SBI’s special loan scheme can work to offset some of the adverse effects of recent hike in car loan interest rates

India’s largest banker, SBI has come up with a 100% finance option for Hyundai cars like Kona Electric as well as CNG models of Grand i10 and Aura. This may work as an incentive for prospective car buyers who may be worried about rising inflation and subsequent increase in car loan interest rates.

As may be recalled, RBI had recently increased the repo rate by 40 basis points. It has resulted in interest rate hikes for most loans such as auto loans, home loans and personal loans. It is likely that RBI will announce further hike in repo rate later this year if inflation continues to spiral.

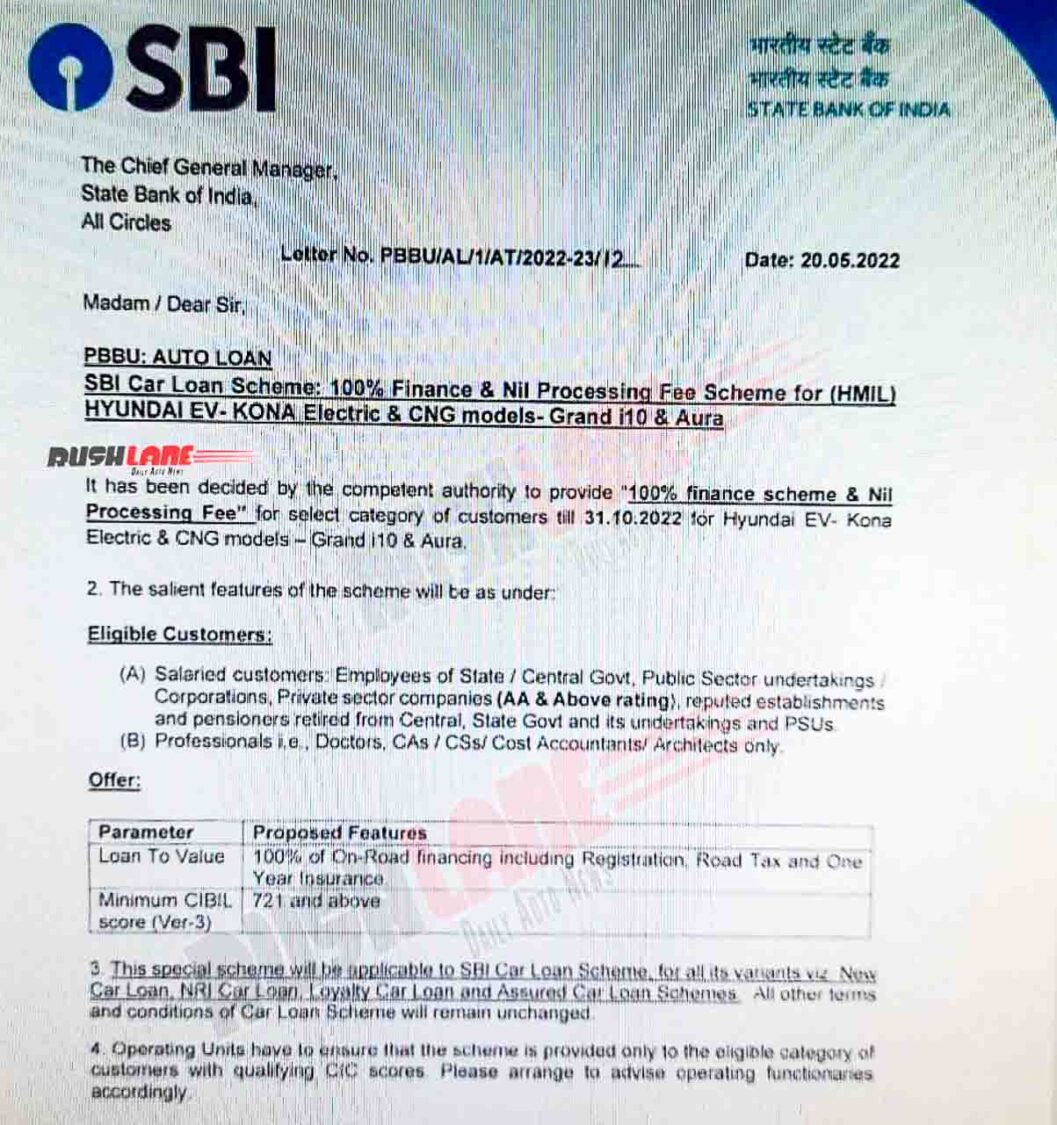

SBI 100% finance scheme

One of the most notable aspects of SBI 100% finance scheme is that it is being offered for on-road price of the vehicle. It will cover road tax, registration and one year insurance. This ensures that users have little to worry about in terms of paying from their own pocket. Furthermore, there will be no processing fee for the loan.

The scheme covers all the different types of SBI car loan products such as New Car Loan, NRI Car Loan, Loyalty Car Loan and Assured Car Loan Schemes. It is possible that OEMs and banks may be expecting a dip in sales due to the increase in car loan interest rate.

Rising prices of other commodities may also impact car sales in coming months. While earlier car loan interest rates were around 7%, it has now risen to around 7.5%. If there are more hikes in repo rate, car loan rates are expected to rise even further.

SBI 100% finance eligibility

With its 100% finance scheme, SBI is targeting buyer segments that are considered relatively safe in terms of their ability to pay back the loan. Among the salaried class, the ones that are eligible for this scheme include employees of state / central government, public sector undertakings / corporations and other reputed establishments. In the private sector, only employees of companies that are AA and above rated will be eligible.

Pensioners retired from state, central government and its PSUs and other undertakings can also apply for SBI’s 100% finance scheme. Professionals like doctors, CAs, CSs, Cost Accountants and Architects are also eligible. However, for all those eligible, the CIBIL score should be 721 or above. This special scheme will be available till 31 October, 2022.

With SBI taking the lead, it is possible that other banks may also launch similar schemes soon. Other carmakers too can partner with banks to launch special packages for prospective buyers. This is probably the perfect time to do so, as consumer confidence has improved with the recent excise duty cut of Rs 8 on petrol and Rs 6 on diesel. Several states have reduced VAT, which has further boosted consumer sentiments.