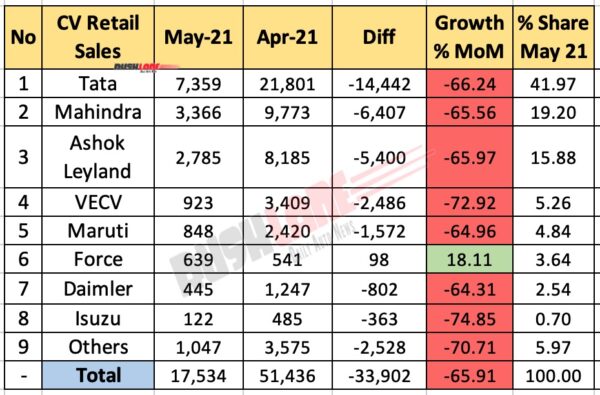

Every commercial vehicle maker in the country, with the exception of Force Motors, has posted a MoM de-growth with dealerships posting negligible revenues

Auto retail sales are at an all-time low. De-growth has been reported across every sector, be it the 2 wheeler (-53%), 3 wheeler (-76%), passenger vehicle (-59%), commercial vehicle (-66%) and tractor (-57%) segments. Talking exclusively of the commercial vehicle segment, MoM de-growth is at exactly 65.91 percent from 51,436 units sold in April 21 to 17,534 units sold in the past month.

The commercial vehicle segment is further divided into LCV, MCV, HCV and Construction Equipment and de-growth was reported in each of these sub-divisions as well. Considering this dismal performance with poor retail sales, dealers have posted negligible revenues, more so through the 30-45 days of lockdown that is even now in place in several cities in South of India. Dealers have been unable to repay loan tranche payments which will have an adverse impact on dealers credit score as per CIBIL rating.

Tata and Mahindra in Top 2 Positions

In the lead was Tata Motors with 7,359 units sold in the past month, down from 21,801 units sold in April 21. Market share also dipped from 42.38 percent held in April 21 to 41.97 percent in the last month. Tata Motors has just set up a wholly owned subsidiary company called TML CV Mobility Solutions.

This new company will offer end to end services of operating, repair and maintenance including annual maintenance contracts (AMC) and Fleet Management Services (FMS) for various electric mobility/electric vehicles, electric buses, fuel cell buses and all types of commercial vehicles.

Mahindra was at No.2 in terms of CV retails with 3,366 units sold in the past month. This was a MoM decline as against 9,773 units sold in April 21 with market share growing marginally from 19 percent to 19.20 percent MoM. Mahindra has lined up a series of new launches both in the PV and CV segments which includes a new pickup trucks based on Bolero and a trademark for the name ‘Xdreno’ has been registered which could be the name for the upcoming range of pickup trucks.

Ashok Leyland, VE, Maruti Suzuki

Ashok Leyland commercial vehicle retails stood at 2,785 units in May 21 with a market share of 15.88 percent. This was against 8,185 units sold in April 1 when market share was slightly higher at 15.91 percent. In May 2021, in view of the current pandemic situation, Ashok Leyland has introduced a Rs 1 lakh life and health insurance scheme for COVID-19 treatment to its channel partners through which approximately 15,000-20,000 people are likely to be benefited.

Reporting a significant dip in MoM retails was VE Commercial Vehicles Limited with 923 units sold in the past month, down from 3,409 units sold in April 21. Market share dipped from 6.63 percent to 5.26 percent MoM. The company has recently introduced the Eicher Skyline Ambulance with enhanced driver and patient safety and equipped with highly advance life saving facilities. Eicher recently donated two of these Skyline Ambulances to the government of Madhya Pradesh in support of the fight against COVID pandemic.

Maruti Suzuki CV retails dipped to 848 units in May 21, from 2,420 units retailed in April 21 while market share increased from 4.70 percent to 4.84 percent MoM. Force Motors also saw its sales and market share increase substantially. Retail sales which had stood at 541 units in April 21 with market share of 1.05 percent, increased to 639 units and 3.54 percent market share making it the only CV maker in India to post increased sales.

Daimler and SML Isuzu also noted MoM de-growth to 445 units and 122 units respectively in May 21 down from 1,247 units and 485 units retailed in April 21. Retail sales of other CV makers stood at 1,047 units with market share of 5.97 percent down from 3,575 units and market share of 6.95 percent in April 21. As the month of June 21 has opened on a more positive note and with predictions of timely and plentiful monsoons, retail sales are expected to be more favorable in the weeks ahead.