Honda has posted one of their lowest ever monthly sales in March 2023 – They are no longer No 2 two wheeler brand of India

The country’s largest scooter maker, Honda Motorcycles and Scooters India (HMSI), has closed its account for FY2022 – 23 (April 2022 – March 2023) on a positive note. With a lot of products planned in the pipeline, we expect HMSI to register even better numbers in the coming months and all the way along FY 2023 – 24.

But YoY, MoM and QoQ analysis reveal that Honda is bleeding numbers in the Indian automotive market. With domination in scooters set in place, Honda seems to aim for the budget commuter motorcycle space where Hero MotoCorp is dominant. The CB Shine 100 will be directly against Hero Splendor, which is currently the highest-selling motorcycle in India by a very significant margin.

Honda 2W Sales For March 2023 – One of their lowest ever monthly domestic sales

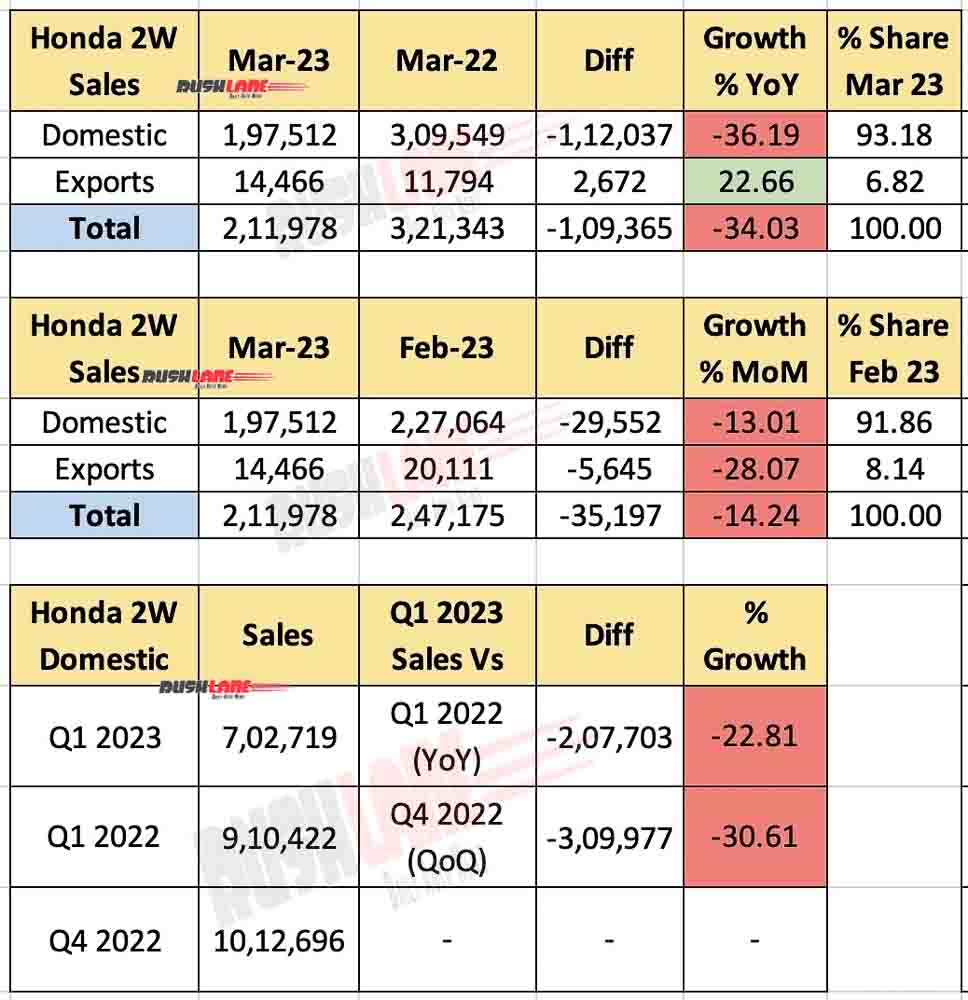

In the domestic market, Honda sold around 1,97,512 units last month. This doesn’t bode well when compared to 3,09,549 units sold a year ago in March 2022. Honda saw a decline of 36.19% YoY in its numbers. Volume loss YoY in the domestic market alone is a staggering 1,12,037 units.

Honda 2W sales in March 2023 is probably one of their lowest ever monthly sales recorded, excluding the months when lockdown was implemented due to Covid-19. TVS has now beaten Honda 2W in domestic sales. TVS sold 2.4 lakh two wheelers in the domestic market last month.

When compared to 2,27,064 units sold in February 2023, Honda registered a 13.01% MoM decline. This directly led to a volume loss accounting for 29,552 units MoM. Exports stood at 14,466 units. In Honda’s total sales, exports account for just 6.82%. As opposed to 11,794 units shipped in March 2022, Honda’s exports is the only saving grace for the brand as it registered a 22.66% YoY growth, gaining 2,672 units in volume YoY.

Honda shipped 20,111 units in February 2023 and hence a 28.07% MoM decline was observed. In the process, Honda lost 5,645 units in volume MoM. In total, Honda’s sales stood at 2,11,978 units, which was not enough to beat 3,21,343 units sold in March 2022 and 2,47,175 units sold in February 2023. A 34.03% YoY decline and 14.24% MoM decline was registered.

Honda 2W Loses No 2 Spot, falls behind TVS Motor

Now that the first quarter of 2023 is past us, Honda has sold 7,02,719 units in that time period. This was significantly lower, when compared to 9,10,422 units sold in Q1 2022 and 10,12,696 units sold in Q4 2022. Hence, a 22.81% YoY decline was registered with 2,07,703 units lost in volume.

QoQ decline was even worse, standing at 30.61% with a loss of 3,09,977 units in volume. In total, HMSI’s sales between April 2022 to March 2023 was around 43,50,943 units. Out of this, domestic sales were 40,25,486 units and 3,25,457 units were exported. Honda’s YTD growth stood at 14% in FY 2022 – 23.

February 2023 sales were considered to be a brutal blow for HMSI as the company saw YoY growth only with Activa. In comparison, March 2023 numbers seem to be even worse for the Japanese brand. We hope Honda turns the table with the new Shine 100.