Maruti Ertiga continues to maintain No 1 spot in the MPV / MUV segment for Feb 2021

February’21 was a good month for the auto industry as the passenger car segment recorded a healthy growth of 20% over February’20. Most OEMs, except Ford and Skoda recorded growths over their February’20 sales figures.

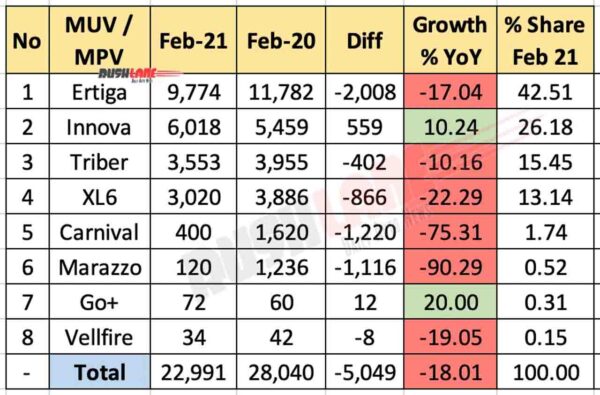

However, not all segments clicked well in Feb’21. One such segment happens to be that of MPVs, which recorded an overall de-growth of 18% over Feb’20. Let’s have a look at the brand wise performance of all major MPVs.

Ertiga – Undisputable King

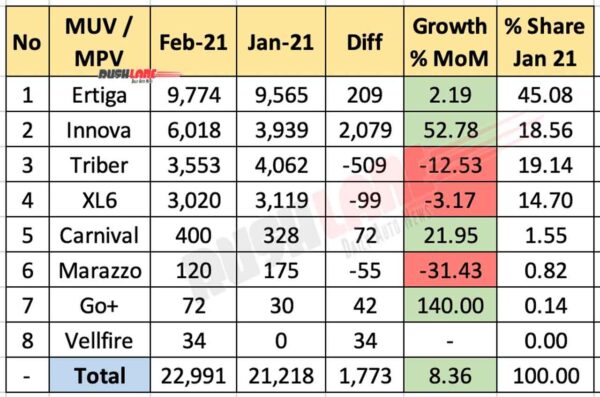

Ertiga has been the undisputed king of the segment since last few years and even in Feb’21, it has managed to retain the No.1 tag. Ertiga was the best selling MPV of Feb’21 with overall dealer dispatch numbers of 9,744 units.

However, what is concerning is that the MPV recorded a steep 17% de-growth over its Feb’20 performance. Ertiga’s cousin, the XL6 also recorded a de-growth of 22% and came in at the 4th spot in the sales tally.

Toyota Innova – On the Road to Recovery

In Feb’21, the Innova from Toyota posted a growth of 10% over its Feb’20 sales numbers. With the easing out of supply related constraints, we expect the numbers to further improve for Innova in the coming months. Launch of facelift also seems to have helped increase Innova sales.

Triber – Sustained Sales Momentum

Triber from Renault seems to have clicked well with Indian customers as even after 1 year of launch, the MPV has been able to clock consistent sales of around 3,500 units. In Feb’21, the model recorded decline of around 10% when compared with its Feb’20 sales figures. However, sales of 3,553 units are decent for the MPV.

Premium MPVs

Kia’s Carnival recorded a massive dip in its numbers, majorly due to a significantly high base of Feb’20 (Launch month of the Carnival). However, sales of 400 units for a MPV of its class is still commendable. Toyota’s Vellfire registered de-growth in sales figures as the numbers fell down from 42 units last year to 34 units in Feb’21.

Potential Reasons for Degrowth

Some of the models like Mahindra Xylo have been discontinued by their respective OEMs, which has further resulted in a stronger de-growth for the segment. Other potential reason for de-growth of the MPV or People’s Mover segment could have been the changing preferences of customers, as commuters are trying to move away from public mobility towards personal mobility.