Commercial vehicle retail sales improved by 2 percent YoY in April 2023 with Tata Motors leading the segment

As per data released by Federation of Automobile Dealers Associations (FADA) the auto industry has seen some ups and downs in April 2023. Two wheelers and passenger vehicles suffered lower YoY sales by 7 percent and 1 percent respectively. Tractors and commercial vehicle retail sales improved by 1 percent and 2 percent respectively. However, outstanding growth was seen in the case of 3 wheelers with YoY sales increasing by 57 percent.

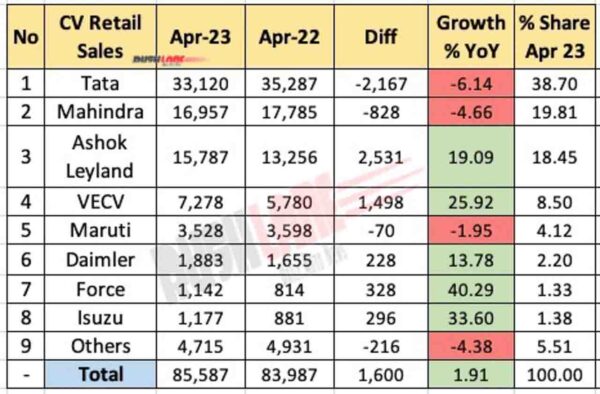

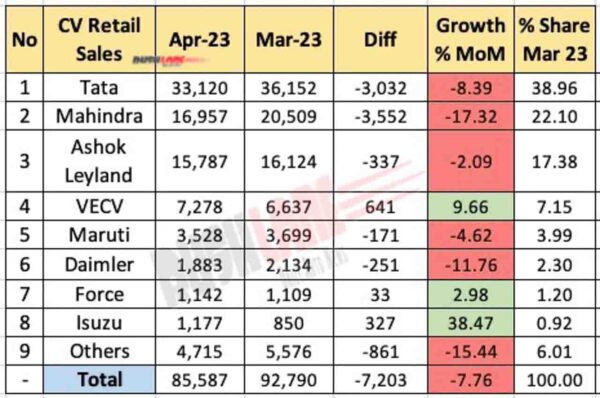

Taking commercial vehicle sales into account, total retail sales increased to 85,587 units in April 2023 up 2 percent from 83,987 units sold in April 2022. Growth was seen across MCV, HCV and other segments. MCV sales improved by 15.71 percent to 6,451 units in April 2023 from 5,575 units sold in April 2022 while HCV sales were up 12.62 percent to 31,165 units in the past month from 28,558 units sold in the same month last year.

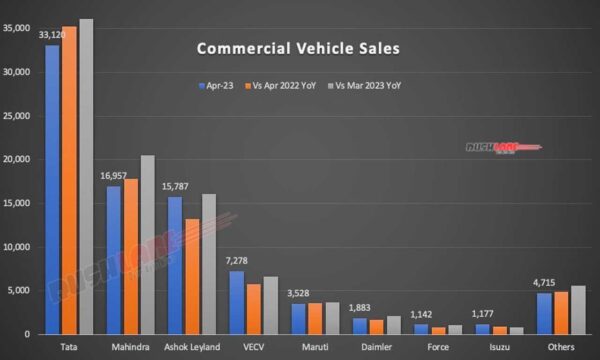

CV Retail Sales April 2023

Sales of CVs in other categories also saw a YoY growth by 55.63 percent to 3,472 units from 2,229 units. However, there was a dip in sales of LCVs that fell by 8.66 percent to 43,501 units in April 2023 from 47,625 units sold in April 2022.

Growth across the commercial vehicle segment could be attributed to a spurt in infrastructure projects across the country. There has also been an improvement in supply chain while buyers have taken well to a price hike in view of new and more stringent BS6 Phase II norms coming into effect.

Tata Motors headed this list with 33,120 units sold in the past month, up from 35,287 units sold in April 2022. This was also a MoM de-growth as against 35,152 units sold in March 2023. The company currently commands a 38.70 percent market share, down from 42.01 percent held in April 2022. Tata Motors increased prices of their commercial vehicle lineup by 5 percent from 1st April 2023.

At No. 2 was Mahindra with 16,957 units sold in April 2023, down from 17,785 units sold in April 2022. Market share dipped to 19.81 percent from 21.18 percent YoY. Sales could be boosted in the months ahead with the new Bolero MaXX Pik-Up launched by the company in April 2023. It is offered in two series of HD Series and City Series, priced from Rs 7.85 – Rs 10.33 lakh.

Ashok Leyland has seen growth in commercial vehicle retail sales which improved to 15,787 units in the past month from 13,256 units sold in April 2022. The company currently commands an 18.45 percent market share. Ashok Leyland showed off a range of electric and alternate fuel vehicles at the 2023 Auto Expo held earlier this year among which was the CNG powered Bada Dost Xpress 12 seater bus.

VECV, Maruti, Daimler, Force Motors

There was also VE Commercial Vehicles that posted a growth in retail sales to 7,278 units in April 2023. This was against 5,780 units sold in April 2022. Market share also improved to 8.50 percent from 6.88 percent YoY.

Maruti Suzuki CV retail sales dipped marginally to 3,528 units in April 2023 down from 5,780 units sold in April 2022. The company unveiled a refreshed model of the Super Carry LCV in April 2023. It is priced at Rs 5.15 lakhs and comes in with improved features and safety equipment. The Super Carry LCV, which is presented in four variants, is on sale via all commercial sales outlets across the country.

Sales growth was also reported by Daimler (1,883 units), SML Isuzu (1,177 units) and Force Motors (1,142 units) in April 2023. There were other CV makers in this list that added 4,715 units to total retail sales in the past month, down from 4,913 units sold in April 2022.