There was a decent growth registered by Royal Enfield sales for January 2023 in domestic market, but exports plummeted

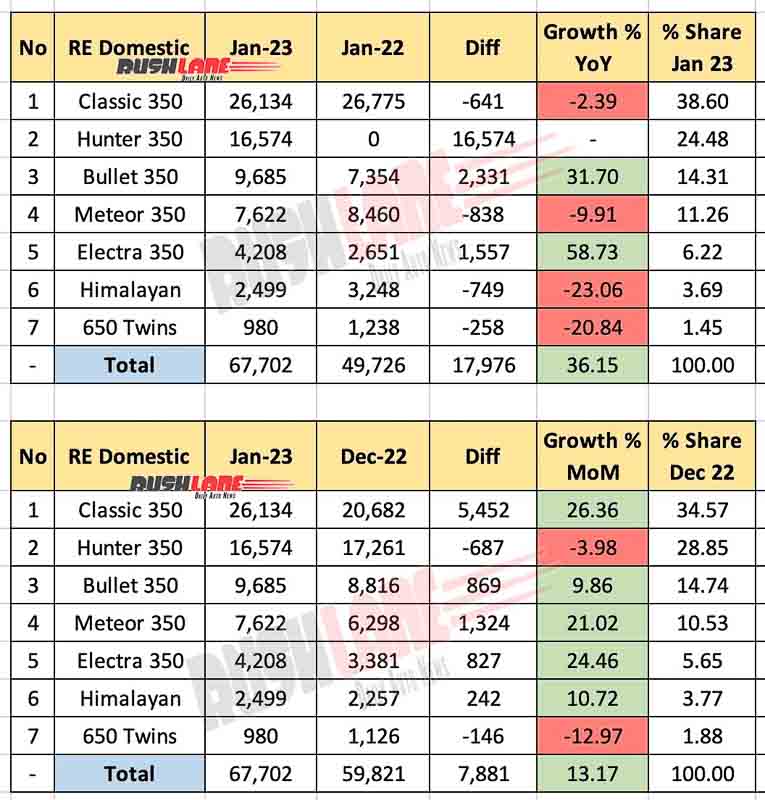

Domestic market is where Royal Enfield shows commendable growth in both YoY and MoM analysis. With 67,702 units sold in the domestic market, Royal Enfield saw a YoY growth of 36.15% over 49,726 units sold a year ago and 13.17% MoM growth as opposed to 59,821 units sold a month before. Volume growth is 17,976 units YoY and 7,881 units MoM.

The highest-seller for RE in India is Classic 350 with a 38.60% market share. RE sold 26,134 Classic 350 and saw 26.36% MoM growth. With 5,452 units of volume growth. There was a 2.39% YoY decline, which is better than the 40.44% YoY decline found in December 2022. Hunter 350 secured 2nd place with a 24.48% market share.

Royal Enfield Sales – Domestic Market

As opposed to 17,261 units sold a month before, Hunter’s sales fell short with 16,574 units with a small 3.98% MoM decline. Bullet 350 is next on this list with 9,685 units sold last month. The evergreen Bullet managed to register 31.70% YoY growth and 9.86% MoM growth. Volume gain stood at 2,331 units YoY and 869 units MoM.

Bullet was followed by Meteor 350 with 7,622 units sold in January 2023. Even though Meteor sales dropped by 9.91% YoY, there was a 21.02% growth MoM. Electra 350 sold 4,208 units with 58.73% YoY growth and 24.46% MoM growth. Volume gain for Electra 350 stood at 1,557 units YoY and 827 units MoM.

ADV Himalayan sold 2,499 units which accounted for a 3.69% share of the domestic market. Sales weren’t enough to beat 3,248 units sold in 2022 and saw a 23.06% YoY decline. It fared better in MoM analysis with 10.72% growth. Lastly, we have 650 Twins with 980 units sold. 650 twins saw a 20.84% YoY decline and a 12.97% MoM decline.

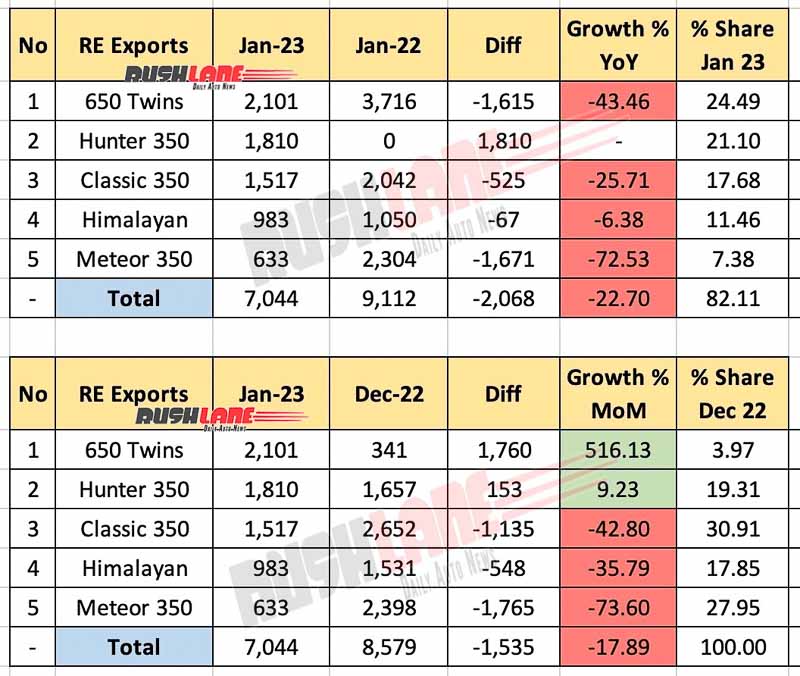

Royal Enfield Sales – Exports

RE’s flagship 650 lineup might have come last in the domestic market. But it tops in exports as it is the highest-shipped motorcycle from Royal Enfield. With 2,101 units shipped, it registered a 43.46% YoY decline as opposed to 3,716 units shipped last year. But, there is a staggering 516.13% MoM growth as RE shipped 341 units of 650 Twins in December 2022.

Due to this, 650 Twins are accountable for 24.49% of RE’s total exports. Hunter 350 is 2nd with 1,810 units shipped with 9.23% MoM growth and 153 units volume gain. Classic 350 is pushed down with just 1,517 units shipped last month. Classic 350 saw a 25.71% YoY decline and a 42.80% MoM decline. Market share went from 30.91% to just 17.68% in just a month.

Himalayan exports were at 983 units last month. It wasn’t enough to beat 1,050 units shipped a year ago and 1,531 units shipped a month before. In effect, Himalayan’s numbers declined by 6.38% YoY and 35.79% MoM. Volume lost was 67 units YoY and 548 units MoM. Lastly, we have Meteor 350 at 633 units.

Meteor 350 fell into the red completely with a 72.53% YoY decline and a 73.60% MoM decline. In total, Royal Enfield shipped 7,044 units in January 2023. The company registered a 22.70% YoY decline as opposed to 9,112 units shipped in Jan 2022 and 17.89% MoM decline as opposed to 8,579 units shipped in December 2022.