Commercial Vehicle registrations increased 236.19 percent YoY to 35,700 units in June 2021

FADA (Federation of Automobile Dealers Associations) announced the sales and registration report for June 2021 (retails sales). In the past month, statistics show that there was YoY growth across each segment, the highest being in the commercial vehicle segment. Where two and three wheeler segment grew by 16.90 percent and 21.98 percent respective YoY, the PV segment saw a 43.45 percent YoY growth.

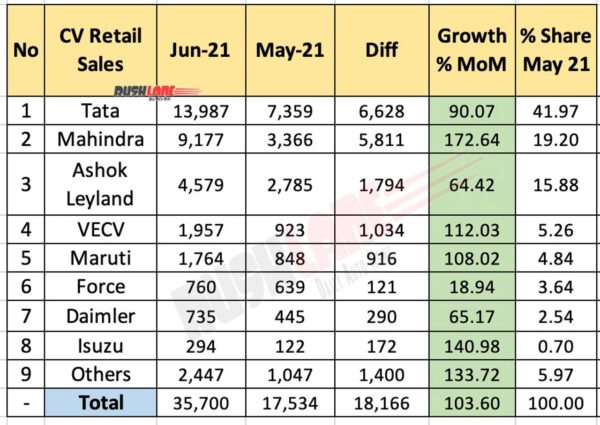

Conversely, the commercial vehicle segment saw YoY retail sales increase 236.19 percent. Retail sales for June 2021 stood at 35,700 units, as against 10,619 units sold in June 2020. However, retails in both months were substantially lower than 65,035 units sold in June 2019, the year prior to the pandemic hitting the nation.

When further categorizing into Light, Medium and Heavy commercial vehicles sales, Light Commercial Vehicle retails in June 2021 stood at 21,650, up from 8,428 units sold in June 2020, a 156.88 percent increase YoY. Medium Commercial Vehicle retails were at 2,091 units in the past month, up from 78 units sold in June 2020, while Heavy Commercial Vehicle retails were at 9,575 units, up from 346 units sold in June 2020.

Tata, Mahindra in Top 2 Positions

OEM wise commercial vehicle retail sales, as have been announced by FADA, detail Tata Motors at No.1. Sales in the past month stood at 13,987 units, with a market share of 39.18 percent over 893 units sold in June 2020, when market share was at 8.41 percent.

Mahindra was at No.2 with 9,177 units retailed in the past month. The company currently commands a 25.71 percent market share in the CV segment. June 2020 sales had been much lower at 5,523 units while market share was higher at 51.01 percent.

Next in line was Hinduja flagship commercial vehicle major Ashok Leyland (ALL) with 4,579 units retailed in June 2021. Market share is currently at 12.83 percent. June 2020 retails had stood at 1,153 units with market share of 10.86 percent. The company expects to see a revival across the commercial vehicle market by July 2021 and would ramp up production and increase number of shifts depending on this situation.

Increase in retail sales was also reported by VE Commercial Vehicles Limited. Total retails for June 2021 stood at 1,957 units, commanding a market share of 5.48 percent. This was a substantial YoY increase over 194 units sold in June 2020 when market share was at 1.83 percent.

Lower down the order, Maruti Suzuki CV retails also increased YoY to 1,764 units though market share dipped to 4.94 percent. This was as against 902 units sold in June 2020 when market share was at 8.49 percent. The company’s Light Commercial Vehicle Super Carry contributed to this increased YoY growth.

Force Motors retail sales increased to 760 units in June 2021 with market share of 2.13 percent. This was substantial YoY growth over just 11 units sold in June 2020 when market share stood at 0.10 percent.