Honda 2Wheelers sees domestic sales fall by about 38 percent in November 2021; exports growth reported

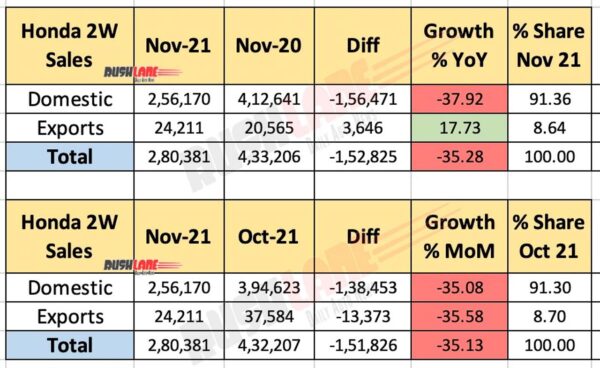

In November 2021, Honda 2W reported domestic sales decline at 37.92 percent. Sales fell to 2,56,170 units, down from 4,12,641 units. Domestic sales accounted for 91.36 percent of total sales for the month. Leading two wheelers from Honda include their best seller Activa range, Dio, Grazia, CB Shine, Livo, Dream, Unicorn, CB350, etc.

While domestic sales fell by almost 38 percent, at 1,56,471 volume loss, exports gained in momentum. Growth is reported at 17.73 percent. Exports rose to 24,211 units, up from 20,565 units at volume growth of 3,646 units.

Honda 2W Sales Nov 2021

Total sales is down at 2,80,381 units. YoY sales fell from 4,33,206 units at 35.28 percent decline. Volume loss stood at 1,52,825 units. Honda two wheeler sales was in fact less than what TVS sold last month. And Bajaj two wheeler total sales was even more than TVS.

MoM sales was reported at decline on all fronts in the range of 35 percent. Domestic sales fell from 3,94,623 units at volume loss of 1,38,453 units. Exports fell from 37,584 units at volume loss of 13,373 units. Total sales fell from 4,32,207 units at volume loss of 1,51,826 units.

Chip shortage challenge

Honda 2Wheelers enjoys a dominant position in India, largely on the back of its Activa scooter. The company is now expanding its scope in the bigger segment. In a year since launch, Honda reported sales at 30k units for its 350cc offerings, Honda CB350 and CB350RS. This is a segment, Honda is keen on, and to reach a wider audience, HMSI is now expanding its BigWing retail store network at quick pace.

Honda sells its 350cc units from BigWing stores. Apart from the newer entry level motorcycles, BigWing dealerships are charged with CB500X, CBR650R, CB650R, CBR1000RR-R Fireblade, and Fireblade SP, Africa Twin Adventure Sports and Gold Wing Tour. But none of the big movers were able to speed up the BigWing network expansion as quickly as the 350cc offerings.

Yadvinder Singh Guleria, Director, Sales & Marketing, Honda Motorcycle & Scooter India Pvt. Ltd. said, “Adding to the supply side challenge of chip shortage in the recent past and a subdued festive season, low market sentiments have continued to prevail in the month of November. However, we are expecting some revival in market sentiments by last quarter of FY’21-22.”

Auto industry disruptions

It goes without saying that it’s now been 20 months that the auto industry has been grappling with uncertainty and disruptions. Following two waves of Covid-19 lockdown restrictions, the global auto industry had to put up with a chips shortage. As such, it’s easy to see why companies are reporting lower dispatches.

Production output is being continually revised to cope with reduced chips procurement. While demand is stable, and production is optimised as best as possible, production output is currently disrupted.