Commercial Vehicle retail sales grew by 27.32 percent YoY with growth seen across LCV, MCV and HCV segments

CV retail sales saw a 27.32 percent YoY growth in July 2022. This growth could be attributed to various Government incentives. The bus segment continues to grow thanks to the opening up of offices and educational institutions after the easing of stringent COVID norms which had resulted in work from home and online classes being held for schools and colleges.

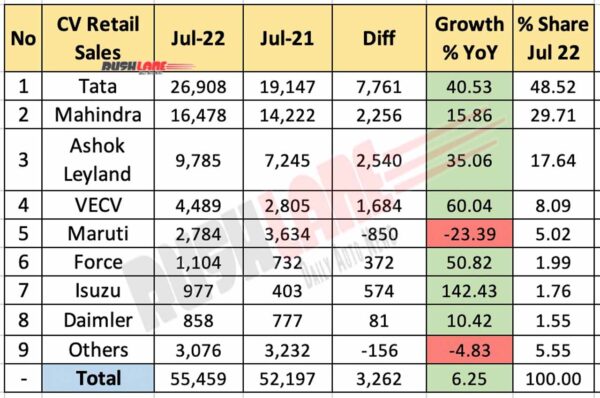

Retail sales in the commercial vehicle segment increased to 66,459 units in July 2022, up 27.32 percent from 52,197 units sold in July 2021. It was also a 238.77 percent growth from 19,618 units sold in July 2020 but a fall of 4.33 percent from 69,468 units sold in July 2019 which was a pre-covid month. Every OEM has reported a YoY growth in commercial vehicle retail sales, except for Maruti Suzuki.

Commercial Vehicle Retail Sales July 2022

Tata Motors had the highest retail sales figures for July 2022. Sales which had stood at 19,147 units in July 2021 increased to 26,908 units in the past month. Market share also improved from 36.68 percent to 40.49 percent YoY. Tata’s Ultra Sleek T-Series range is among its products that are high in demand. These trucks are offered in a range of 3 models- T.6, T.7 and T.9 and are priced at Rs. 13.99 lakhs, Rs. 15.29 lakhs and Rs. 17.29 lakhs respectively.

At No. 2 was Mahindra with CV retail sales at 16,478 units in July 2022, up from 14,222 units sold in July 2021. Market share dipped to 24.79 percent from 27.25 percent YoY. Mahindra has also dropped a teaser of its upcoming Electric Bolero Pickup. As against Tata’s Ultra T.7 Electric, which is a large truck, while with the Mahindra Bolero Pickup, the company enters a segment un-chartered by any other OEM to date.

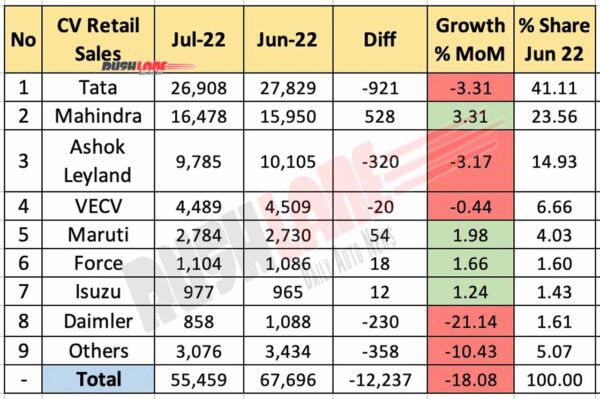

Ashok Leyland, at No. 3, saw its CV retail sales at 9,785 units in July 2022. This was a growth of over 7,245 units sold in July 2021. Market share also increased to 14.72 percent from 13.88 percent in the corresponding periods. It was however a MoM de-growth for Ashok Leyland which had seen retail sales at 10,105 units in June 2022.

VE Commercial Vehicle retail sales were at 4,489 units in July 2022, up from 2,805 units sold in July 2021. Market share also improved to 6.75 percent in the past month from 5.37 percent held in the same month of the previous year. VECVs Volvo Buses India recently launched their new 9600 platform luxury buses.

Maruti Suzuki Posts YoY Degrowth

Maruti Suzuki was the only OEM on this list to post a YoY de-growth in retail sales. Sales which had stood at 3,634 units in July 2021, dipped to 2,784 units in the past month. Market share also fell from 6.96 percent to 4.19 percent YoY.

Lower down the list was Force Motors with 1,104 units sold in July 2022, up from 732 units sold in July 2021. SML Isuzu CV retail sales increased to 977 units in the past month from 403 units sold in July 2021 while Daimler sales were at 858 units last month, an increase from 777 units sold in the same month last year. There were other OEMs that added 3,076 units to retail sales, a de-growth over 3,232 units sold in July 2021.