Sales volume for most segments was low due to limited production of vehicles thanks to the lack of semiconductor chips

SUVs are the blue-eyed boys of Indian car buyers. Over the last few years, the PV segment has been led by entry level hatch (Alto, WagonR, etc), then the premium hatch (Baleno, i20, etc), sub 4 meter sedan (Dzire, Xcent, Amaze, etc) and now, it is the turn of the SUVs.

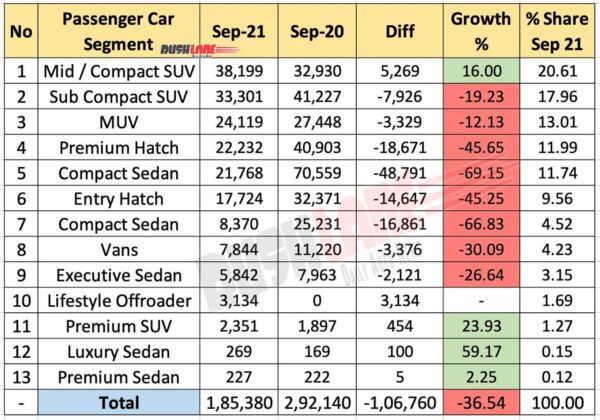

With the advent of new compact (Creta, Seltos), sub-compact (Brezza, Nexon) and mid-size SUVs (Harrier, Hector) in market, the focus has shifted from hatchbacks and sedans which once ruled the Indian roads. Together, the Compact, Sub-compact and Mid SUVs have a market share of 51.58% in the Indian car market. This means, for Sep 2021, every 2nd car sold was an SUV.

Both compact and mid-size SUV segments have begun to outsell their sedan and hatchback counterparts. The passenger vehicle segment witnessed an overall YoY decline of 36.6 percent in September this year. However, the decline was mostly contributed by sedans and hatchbacks.

Compact / Mid-size SUVs flavour of Indian consumers

This segment emerged as the highest-selling segment in the PV market last month and was one of the few segments to witness positive YoY growth. As opposed to September last year, when 32,930 units of compact and mid-size SUVs were sold, the industry recorded a total volume of 38,199 units. A sudden influx of new models in recent times in this space shows all OEMs are rushing to make a presence here.

In recent months, compact-size SUVs such as Skoda Kushaq, Volkswagen Taigun have been launched in the country. At least one out of every five cars sold last month was a compact / mid-size SUV. With newer models such as Mahindra XUV700 and MG Astor expected to make inroads this month, this space is expected to generate huge volumes in the near future.

Sub-Compact SUVs, hatchbacks witness decline

The next spot was occupied by the sub-compact SUV (sub 4m SUV) segment with a total of 33,301 units sold in September 2021 in comparison to 41,277 units sold during the same period last year. This resulted in a YoY decline of 19 percent. A total of 24,119 MUVs were sold across the country last month. In comparison, 27,448 MUVs were sold during September last year which has resulted in a 12 percent YoY fall.

The sales of compact hatchbacks (Swift, NIOS) fell by 69 percent last month with a registered monthly sales volume of 21,768 units only. On the other hand, entry-level hatchbacks recorded a sales volume of 17,24 units with a YoY decline of 45 percent. Premium hatchbacks fared slightly better with 22,232 units sold yet it recorded a sizable drop in YoY sales by 46 percent.

Sedans lag behind

Compact sedans (sub 4m sedan) also registered a low sales volume of 8,370 units in September this year with a YoY decline of 67 percent. A segment higher in the Executive class of sedans (City, Verna, Ciaz), it witnessed a sales volume of 5,842 units.

The lifestyle off-roader segment shows only Mahindra Thar which has recorded a sales volume of 3,134 units. This space saw the inclusion of the new Force Gurkha recently which will add to the volumes this month. The premium SUV (Fortuner, Gloster) and premium sedan (Superb, Camry) segment recorded YoY growths of 24 percent and 2 percent respectively.