Hyundai Motors reports decline in domestic sales and exports in February 2022

As the fiscal inches towards an end, car sales continue to be in a difficult place. The search for semiconductors is high on everyone’s mind in the ongoing shortage situation.

The situation stresses delivery deadlines on account of unavailability of parts, and Hyundai along with its partners continue to find alternatives to ensure early deliveries to customers. The situation is one that has gotten Hyundai cornered in recent months.

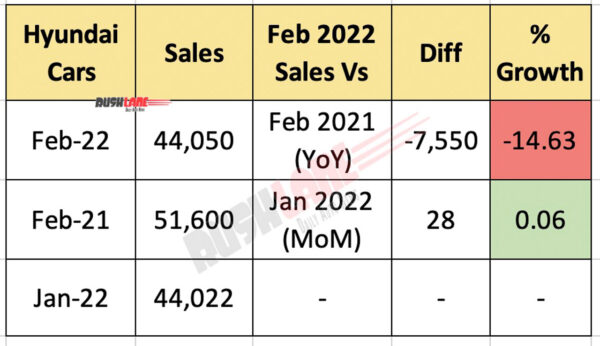

Hyundai Sales Feb 2022

In the meantime, sales have been hit. Hyundai India reports domestic sales down at 44k units in February 2022, down from 51.6k units. Volume loss stood at 7,550 units at 14.63 percent decline.

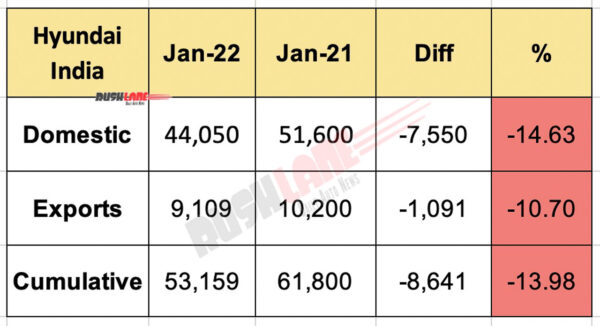

Exports too took a tumble, down at 9.1k units, down from 10.2k units. Volume loss stood at about 1.1k units at 10.70 percent decline. Cumulative sales last month fell to 53,159 units, down from 61.8k units. Volume loss stood at 8,641 units at 13.98 percent decline.

Hyundai Creta and Venue

While YoY sales decline was in double digits, MoM sales diff was marginal. Sales had been similar in January 2022 at 44,022 units. Depending on manufacturer, the sales narrative is a mixed one in current months. While the two big names are finding it difficult to reach new highs, the next three are inclined to report sales growth.

Hyundai has in recent years aligned its position in India to compete strongly in the UV segment. This means, the company relies greatly on Creta and Venue to boost sales numbers. Depending on the chip shortage situation, buyers can expect a facelift for both cars sometime in 2022.

Hyundai Exports Feb 2022

Hyundai India has for long been on top of the export table but finds the competition tougher even on this front. Maruti Suzuki did export 24k units last month, far more than what Hyundai did.

As the chip shortage continues to be a bit of a bother where domestic car production is concerned, manufacturers are leaving no stone unturned to focus on opportunities to sell in overseas markets. This continues to be a viable plan considering no manufacturer worth their salt would want to underutilized manufacturing capacity, and it’s still possible to sell cars to other markets where the same parts that are in short supply, aren’t required.

While Hyundai’s clear lead as the second largest auto manufacturer in the country goes largely unchallenged, a recent shift in focus by MSIL means its position as a leader in exports is now contended.