Close fight between Bajaj Chetak and TVS iQube continues in 2022 – the latter was ahead in 2021

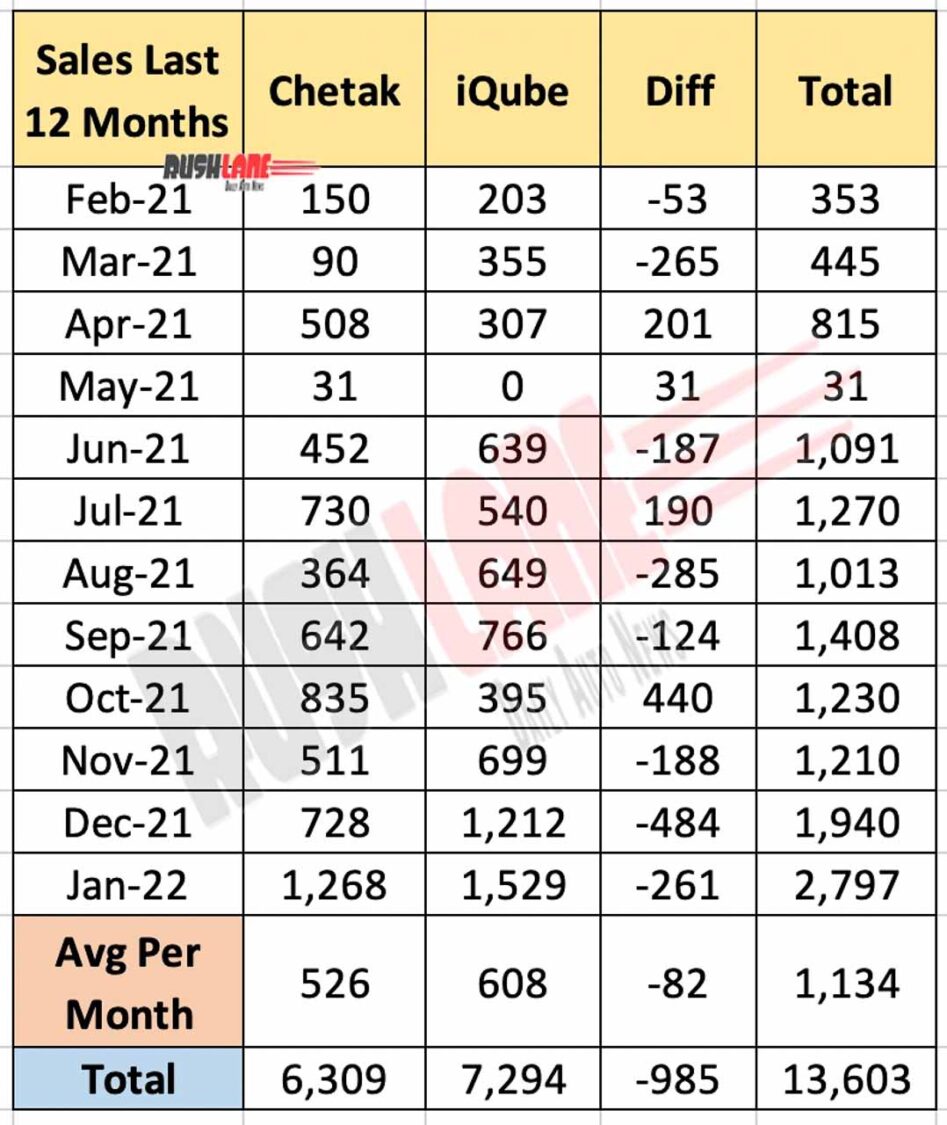

In 2021, TVS iQube had posted annual sales of 5,976 units. This was more than Chetak’s sales of 5,071 units. The battle continues in 2022 with iQube registering sales of 1,529 units in January. This is the highest ever monthly sales of iQube in the last 12 months. This is also the second consecutive month, wherein iQube sales are in four digits.

In comparison, Chetak sales are at 1,268 units in January 2022. This is the highest monthly sales for the scooter in last 12 months. Rising sales is an indication that an increasing number of users are now coming forward to make the switch from petrol to electric. It also shows that situation on the supply side may have improved, as compared to a few months back.

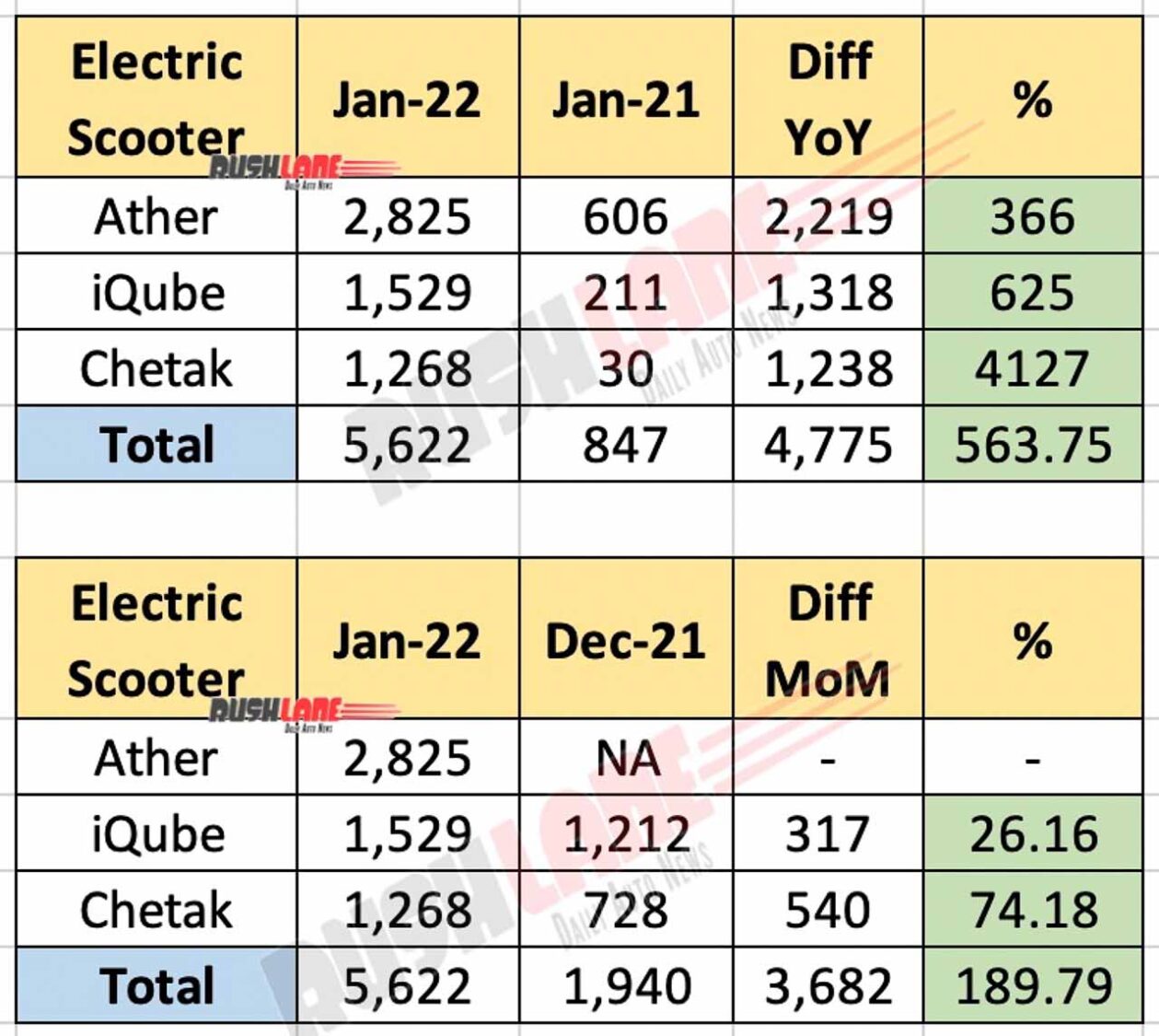

Electric Scooter Sales Jan 2022 – Ather vs Chetak vs iQube

All three, Ather, Chetak and iQube have made impressive gains in terms of YoY and MoM growth. Ather YoY growth is at 366%, and leads the sales charts for Jan 2022 with 2,825 units sold. Chetak YoY growth is 4127%, as compared to 30 units sold in January last year.

iQube has registered gains of 625%, as compared to 211 units sold in the corresponding period last year. Taken together, the combined YoY growth of Ather, Chetak and iQube is 563%. This is quite encouraging not only for Bajaj, Ather and TVS but also for the entire electric two-wheeler industry.

MoM sales growth of Chetak is 74.18%, as compared to 728 units sold in December 2021. iQube MoM growth in January is 26.16%, as compared to 1,212 units sold in December 2021. Combined MoM growth rate of these sooters is 44.18%. In the last 12 months, average monthly sales work out at 526 units for Chetak and 608 units for iQube.

iQube’s price advantage

Both Chetak and iQube are quite similar in terms of their key performance indicators. For example, range is 90 km for Chetak and 75 km for iQube. Top speed is around 80 kmph for Chetak and 78 kmph for iQube. Chetak offers IP67 water protection whereas iQube’s battery is packed in high strength aluminium extrusion casing to make it resistant to water and dust.

Both scooters have non-removable batteries. There is not much difference in charging time as well. Battery warranty of 50,000 km or 3 years (whichever is earlier) is the same for both scooters.

A significant advantage that iQube enjoys over Chetak is its affordable pricing. For example, iQube costs approximately Rs 1.01 lakh in Delhi (inclusive of FAME II subsidy). In comparison, Chetak price in Delhi is close to 1.48 lakh (ex-showroom). It is apparent that users with limited budgets are likely to choose iQube.

Although Chetak and iQube sales have improved in recent months, they still have a long way to go. Other manufacturers such as Hero Electric, Okinawa, Ather and Ampere are comfortably ahead in this space.

Competition is expected to intensify in future with the likes of Hero MotoCorp, Honda, Suzuki and Yamaha planning to launch their respective electric two-wheelers. Chetak and iQube will also have to face the growing threat from startups such as Ola Electric, Simple Energy, Tork Motors, etc.