Retail sales of commercial vehicles increased 7.41 percent on a YoY basis with increased demand for Heavy Commercial Vehicles

Significant increase in Government of India spending on infrastructure, improved economic activity and movement of cargo along with growth in e-commerce businesses has led to growth in commercial vehicle retails in the past month.

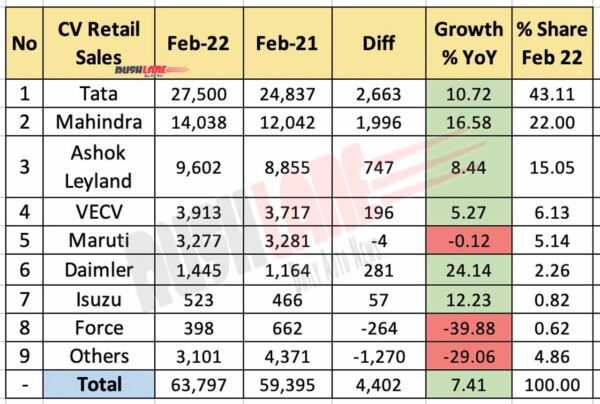

Commercial vehicle retail sales increased 7.41 percent to 63,797 units in February 2022, up from 59,395 units sold in February 2021. It was however, a dip of 24.01 percent when compared to 83,952 units sold in February 2020 which was the last month prior to onset of the COVID-19 pandemic.

Under CV categories, LCV (37,095 units) and HCV (19,822 units) retail sales increased 5.67 percent and 20.73 percent respectively. MCV (3,782 units) noted a 0.29 percent dip in retail sales and sales of others (3,098 units) in this segment saw retail sales fall 24.05 percent

Commercial Vehicle Sales Feb 2022 – Tata leads

Tata Motors led the segment with retail sales of 27,500 units, up from 24,837 units sold in February 2021. Market share of the company also increased from 41.82 percent to 43.11 percent YoY. At No. 2 was Mahindra with CV retail sales at 14,038 units, up from 12,042 units sold in February 2021. Market share also increased from 20.27 percent to 22 percent on a YoY basis.

Ashok Leyland reported a growth in retail sales in February 2022. Sales which had stood at 8,855 units in February 2021 increased to 9,602 units in the past month causing market share to go up from 14.91 percent to 15.05 percent YoY.

VE, Maruti, Daimler, Force Motors

At No. 4 on the list was VE Commercial Vehicles, posting a YoY growth to 3,913 units from 3,717 units sold in February 2021. Maruti Suzuki saw a marginal dip in YoY retail sales to 3,277 units, down from 3,281 units sold in February 2021. Market share also fell to 5.14 percent in the past month from 5.52 percent held in the same month a year ago. Maruti Suzuki has been seeing outstanding demand for the Super Carry and production of this light commercial vehicle was boosted last month to cater to this increased demand.

Daimler India (1,445 units) and SML Isuzu (523 units) posted an increase in retail sales last month while Force Motors (398 units) saw retail sales dip from 662 units in February 2021. Others in this segment reported retail sales at 3,101 units, down from 4,371 units sold in February 2021 bringing down market share to 4.86 percent from 7.36 percent held in February 2021.

New Launches

Tata Motors, largest cargo truck and bus manufacturers in India offer a wide range of products in light, intermediate and heavy commercial vehicle segments. Tata Motors has just launched ‘Anubhav’, a showroom on wheels to tap sales in rural markets. Built by Tata Motors Commercial Vehicles Fully Built Vehicles Division, ‘Anubhav’ showroom on wheels, has been developed on Tata Intra V10.

Ashok Leyland seeks to be a leader in CNG commercial vehicles. As on date the company share stands at 10 percent of the industry while the remaining 90 percent are diesel powered CVs. Its most recent launch in the CNG CV goods carrier space is the E-Comet Star ICV (intermediate CV) CNG truck range. The trucks are available in two gross weights of 16.1 ton and 14.25 ton with 3 CNG cylinder options. Alongside the CNG range, Ashok Leyland is also working on multiple alternate fuels like electric, LNG, Methanol. They also launched AVTR 4825 10×2 Tipper with Tandem dummy axle recently.