Hyundai India domestic sales in October 2021 falls by a third, down to 37k units

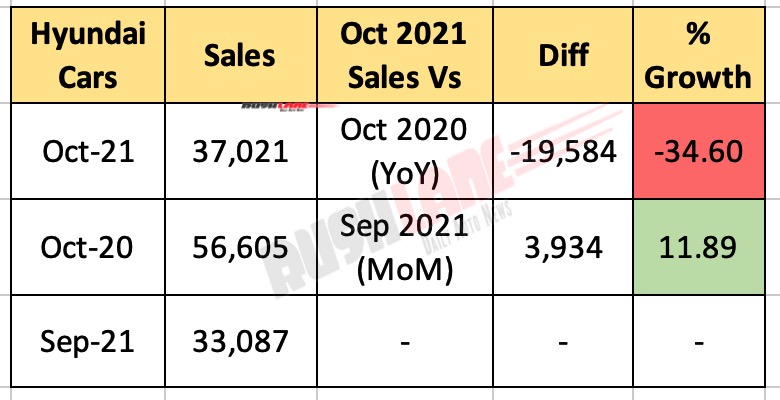

For October 2021, Hyundai India reports sales at 37k units, down from 56,605 units. Volume declined by 19,584 units at 34.60 percent decline. MoM sales grew 11.89 percent up from 33k units at volume gain of just under 4k units.

Hyundai Oct 2021 Sales

Best selling Hyundai cars in India include Creta, Venue and new Alcazar SUV. Even their hatchbacks, new i20 as well as the Grand i10 NIOS posted good numbers. Santro too helped in adding to the sales numbers.

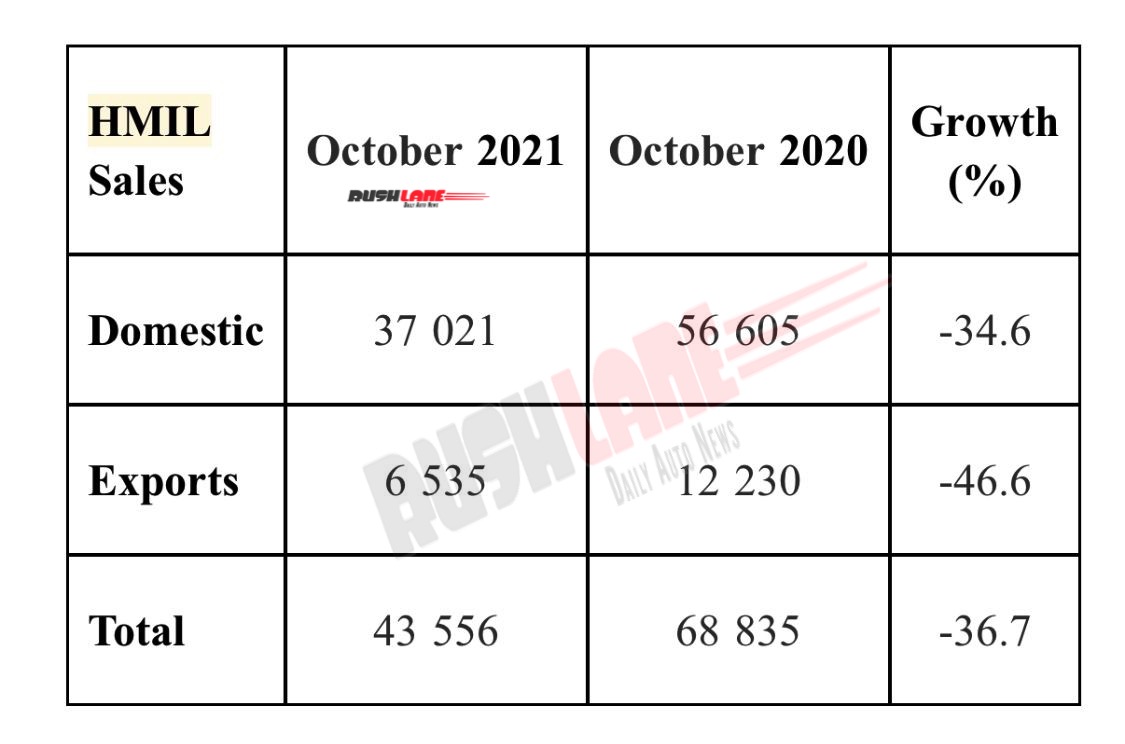

Hyundai India Exports fell by 46.6 percent. Export volumes were down to 6,535 units, down from 12,230 units. Total sells fell to 43,556 units, down 36.7 percent from 68,835 units. Decline in sales is not due to low demand, but due to shortage of parts.

The ongoing supply shortage has decreased the demand for key Semi-conductor materials, which are in high demand. At the same time, market sentiment is also weakening due to margin pressure, structural changes in the industry and uncertainty that remains about when this shortage will end. As a result of these negatives, semiconductor stocks have been trading softer this year but still managed to make up some ground. However, there is no clarity on how quickly this shortage will be negated.

Tightening of semiconductor supply has led to an increase in pricing for most semiconductor components. Additionally, the industry is seeing lower than usual inventory levels which will continue to complicate the situation in the future. Given the uncertainties, it’s difficult to tell for how many long months manufacturers are going to have to re-adjust vehicle production to lower output.

Semiconductor shortage

The current situation has affected the availability of certain key components. Manufacturers are carefully managing inventories to minimize any disruption to our customers’ high-quality product deliveries. A slowdown in the global semiconductor market means an impact on the foreseeable future will be more challenging for smaller companies.

To cope with this, small-cap companies are leveraging emerging technologies to better protect themselves from disruptions brought about by sudden changes in demand. Current disruption management points strongly at adapting to remain competitive. Despite constraints, manufacturers continue to increase operational efficiency so as to continue growing revenues and earnings for the year.

With increasing production costs and increasing demand for semi-conductors, one must examine new approaches to make the most of resources. So despite reducing reliance on certain aspects, production costs will continue to increase. Rising polymer prices and production costs also continue to put pressure on the semiconductor supply chain.

As the industry continues to evolve, opportunities for managing these challenges will need to be reevaluated. Alternatives such as other materials, equipment and process designs could make a big difference in reducing costs and keeping profits attractive to manufacturers.