Last month, Ather was the only company to register degrowth YoY, but strikes back with a vengeance in August

Industry experts predict that India will be one of the largest EV markets in the world in near future. Electric 2W and 3W vehicles will play a major role in India getting that title. India is one of the largest markets for motorcycles in the world. Also helping its cause are central and state subsidies to take some burden off customers.

Due to this reason, a lot of startup EVs have sprung up and are pushing toward a green revolution. Even LML wants a piece of this pie. Let’s take a look at how these companies fare and how this segment as a whole, fares with data revealed by FADA.

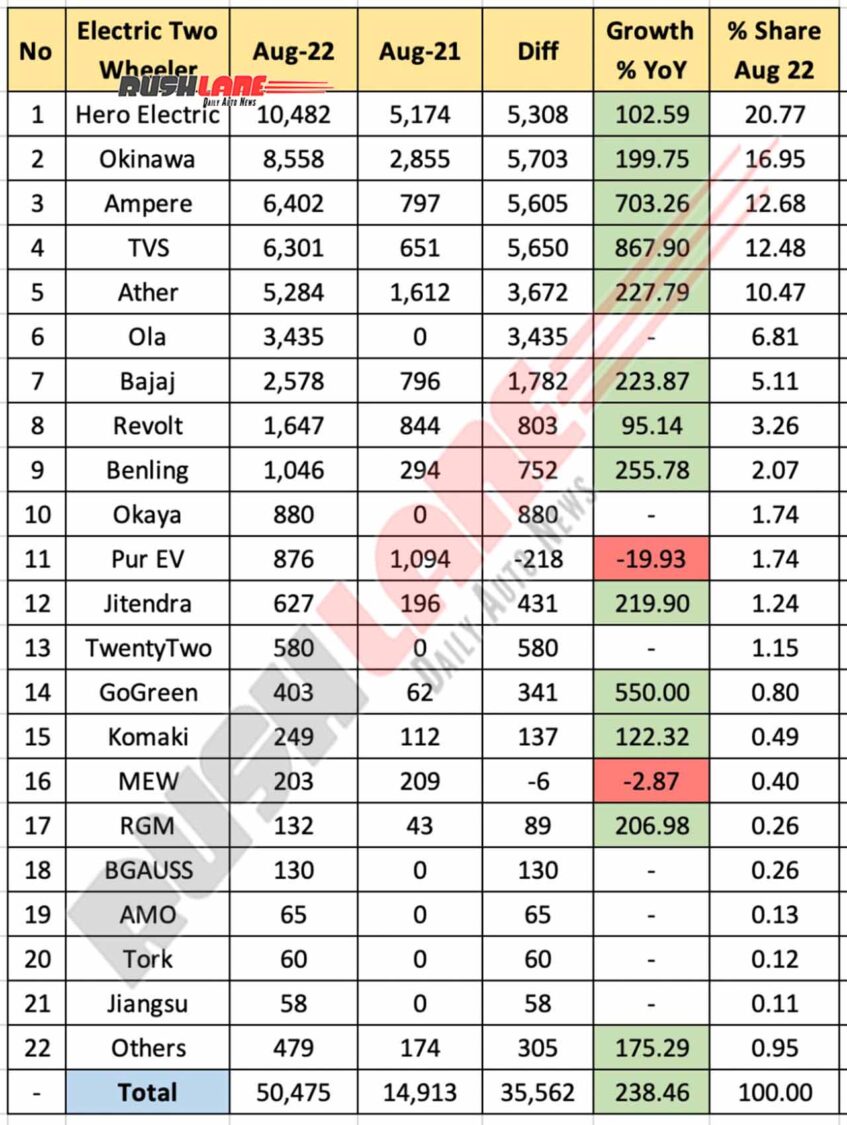

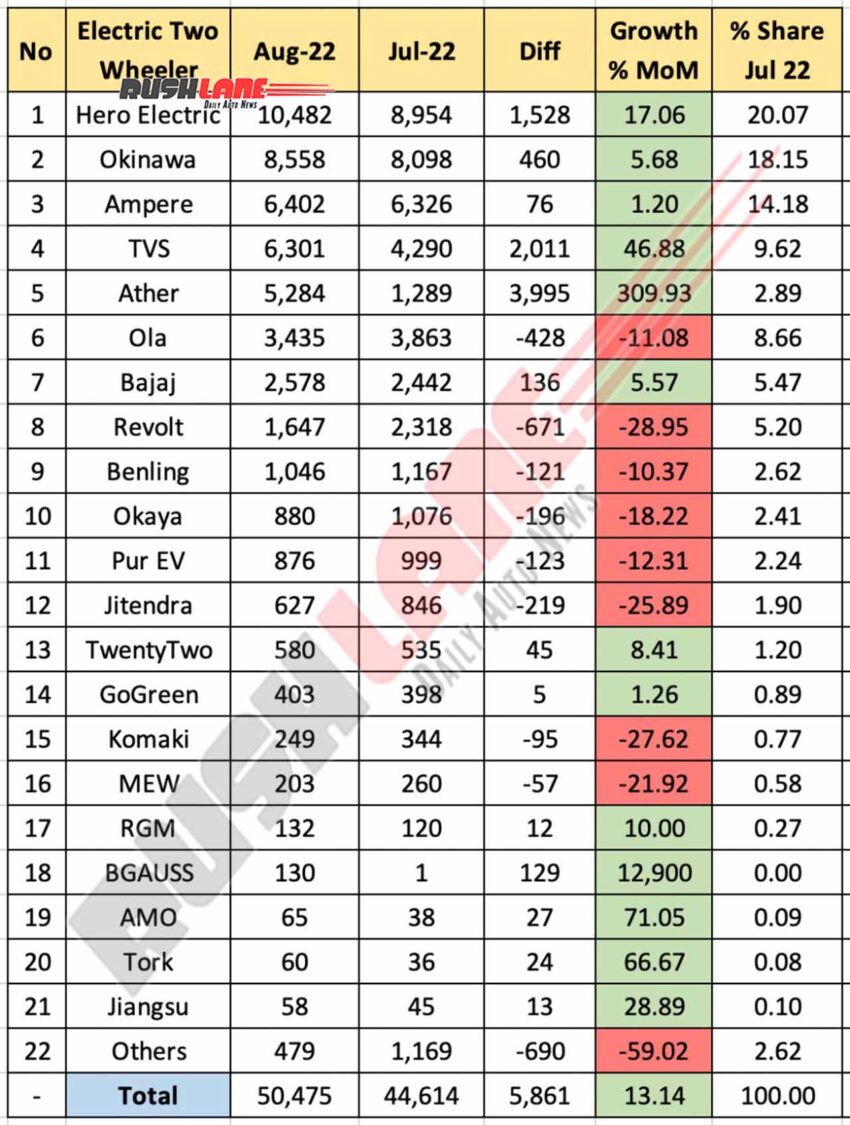

Electric Two Wheeler Sales Aug 2022

Like in July, Hero Electric took the top spot with 10,482 units sold with 5,302 unit volume growth and 102.59% growth YoY. Hero Electric also registers 17.06% MoM growth with a 1,528 unit increase in volume. It commands 20.77% of this cut-throat segment. In 2nd spot is Okinawa which was at the top just two months ago.

Okinawa sold 8,558 units and registered 199.75% with 5,703 units YoY growth. It also registers a 5.6% growth, MoM, with volume growth of 460 units. Okinawa holds 18.15% of this market. At 3rd spot is Ampere by Greaves which sold 6,402 units in August 2022 and registered a staggering 703.26% YoY growth and 1.20% MoM growth. It holds 12.68% of this segment.

TVS with its iQube range sold 6,301 units registering an impressive 867.90% YoY and 46.88% MoM growth and holding 9.62% of this market. At 5th spot is one of the most impressive performers on this list, Ather Energy. It sold 5,284 units while registering 227.79% YoY and 309.93% MoM growth. It outsold its arch-rival Ola by quite some margin.

Ola stands in 6th spot and is the first company to register negative MoM growth of 11.08%. It sold 3,435 units and holds a 6.81% share of this segment. Bajaj Chetak sold 2,578 units and saw a strong surge YoY of 223.87% and a decent 5.57% MoM growth. Revolt and Benling sold 1,647 and 1,046 units respectively and both registered positive growth YoY and drop MoM. At 10th place is Okaya which sold 880 units and saw a drop of 18.22% MoM.

YoY & MoM Analysis

Pure EV saw a dip in both MoM and YoY basis while Jitendra saw a growth of 219% YoY and dropped 25.89% MoM. TwentyTwo saw 8.41% MoM growth while GoGreen saw growth on both YoY and MoM basis. Both Komaki and RGM register positive growth YoY but see a drop in sales MoM. Whereas MEW falls in the red zone in both YoY and MoM records.

Companies like BGAUSS, AMO, Tork, and Jiangsu are launched after August 2021. But all of these companies are doing good and register MoM growth and fall in the green zone. The rest of the companies are compiled into Others section and register 175.29% YoY growth and a 59.02% drop in sales.

All-in-all, with Hero Electric at the absolute top, electric 2W retail sales stand at 50,475 units in the month of August 2022 and register a solid growth of 238.46% YoY with a staggering 35,562 unit net volume growth. This segment also registers 13.14% MoM with 5,861 units net volume growth. With steady growth like this, the Indian electric 2W segment is likely to flourish further and reach new heights and possibilities in the future.