Firstly, the price gap between petrol and diesel fuel is narrowing at a rapid pace despite petrol being the costlier choice in almost all parts of India. Secondly, the country’s volume sales mainly happen in the budget car segment which mostly consists of petrol cars. With stringent emission norms kicking in soon, certain manufacturers have slowly started to turn their attention from diesel-powered vehicles to cleaner petrol, petrol mild-hybrid or petrol-hybrid products.

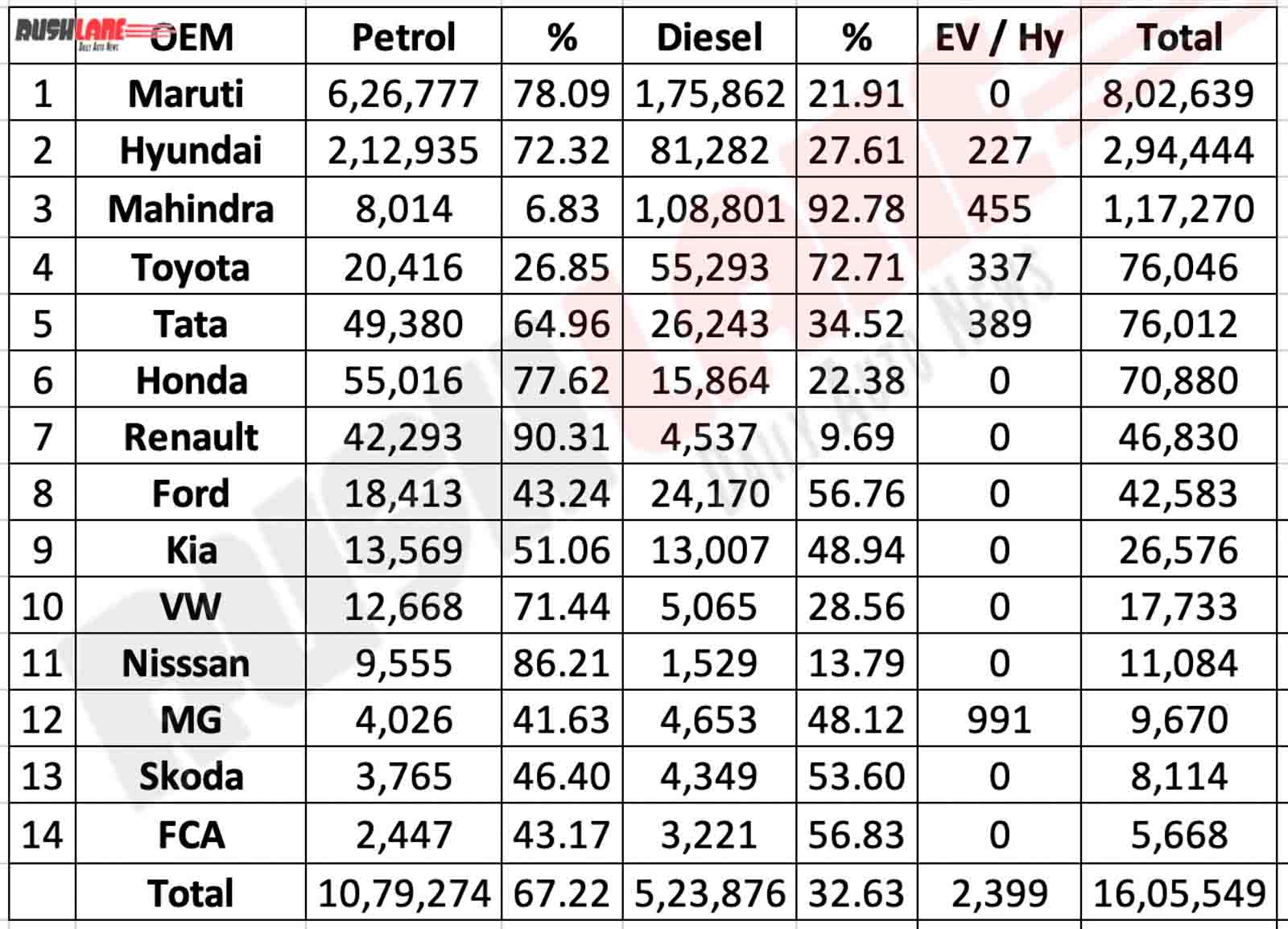

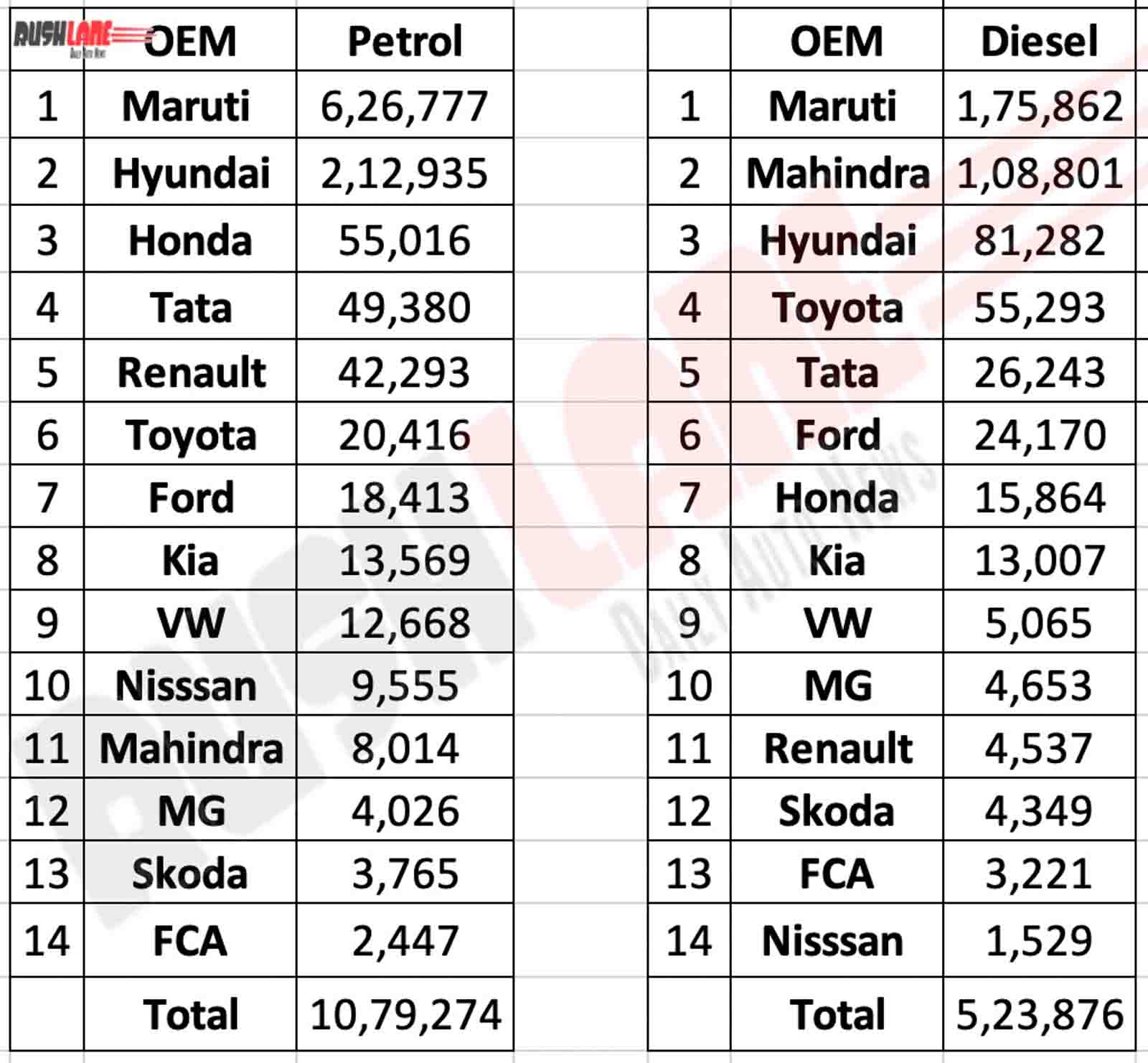

That being said, the recent petrol vs diesel car sales report for the period of April-November 2019 clearly shows that petrol vehicles account to more than 67% (10,79,274 units) of the overall automotive sales of 16,05,549 units. While diesel models accounted for just 32.6% (5,23,876 units), electric/hybrid/mild-hybrid products stood for a mere 0.1% (2,399 units).

With a total sales figure of 8,02,639 units within the given time period, over 78% of Maruti Suzuki’s sales were petrol models while diesel products formed just under 22%. The second best-selling brand in the country, Hyundai India, is narrowing the sales gap between the market leader at a strong rate. Out of the total 2,94,444 units, the company sold 2,12,935 petrol models and 81,282 diesel vehicles, alongside just 227 electric/hybrid vehicles.

Mahindra Automotive has an SUV-focussed portfolio and for the same reason, diesel sales account for almost 93% out of the total 1,17,270 units sold while petrol and other forms of power plants contributed just 6.8% and 0.4%, respectively. Toyota India is another brand which has a stronger diesel portfolio. In the given period, the Japanese brand sold almost 73% diesel vehicles and around 27% petrol models. The remaining 337 electric/hybrid products stood for 0.4%.

The total sales by Tata Motors, at 76,012 units, slid behind that of Toyota India by just 34 units. The reputed Indian name sold 65% petrol cars and 34.5% diesel cars. Hybrid/EVs accounted for 389 units (0.5%) thanks to the Tigor EV and the figure is expected to see an appreciable rise with the launch of the all-new Nexon EV.

Honda Car India is relatively new in the diesel-car market, but the company achieved a respectable sales figure of 22.4%, against 77.6% petrol models, out of the total 70,880 units. Renault India achieved 90.3% of petrol-car sales thanks to the popular budget segment offering, the Kwid. Diesel models accounted for just 9.7% out of the total sales of 46,830 units.

Ford India arguably makes the best engines (in terms of driving enjoyment) in the country. At 43.2%, petrol sales went down from diesel by 13.6% in the months from April to November 2019. Total sales stood at 42,583 units. Kia Motors India almost hit the right balance for petrol and diesel sales with its only product — the Kia Seltos SUV — at 51.1% and 48.9%, respectively; out of the total sales figure of 26,576 units.

Volkswagen India sold a total of 17,733 units (out of which a good majority is the Polo hatchback) in which petrol products formed a strong 71.4% while diesel products contributed 28.6%.

Coming first outside the top 10 is Nissan India. The company has not been doing particularly well in the country for quite a few months and in this particular period, it could achieve an overall sales figure of 11,084 units; 86.2% petrol and 13.8% diesel.

MG Motor India, at a total sales figure of 9,670 units, showed a respectable market performance for an entirely new name for Indian buyers. The SAIC-owned brand currently sells only the Hector 5-seater SUV — which solely accounted for 41.6% petrol, 48.1% diesel and 10.2% hybrid sales — while quite a few products are in the works to launch soon.

Finally on the chart are Skoda India and FCA (Fiat, Jeep, etc.), with a total sales figure of 8,114 units for the former and 5,668 units for the latter. Petrol/diesel break-up of both brands are somewhat similar at 46.4%/53.6% and 43.2%/56.8%, respectively.