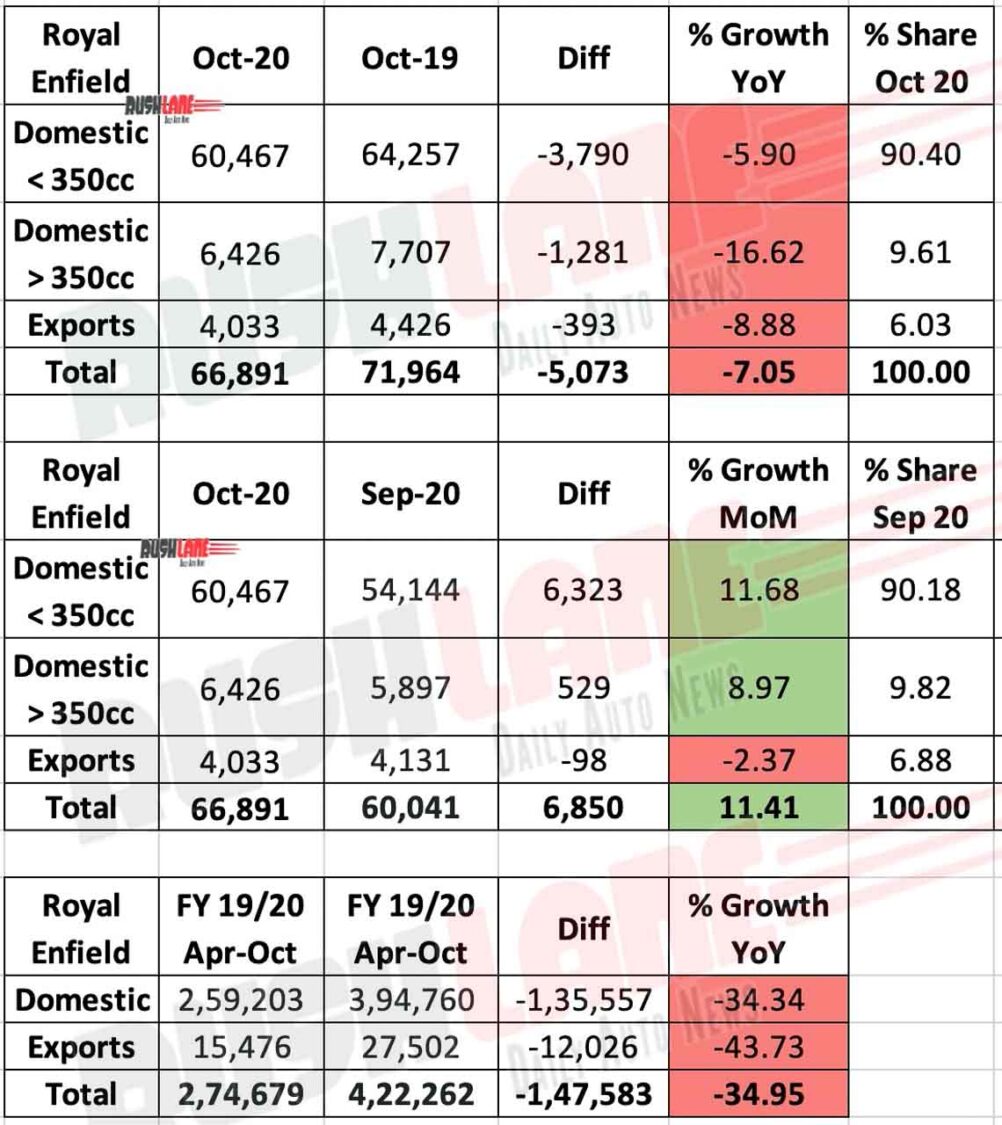

Royal Enfield’s Oct 2020 total sales including exports stood at 66,891 units – a decline of over 7%

As the world awaits Royal Enfield Meteor 350 launch scheduled on November 6, 2020, the manufacturer has reported October 2020 sales. Albeit at a decline, the manufacturer has reported MoM sales gain.

Total sales including exports amount to 66,891 units, down 7 percent from 71,964 units reported a year earlier. Exports fell 9 percent to 4,033 units from 4,426 units.

Disruptions in global business logistics have played some part in this, and a recovery is expected as business operations ease. Royal Enfield is committed to exports in the mid-segment, and has been increasing export destinations in recent months.

Domestic Sales

Domestic sales fell to 62,858, down 6.9 percent from 67,538 units sold in October 2019. In the up to 350cc segment, sales stood at 60,467 units, down 6 percent from 64,257 units. The segment is Royal Enfield’s stronghold for decades at an end.

For now though Royal Enfield is building on its classic appeal in the segment. It already has the Himalayan to do what Classic can’t.?? 6,424 units were sold in the segment above 350 cc (Himalayan, ). Segment sales contracted by 17 percent, down from 7,707 units sold in October 2019.

And the company is now set to introduce yet another segment offering with Meteor 350. Though launch was expected last month, it’s still in time for the ongoing festive season. Pre-booking numbers are available at the moment. ?

Battle For 200-500cc Segment

The mid-size segment has seen growing interest not just from potential buyers, and has seen manufacturers step up to the game. It’s also a segment that’s dear to Royal Enfield, and the brand would need to diversify as an opportunity presents itself to ensure little chunks of the segment aren’t snatched from it. Currently, RE has a market share of 81% in the 200-500cc segment motorcycles in India.

??While Royal Enfield has for long enjoyed the classic and retro tag in the 350 segment, the cc range as a whole has seen a range of new offerings from manufacturers in recent years. While this doesn’t pose a sales challenge for RE, it does recognise the fact that there are those who would buy a mid-segment bike, and this number though small, is growing. Honda CB350 launched last month is however a direct RE Classic 350 cc competitor.

Honda is selling CB350 DLX at Rs 1.85 lakh and DLX Pro at Rs 1.9 lakh at its Big Wing dealerships. Considering, the number of such dealerships are limited for now, Honda two wheelers is quickly remedying that by inaugurating more such dealerships. Jawa and Jawa 42 pose a small challenge to RE. Total Jawa retail sales in September 2020 was reported at 2,121 units. There’s also the Benelli Imperiale 400. Other mid segment plays include the BMW twins, Apache 310, and a range of KTM and Duke bikes.