Currently, Maruti Suzuki has the largest portfoilo of small cars in India and is likely to stay that way for years to come

Maruti Suzuki is a dominant player in the Indian automotive industry since the beginning. MSIL is widely recognised for its continued emphasis on small cars. Despite a shift towards compact UVs and sub-4m crossover UVs in the Indian market, Maruti Suzuki still considers small cars to be a great bet in the country. Compact UV and sub-4m crossover UV segments mostly defy logic when termed as a SUV. In truth, they are all small cars.

In India, small cars have always been popular due to their affordability, fuel efficiency, and low maintenance costs. And the market has evolved with time since the ubiquitous Maruti 800 model, a small, economical car that became an instant success. Since then, Maruti Suzuki has become synonymous with small cars in India and has defined the large segment for years.

First-Time Buyers and Small Cars: A Perfect Match for the buyer market and Maruti Suzuki

Small cars is an important segment in the Indian automotive industry. Maruti Suzuki has been the dominant player in this segment, with an overarching market share. If we took a quick glance at Indian small and economic car space, the segment has lost many a car. Nissan Micra, Datsun Redi Go, Go and Hyundai Santro and Eon, Honda Brio and Jazz, Maruti Suzuki Alto 800 and A-Star, VW Polo, Renault Pulse and more are now history.

The small car market in India stood at a mighty volume of 1.55 million units sold in FY 2019. However, sales declined in the subsequent years due to the COVID-19 pandemic, the transition to BS6 emission norms, rising fuel costs, stricter safety standards, and an increase in taxes. Despite this decline, Maruti Suzuki believes that small cars will remain in demand in India, especially among first-time buyers who account for nearly half of all vehicle sales.

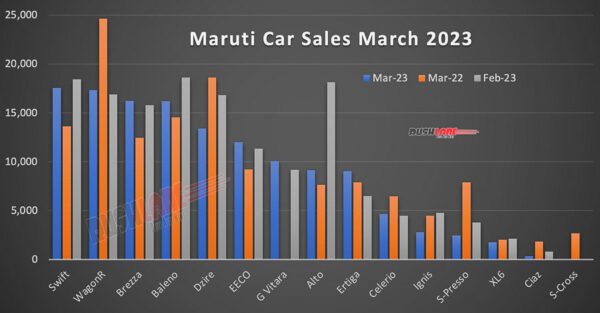

Segment sales have picked up in FY 2023 with 1.34 million small cars sold. Shashank Srivastava, Senior Exec Director at Maruti Suzuki, revealed that demand for cars at entry-level space will always persist in both new and pre-owned segments. He mentions low vehicle penetration and inadequate public transport as some reasons for this. He added that 47-48% of vehicle sales come from first-time buyers.

CV Raman, CTO at Maruti Suzuki expressed that the company will always look at small car spaces for safe and sustainable mobility. Offering entry-level solutions for upgrades from two-wheeler customers is of prime importance. Passenger vehicle penetration still stands at about 25 per 1,000 households in India. India is the largest market in the world for motorcycles and scooters. There will always be a purchase upgrade, and scope for small cars will stand the test of time.

How Technology Is Making Small Cars More Attractive Than Ever

The small car segment continues to play a crucial role in the Indian automotive industry growth story. The government’s focus on sustainability and self-reliance has led to the promotion of alternative fuel vehicles such as CNG, biofuels, and electric vehicles. Maruti Suzuki, which already offers CNG variants of several small cars, is well-positioned to benefit from this trend.

The industry as a whole is prepping for the launch of more hybrid and electric small cars in the future. MG Comet EV launch this week is a great big step in bringing a small electric car to a larger buyer group. Hyundai Exter which is yet to launch could in fact already be EV ready. Citroen, a fairly new manufacturer in India has launched its eC3.

Moreover, technological advancements in small cars are making them more attractive to consumers. Features such as touchscreen infotainment systems, connected car technologies, and advanced safety features are becoming increasingly common in small cars, which is further boosting their appeal.