Motorcycle and scooter sales have already been hit by the on-going slowdown in the auto industry and now increased third-party insurance rates may further dampen consumer sentiments. Increased third-party insurance rates were announced by Insurance Regulatory and Development Authority of India (IRDAI), a move that will help insurance companies to manage rising costs related to third-party claims settlements.

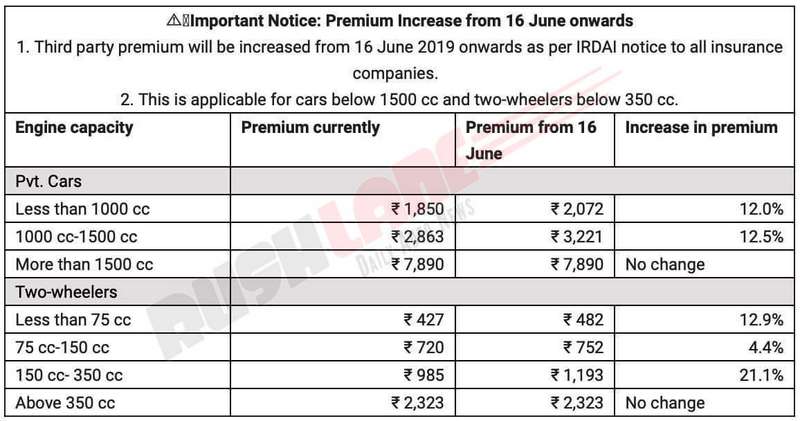

Revised third-party insurance rates will become effective from June 16, 2019. Anyone buying a new two-wheeler after June 16 or renewing their third-party insurance after this date will have to pay the increased rates.

However, IRDAI seems to have looked into consumer interests as well, as new rates are not too high. Revised rate for 75 cc to 150 cc two-wheelers, which is the largest segment, is Rs 752, which is just 4.44% more than Rs 720 earlier. New rate for two-wheelers below 75 cc is Rs 482, which is 12.88% more than Rs 427 earlier.

The highest increase in rates is for two-wheelers in the range of 150 cc to 350 cc. Third-party insurance rates for these bikes are up 21.11%, from Rs 985 earlier to Rs 1,193. The only segment spared from increased rates is above 350 cc segment.

At Rs 2,323, there is no change in third-party insurance costs for motorcycles exceeding 350 cc. Such bikes are fewer in numbers, so mathematically they have a lower probability of being involved in an accident.

IRDAI has also announced third-party insurance rates for electric two-wheelers, which are gaining momentum across the country. Rates for electric two-wheelers are based on their engine capacity, expressed in kW. For e-scooters below 3kW, the rate is Rs 410. For 3kW to 7kW, rate is Rs 639 and for those between 7kW to 16kW, rate is Rs 1014. Any electric two-wheeler above 16kW will be charged Rs 1975.

Federation of Automobile Dealers Associations(FADA) quote on Insurance regulation price hike – “The Automobile Industry is already going through a difficult phase with low sales & subdued customer sentiments. This sudden change in price hike of 3rd party insurance will again dent the pace of sales, specially the 2W category which is already reeling under price hike for mandatory 5 yrs insurance and ABS/CBD implementation.

We feel IRDAI should reconsider the price hike, as this increase would significantly impact the sales volume also affecting the insurance business. However, as the report says the proposed 15% discount on third party insurance on Electric Vehicles (private cars & two wheelers) is a welcome move through the sales of such vehicles are very minuscule.

Going forward, we would require substantial support from all quarters and specially the insurance industry to help the automobile industry to recover from the slowing demand affected by the uncertainty around NBFC and the previous regulation passed for collecting three and five years of premium for new cars & two-wheelers respectively.” – said Manish Raj Singhania, Hony. Secretary – F A D A.