December 2022 was not a productive month for sub 4m SUV makers as the segment dropped sales in both MoM and YoY

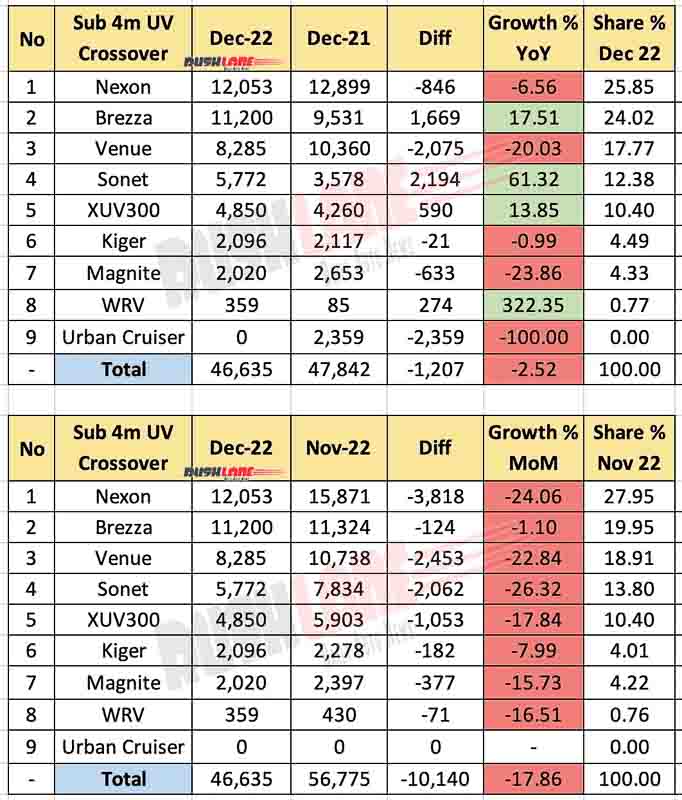

Sub 4m SUVs are currently all the rage among SUVs in India. Owing to its lower price point, this segment generally pushes more volume than compact SUVs. For December 2022, sub 4m SUVs crumbled in both YoY and MoM analysis. With a total of 46,635 units, the segment lost 1,207 units YoY to 47,842 units sold in December 2021.

A drop in sales was recorded at 2.52% YoY for this segment. MoM analysis didn’t prove beneficiary either. In fact, it is far worse than YoY analysis. With 56,775 units sold in November 2022, sub 4m SUV segment lost 10,140 units MoM. Sales decline was recorded at 17.85% MoM. Every single vehicle falling in this segment saw a decline in MoM analysis.

Sub 4m SUV Sales Dec 2022

Tata Nexon topped the charts with 12,053 units sold in its name. Sales weren’t adequate to beat 12,899 units sold a year before and a massive 15,871 units sold a month before. This way, Nexon sales dropped by 6.56% YoY and 24.06% MoM. Volume loss stood at 846 units YoY and 3,818 units MoM. Despite that, Nexon held a 25.85% market share in sub 4m SUV segment.

Brezza fell behind Nexon in sales by just under 1000 units. With 11,200 units sold in its name, Brezza managed to surpass 9,531 units sold a year ago and registered 17.51% YoY growth. Figures fell short by just 124 units or 1.10% to register MoM growth. Brezza’s market share used to be 19.95% in Nov 2022, now up to 24.02%.

Hyundai had sold 10,360 units a year ago and 10,738 units a month prior to analysis. With just 8,285 Venue sold last month, Hyundai failed to surpass Brezza and Nexon. YoY drop was 20.03% and MoM drop was 22.84%. Volume loss stood at 2,075 units YoY and 2,453 units MoM and held 17.7% of this segment in terms of market share.

Sonet holds a 12.38% market share and secured 4th place on this list. With 5,772 units sold last month, Sonet registered 61.32% growth YoY as opposed to 3,578 units sold a year ago and saw a 26.32% decline MoM. XUV300 sales improved by 13.85% YoY and declined by 17.84% MoM. With just 4,850 units sold, XUV300 took a 10.40% market share in this segment.

Magnite, Kiger sales decline

Platform partners Kiger and Magnite sales fell close to each other. The former sold 2,096 units and the latter 2,020 units last month. Both of them registered a decline in sales in both YoY and MoM analysis. Even though Kiger’s loss doesn’t seem that significant, Magnite pushed more volume than Kiger in the past and saw a greater decline rate.

At the end of its lifecycle, Honda WR-V seems to be enjoying some offers at the dealer end. As opposed to 85 units sold last year, WR-V registered 322% YoY growth by selling 359 units. Even that was not enough to beat 430 units sold a month before. Like every other sub 4m SUV, WR-V also registered a decline in MoM by 16.51%.