As on date, taxes account for half of the price consumers pays for petrol and diesel. Fuel taxes are a percentage of prices which means that the government tax taxes go up correspondingly.

In fact, over 50% of petrol’s retail price constitutes taxes and dealer commissions while for diesel, the percentage is over 40%. These taxes vary state wise which results in varying retail prices. But how much is the exact break-up of money earned by petrol pump owner / dealer, state government and central government?

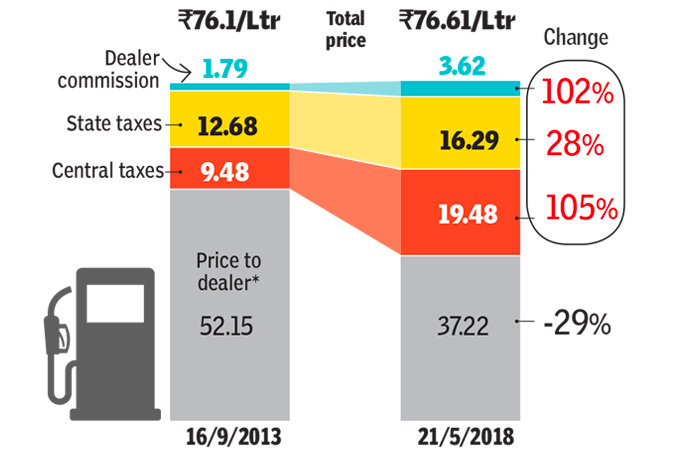

As per a report by Times of India, Central government has benefitted the most by the hike in petrol / diesel prices. Back in 2013, price of petrol to dealer (fuel pump owner) was Rs 52.15, today the price to dealer is Rs 37.22. Even then the prices are at an all time high. How? Well the taxes, dealer commissions have more than doubled.

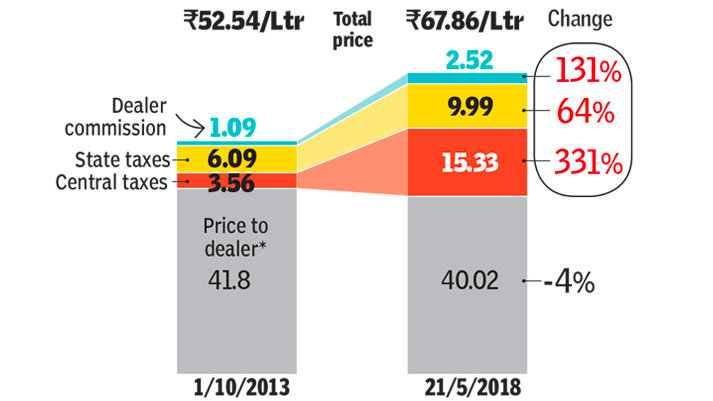

In the case of petrol, dealer commissions have gone up by 102%, state govt taxes have gone up by 28% while central government taxes have gone up by 102%. In the case of diesel, dealer commission has increased by 131%, state govt taxes by 64%, while center govt taxes have gone up by a staggering 331%.

Central government’s earning from the petroleum sector has gone up drastically. In the fiscal year 2014/15, Central govt earned Rs 1.3 lakh crore. This shot up to Rs Rs 2.7 lakh crore in 2016/17 – a growth of 117%. State govt’s earning grew by 18%, from Rs 1.6 lakh crore to Rs 1.9 lakh crore.

With crude oil prices past the $80 mark, prices of petrol and diesel will continue to increase even more, unless the taxes taken by government are reduced.

Oil Minister Dharmendra Pradan stated that the Center was sensitive to these rising prices and will be looking at alternatives which would help in bringing some relief to customers. Pradhan has expressed hopes in cuts in excise duty which could soften the impact but also indicates that states should cut VAT and bring fuel under the GST regime.