MG motor India continues to witness retail sales growth at the start of Q2 FY22 – Total sales in 2021 crosses 25k mark in July

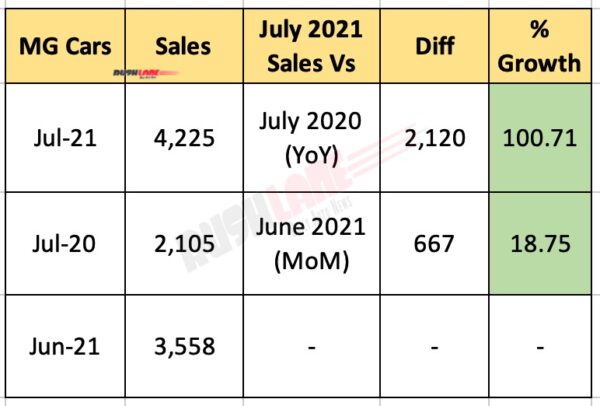

MG Motor India reports retail sales of 4,225 units during July 2021. YoY growth is reported at 101 percent. This is largely on account of the fact that business processes were continually impacted at the same time last year. Sales in July 2020 was reported at 2,105 units. Volume growth is reported at 2,105 units.

2021 Sales Cross 25k In July

MoM sales growth is pegged at 18.75 percent. Volume growth is reported at 667 units, up from 3,558 units. For July 2021, the manufacturer recorded the highest ever bookings and retail sales of ZS EV till date. The end result sees the brand cross the 4k unit sales mark for the month.

This is notable considering MG India has a product portfolio that touches upon select segments. This was the 3rd time in 2021 that monthly sales have crossed the 4k mark. In all of 2020, MG had reported sales of around 28k units.

In 2021, their sales have already crossed the 25k mark with 5 more months to go for the year to end. Most of these sales have come via Hector, Hector Plus and Gloster. ZS EV sales are also on the rise. Last month, the company found itself positioned favourably in in a Dealer Satisfaction Study conducted by FADA.

Hector and ZS EV sales momentum

Rakesh Sidana, Director-Sales, MG Motor India, said, “The Hector and ZS EV have further gained momentum during the month. However, the severe shortage of chips is expected to continue for some time and will lead to supply constraints. While we expect overall consumer demand to rise, we should also remain cautious of the potential threats posed by the third wave.”

To date, auto manufacturers are effectively negotiating inventory levels of channel partners. This has been essential owing to along chain of longterm disruptions. Close on the heels of mandatory BSVI transition, the Indian auto dealt with a complete lockdown, which meant production and sales came to nought.

And while lockdowns have been lifted as per state government directives, and production is renewed, the industry has been left high and dry when it comes to acquiring chips. The chips shortage is real, and looks like it’s here to cause a continuous niggle.

Ongoing supply constraints

MG India has quite a few things that works in its favour. Having started ops here fairly recently, the auto manufacturer was able to ensure things got underway on a smart note. Having strategically invested in smart processes for improved quality. The company will continue to invest in order to remain competitive. In the meantime the company continues to develop solutions that create segment benchmarks.

The shining future of cars will be coloured by next-generation technology developments. In the last decade, we have witnessed a major breakthrough in the semiconductor/chips industry. We are now enjoying the numerous benefits that next-generation semiconductors provide. Industry forecast expects that the adoption rate for these new technologies will continue to rise. With next-gen semiconductor tech procurement now constrained, manufacturing processes are impacted directly.