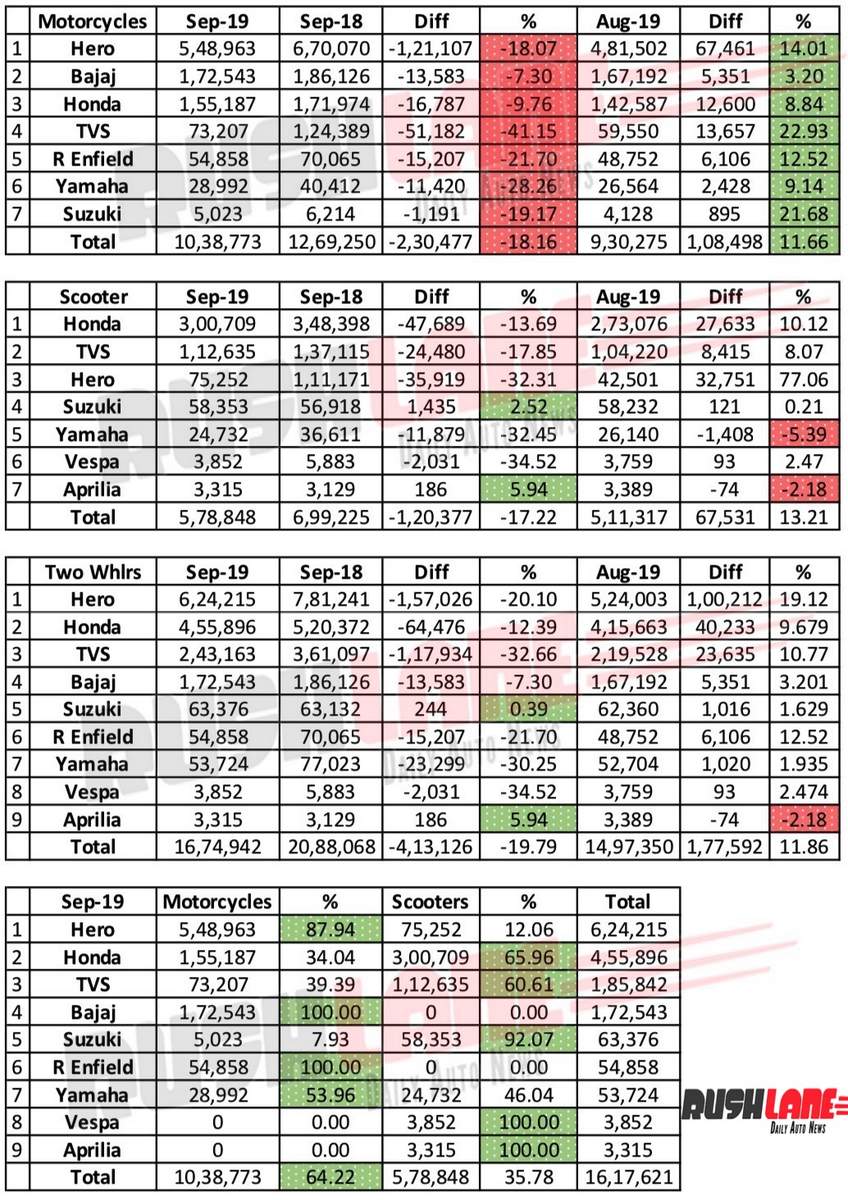

The two wheeler sales in September 2019 clearly indicated that the slowdown isn’t going anywhere in a hurry. The dent in sales performance has affected motorcycles and scooters almost to a similar extent as mass market OEMs registered YoY decline of 18.15% (10,38,773 units) and 17.22% (5,78,848 units) in these segments respectively.

As usual, when it comes to motorcycles, Hero Motocorp continued to have an unassailable lead with a tally of 5,48,964 units which is 18.07% lower than what it managed in September 2018. Of every 100 motorcycles sold in the country last month, more than 50 were wearing Hero badges.

Bajaj Auto which has no scooter on sale (the Chetak electric is gearing up for launch in the coming months) finished as the country’s second largest motorcycle maker last month with a sales performance of 1,72,543 units. At YoY decline of 7.30%, the Pune-based company faired better compared to its rivals.

The worst affected brand when in comes to motorcycle sales in September 2019 is TVS which registered a worrisome decline of 41.15%. The company only managed to dispatch 73,207 motorcycles last month as against 1,24,389 units in September 2018. Royal Enfield, Yamaha and Suzuki found their motorcycle sales plunge by 21.70%, 28.26% and 19.17% respectively.

Coming to scooters, Honda maintains in dominance over the segment albeit not without registering a YoY slump of 13.69%. At 3,00,709 units sold, the Japanese brand occupied over half of the scooter segment last month, thanks to the venerable Activa family.

At 1,12,635 units, scooters contributed to 60.61% of TVS’ total two wheeler sales. Finishing third in the scooter segment was Hero Motocorp which clocked 75,252 units at a decline of 32.31%. Suzuki was the one of only two brands which posted positive YoY growth in scooter sales last month but with a small base (58,353 units) to boot with, 2.52% doesn’t make a big impact. Yamaha and Vespa saw their scooter sales dip over 30% while Aprilia posted a 6% growth at 3,315 units. Again, small base and small gain.

Combining both motorcycles and scooters, Hero still leads the game by a fair margin despite an overall dip of 20.14%. Strong market share in scooter segment helped Honda to outsell Bajaj Auto to take second spot. TVS too rode on the back of its scooter sales to keep Bajaj at bay.

Overall, the two wheeler sales in September 2019 witnessed a YoY decline of 19.79%. Things are expected to be better in October owing to Danteras and Diwali.