Commercial vehicle sales increased by 13 percent on a YoY basis with growth seen across the MCV and HCV segments while LCV sales dipped

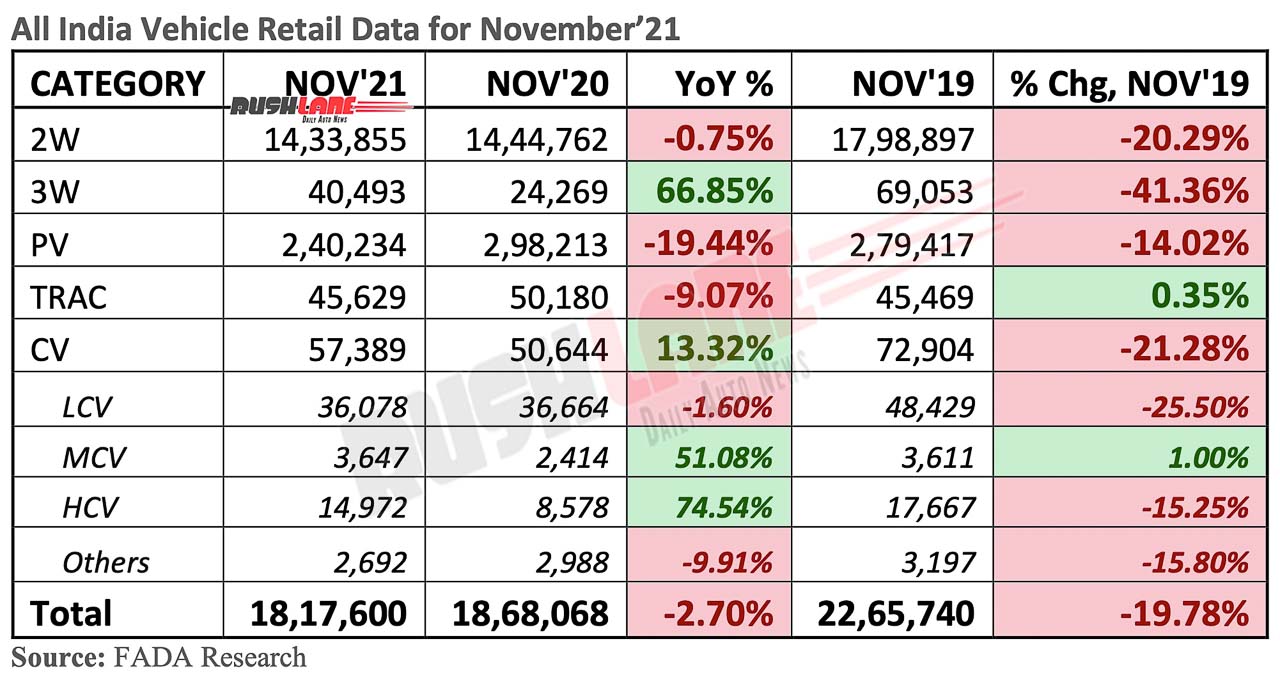

Federation of Automobile Dealers Associations (FADA), the apex national body of Automobile Retail Industry in India has released sales results for November 2021. It may be seen that on a YoY basis, while 3 wheeler and commercial vehicle sales increased 67 percent and 13 percent respectively, that of three wheelers, passenger vehicles and tractors dipped by 1 percent, 19 percent and 9 percent respectively.

Speaking of commercial vehicle retail sales, even as the industry faces trying times, sales increased 13.32 percent. Retail sales which had stood at 50,644 units in November 2020 increased to 57,389 units in the past month. Once again, Tata Motors commanded the list followed by Mahindra and Ashok Leyland. Mahindra was the only commercial vehicle maker to report a YoY de-growth.

LCV retail sales dipped to 36,078 units last month, down 1.60 percent over 36,664 units sold in November 2020 while MCV and HCV retails stood at 3,647 units and 14,972 units respectively, a growth of 51.08 percent and 74.54 percent over 2,414 units and 8,578 units sold in November 2020.

Commercial Vehicle Sales Nov 2021

Leading the sales charts, Tata Motors saw its retails at 25,132 units in the past month. This was significant growth over 17,720 units sold in November 2020 causing a rise in market share from 34.99 percent to 43.79 percent. Tata Motors has announced a hike in prices across its commercial vehicle range by 2.5 percent from January 2022. Higher prices of commodities such as steel, aluminum and other precious metals, along with increased cost of other raw materials has necessitated this price hike.

Mahindra CV sales dipped from 17,027 units sold in November 2020 to 12,045 units retailed last month. Market share also fell from 33.62 percent to 20.99 percent. Production itself saw slowed activity on account of the global chip shortage and rising input costs.

At No.3 was Ashok Leyland with sales of 7,609 units in the past month. This was an increase over 6,131 units retailed in the same month of the previous year. Market share also increased from 12.11 percent held in November 2020 to 13.26 percent last month.

Ashok Leyland is working on commercial vehicles powered by hydrogen. The company plans to roll out CNG-fitted commercial vehicles set for launch in the fourth quarter of this financial year. In October 2021, the company introduced the ECOMET STAR CV. It will cater to 11T – 16T GVW ICV segment and to 5 and 6 cum tipper segment while will support multiple applications of e-commerce, courier and parcel services, perishable agricultural produce, delivery of white goods and FMCG, etc.

VECV, Maruti Suzuki, Daimler

Also posting growth in commercial vehicle retails were VECV, Maruti Suzuki, Daimler. VE sales stood at 3,745 units last month, up from 2,592 units retailed in November 2020 with market share increasing to 6.53 percent. Maruti Suzuki retails increased to 3,650 units in the past month from 2,282 units retailed in November 2020 while market share went up from 4.51 percent to 6.36 percent on a YoY basis.

Daimler India CV retails also improved to 1,146 units in the past month from 853 units sold in November 2020 along with Force Motors that saw its CV sales up to 643 units last month from 479 units retailed in November 2020. SML Isuzu also saw its CV sales increase to 566 units in the past month, up from 370 units sold in November 2020. There were other CV makers on this list that noted an increase in demand in November 2021 with 2,853 units retailed as against 3,190 units retailed in November 2020.