Every CV maker in the country with the exception of Maruti Suzuki posted YoY de-growth while MoM sales ended on a more positive note

Federation of Automobile Dealers Associations (FADA), has released sales for Jan 2021. As per vehicle registration data, overall retail sales have been in the red, be it the 2 wheeler, PV and CV segments with a 9.66 percent YoY decline.

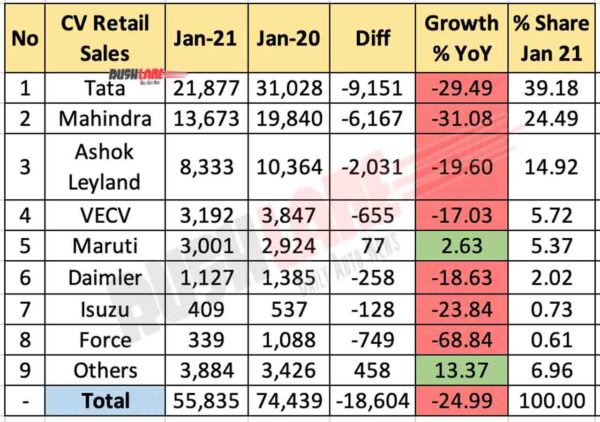

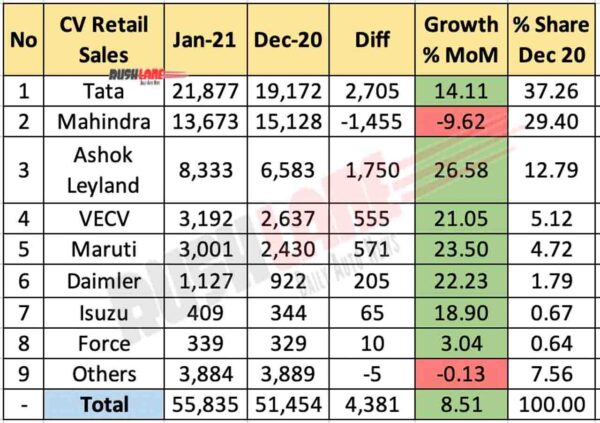

Taking exclusively of the commercial vehicle segment, it may be seen from the attached tables that YoY sales declined 24.99 percent to 55,835 units in Jan 2021, down from 74,439 units sold in Jan 20. However, MoM sales increased 8.51 percent with 51,454 units sold in Dec 20.

Tata Motors and Mahindra leads charts

At the top of sales charts was Tata Motors despite YoY sales de-growth of 29.49 percent and 21,877 units sold in Jan 21 as against 31,028 units sold in Jan 20. MoM sales of the company however, increased 14.11 percent as against 19,172 units sold in Dec 20. Market share also increased from 37.29 percent held in Dec 20 to 39.18 percent in the past month.

Mahindra was in a second spot where CV sales were concerned with de-growth both in terms of YoY and MoM. Sales in Jan 21 stood at 13,673 units, down 31.08 percent as against 19,840 units sold in Jan 20. MoM sales dipped 9.62 percent as compared to 15,128 units sold in Dec 20. Last month, Mahindra announced a price increase of both PVs and CVs by around 1.9 percent with immediate effect so as to offset increase in commodity prices.

Ashok Leyland and VECV Sales

Ashok Leyland reported a YoY sales decline of 19.60 percent to 8,333 units sold in Jan 21. The company had registered sales of 10,364 units in Jan 2020. MoM sales however increased significantly by 26.58 percent, up 1,750 units as against 6,583 units sold in Dec 20.

VE Commercial Vehicles (VECV), a Volvo Group and Eicher Motors joint venture, reported increased market share to 5.72 percent in Jan 21 as against 5.12 market share held in Dec 20. CV sales stood at 3,192 units in Jan 21 down from 3,847 units sold in Jan 20. MoM sales however increased 21.05 percent as compared to 2,637 units sold in Dec 20.

Maruti Suzuki posted positive YoY and MoM sales making it the only commercial vehicle maker to do so. YoY sales increased by 2.63 percent to 3,001 units, up from 2,924 units sold in Jan 20. MoM sales noted a significant growth of 23.50 percent following sales of 2,430 units sold in Dec 20.

Other CV makers on the list include Daimler (1,127 units), Isuzu (409 units), and Force Motors (339 units) thereby recording negative YoY growth in Jan 21 but each of these manufacturers posted positive MoM growth.

Vehicle Scrappage Policy

The new Vehicle Scrappage Policy as announced in Union Budget 2021-22 is expected to bring some respite to the commercial vehicle segment. It will boost demand for both trucks and buses benefitting automakers such as Tata Motors, Ashok Leyland and Volvo Eicher Commercial Vehicles.

The Union Govt also plans to spend Rs.18,000 crore to introduce 20,000 new buses in cities and has made record allocation of Rs.1.18 trillion for infrastructure projects which would also go a long way to boost demand of commercial vehicles.