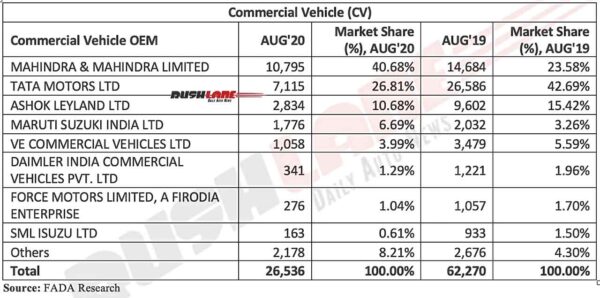

Mahindra and Tata together have a market share of over 67% in the CV segment for Aug 2020

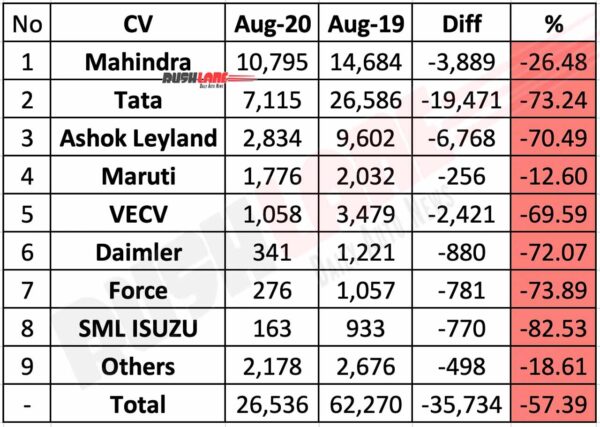

As per vehicle registration data published by the Federation of Automobile Dealers Associations (FADA), CV sales have witnessed 57.39% YoY de-growth in August 2020. A total of 26,536 units were sold in August 2020, as compared to 62,270 units in August last year. However, a positive development for CV segment is that MoM sales have improved in August 2020.

Mahindra & Mahindra takes pole position

Leading the CV segment is Mahindra with 10,795 units sold in August 2020. YoY sales are negative, as compared to 14,684 units sold in August last year. M&M market share has improved from 23.58% in August last year to 40.68% in August 2020.

At number two is Tata Motors with 7,115 units sold in August 2020. This is a massive YoY drop, as compared to 26,586 units sold in August last year. Tata Motors market share has also come down to 26.81% from 42.69% in August last year. Tata was the No 1 CV brand in the country for Aug 2019. But last month, it has registered massive sales decline of 73%, which has resulted in Tata slipping behind Mahindra to No 2 spot.

At number three is Ashok Leyland with 2,834 units sold in August 2020. YoY sales have dropped significantly, as compared to 9,602 units sold in August last year. Ashok Leyland’s market share has also come down to 10.68% from 15.42% in August last year.

At number four is Maruti Suzuki, a relatively new entrant in the CV space. The company sold 1,776 units in August 2020, which is negative growth, as compared to 2,032 units sold in August last year. However, Maruti Suzuki’s market share has improved from 3.26% to 6.69% in August 2020. Other OEMs with negative YoY growth include VE Commercial Vehicles, Daimler India, Force Motors and SML ISUZU.

CV segment insights

In its report, FADA has noted that there’s increasing positivity in auto market owing to start of the festive season and government’s continued efforts to boost the economy. While rural markets had stayed resilient, increased demand can also be seen now in urban centres. Demand for small commercial vehicles has increased in rural markets, powered by abundant monsoon rains and a healthy sowing season. Government’s increased spending on agriculture and rural development has also contributed to higher demand for vehicles in rural markets.

In case of commercial vehicles, some key problems noted by FADA include the cautious approach being taken by banks and NBFCs for auto loan approvals. This is especially true for the M&HCV category. Financial institutions are adhering to stricter CIBIL score norms, which is another factor that is adversely impacting customer finance.

However, FADA is hopeful that an incentive-based scrappage policy will soon become a reality. As may be recalled, Union Minister Nitin Gadkari had earlier said that a scrappage policy could be announced by October. A scrappage policy can kick-start the ailing CV segment by boosting sales of medium and heavy commercial vehicles.