As of today, the total tax charged on petrol is 45-50% and that on diesel is 35-40%. If petrol and diesel are brought under the GST, the taxes will have to be reduced to 28%, as that is the maximum that the govt can charge under GST.

This is the main reason why petrol and diesel are yet not brought under the GST umbrella. With activists and opposition making noise, the govt might bring the fuels under GST. But, even then, there might not be change in retails rates. Here’s why.

After taxing consumers 28% GST (CGST + SGST), state govt might charge additional taxes, which will bring the retail rate of petrol and diesel to same as today, when they are not under GST. This was revealed by Bihar Deputy CM Sushil Kumar Modi to PTI.

However, prior to taking this decision, the Center will have to decide on if it is willing to forego the INR 20,000 crores it collects by way of input tax credit after the GST regime came into effect in July 2017. However, even if petro products are bought under GST, it will not have any major impact on tax or price as the price of petrol and diesel will continue to be determined by global factors.

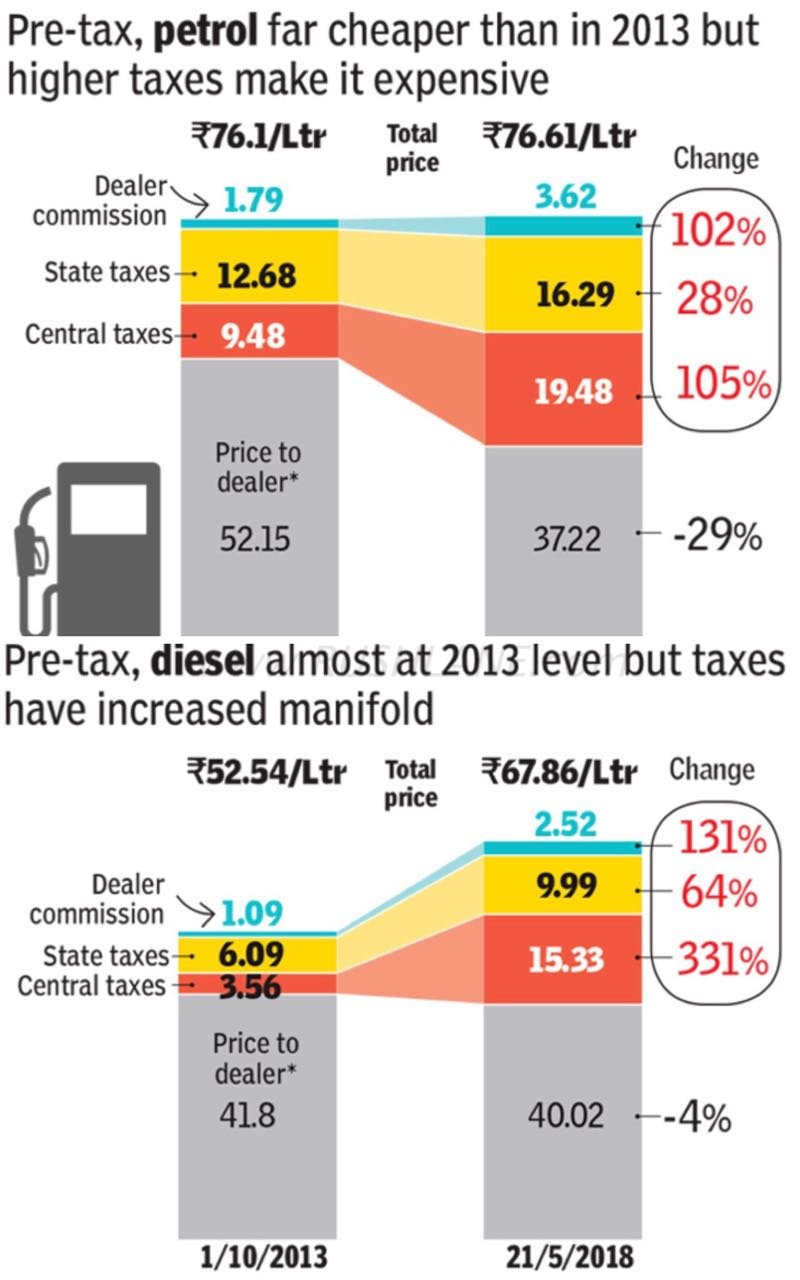

The Center currently levies a total of INR 19.28 per liter as excise duty on petrol and INR 15.33 per liter on diesel. The states also levy VAT which in the Andaman and Nicobar islands is at 6% on petrol and diesel while it Mumbai this goes up to 39.12% on petrol. Telangana charges VAT at 26% on diesel while Delhi charges VAT at 27% on petrol and 17.24% on diesel. This takes total tax on petrol to 45-50% and on diesel at 35-40%.

Under GST, a uniform rate of taxation at just 28% would bring with it a monumental loss in revenues both for the Center and States. Price of petrol, which reached an all time high of 78.43 per liter is now at INR 75.55 per liter while diesel which stood at INR 69.31 during that peak pricing period has now come down to INR 67.38 as on date.