Commercial vehicle retail sales increased to 67,158 units in August 2022 in view of rising demand across the passenger carrier segment

A series of new launches in this segment, special benefits being offered by the Government of India in terms of infrastructure, a favourable monsoon season along with festive purchases and rise in construction activity has all resulted in increased demand for commercial vehicles in India.

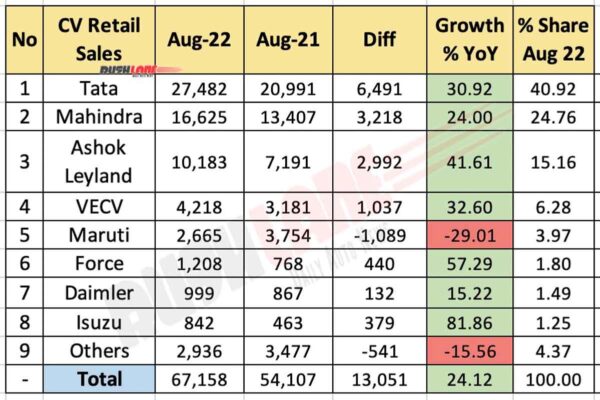

Retail sales figures also show that the commercial vehicle segment is on the road to recovery with demand rising over the past 3 years. CV sales improved 8.31 percent in August 2022 to 67,158 units from 54,107 units sold in August 2021. It was also a 144.64 percent growth when compared to 27,452 units sold in August 2020 and a 6.16 percent increase in retail sales as against 63,259 units sold in August 2019.

Commercial Vehicle Sales Aug 2022

Commercial Vehicle retails, which increased 8.31 percent YoY in August 2022, has seen growth across the LCV, MCV and HCV segments. Tata Motors was the leading CV maker in the past month with sales of 27,482 units, up from 20,991 units sold in August 2021. The company currently commands a 40.92 percent market share up from 38.80 percent held in August 2021. Tata Motors has revamped its CV lineup with the new India’s first truck with car-like ADAS, called the Prima and a CNG powered medium and heavy truck called the Signa.

Mahindra CV retail sales stood at 16,525 units in August 2022 up from 13,407 units sold in August 2021. Market share dipped marginally to 24.76 percent from 24.78 percent YoY. Mahindra also extended its Bolero pick-up range with the new 2022 Mahindra Bolero Maxx Pik-Up City 3000 model. It is presented in three variants of City 3000, City 3000 LX and City 3000 VXI and priced from Rs 7.68 lakh (ex-showroom).

VE, Maruti, Force Motors

Retail sales growth was also reported by Ashok Leyland up to 10,183 units in the past month from 7,191 units sold in August 2021. Market share improved to 15.16 percent from 13.29 percent YoY. VE Commercial Vehicles Limited has posted a YoY growth in retail sales to 4,218 units in August 2022, up from 3,189 units sold in August 2021. Currently commanding a 6.28 percent market share, this is also an improvement over 5.89 percent held in August 2021.

Maruti Suzuki has seen a dip in demand for its commercial vehicle lineup. Sales fell to 2,665 units in August 2022, down from 3,754 units sold in August 2021. Market share dipped to 3.97 percent from 6.94 percent YoY.

Force Motors, on the other hand reported a sales growth to 1,208 units in the past month, from 768 units sold in August 2021 while Daimler India CV retail sales also increased to 999 units last month from 867 units sold in August 2021. SML Isuzu Ltd had retail sales at 842 units in August 2022 from 463 units sold in August 2021 taking up market share to 1.25 percent from 0.86 percent YoY.

There were also other commercial vehicle makers in this segment that have reported a YoY de-growth in retail sales to 2,936 units in August 2022 from 3,477 units sold in August 2021 bringing down market share to 4.37 percent from 6.43 percent. There are strong projections for the commercial vehicle industry to see a 12-15% growth in FY2023 as there has been gradual improvement in the macroeconomic environment of the country.