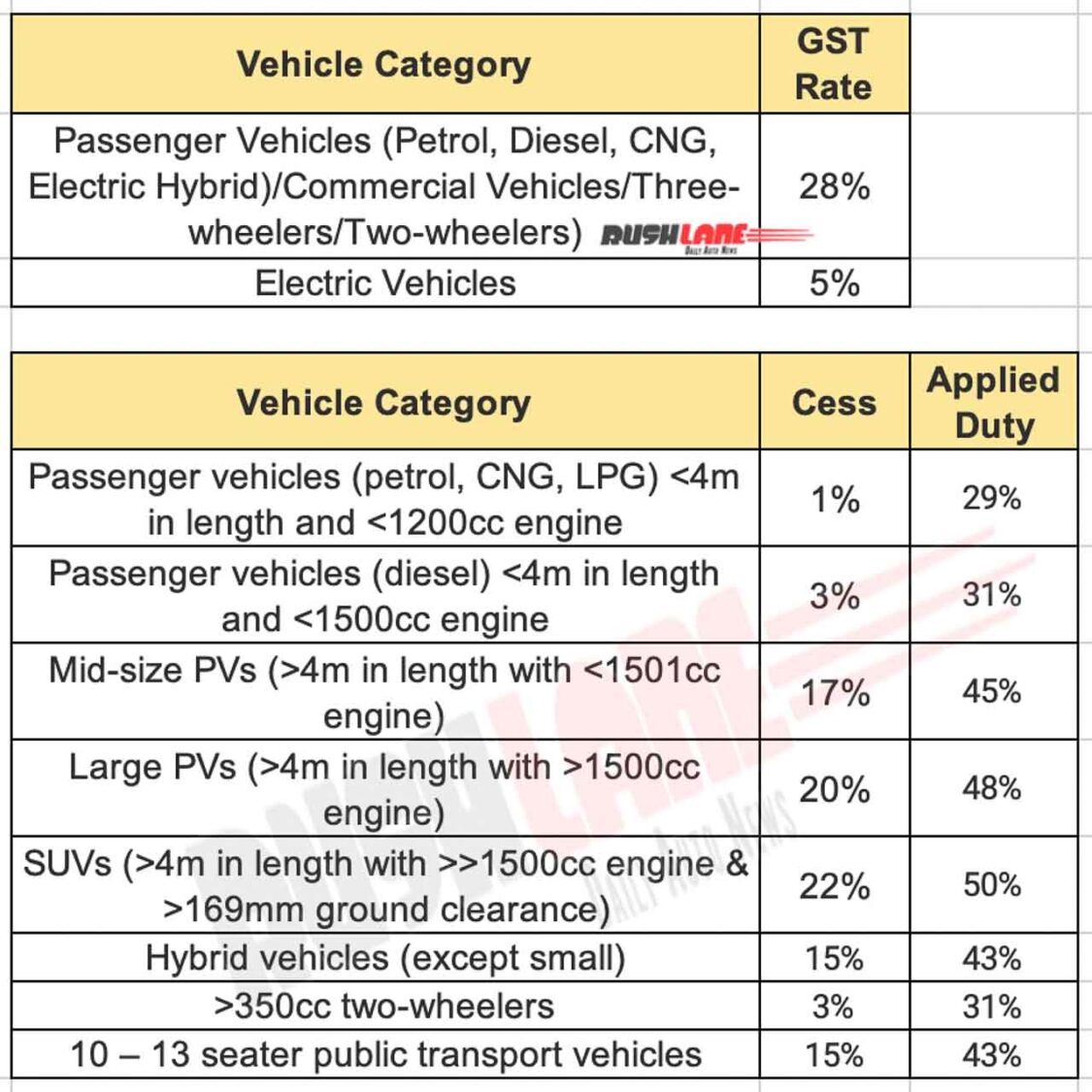

28% GST rate on cars

As of now, a uniform GST rate of 28% is applicable on automobiles. There is an additional cess component based on the type of vehicle. It is in the range of 1-22%. EVs fare better, as GST is 5%. However, here too, the issue of uniform tax rate can be seen. Cars imported via CBU route have to pay custom duty in the range of 60-100%. It varies based on the size of engine and CIF value (cost, insurance and freight) being less or more than $40,000.

Automobile taxes in India are much higher in comparison to developed markets like Europe and Japan. In Europe, tax on automobiles is around 19%. That’s surprising, as per capita income is lower in India. The mindset of treating cars as luxury goods needs to change, especially in case of small cars.

Talking about future prospects, Bhargava said that Indian economy is on track to achieve 7% GDP growth this year. However, he cautioned about headwinds in global markets, which could hamper growth next year. He said manufacturing has to be boosted to spur economic growth. He pointed out that 50% tax on automobiles is too high and likely to impact growth. He suggested that state governments should also lend their support to enhance ease of doing business.