After a long time, sub 4m SUV sales have favoured Brezza against Nexon which had held its ground against rivals

Sub 4m SUVs are of stark importance for manufacturers. This segment draws in more volumes than compact SUVs (Creta, Seltos) and is one of the, if not, the hottest segment in Indian automotive segment. For the month of February 2023, this segment showed interesting results as customer trends seem to have shifted toward Brezza, instead of good ol’ Nexon.

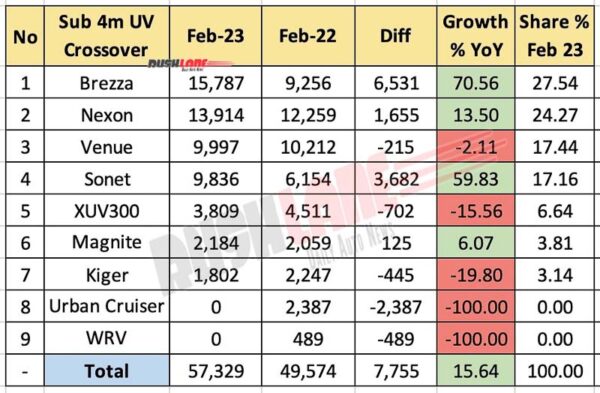

Sub 4m SUV Sales Feb 2023 – Brezza No 1

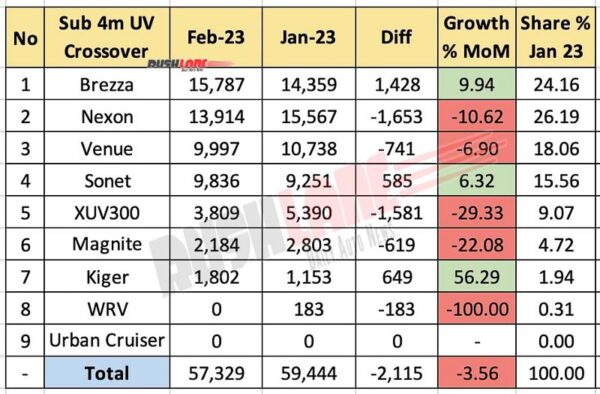

Ever since Maruti Suzuki launched Brezza, replacing Vitara Brezza, it has worked wonders for the brand. Customer response is very positive, which is reflected in the 15,787 units sold last month. Brezza takes the crown of highest-selling sub 4m SUV and highest-selling SUV of any kind as well. Brezza registered 70.56% YoY growth over 9,256 units sold by Vitara Brezza in Feb 2022 and has outdone itself from a month before by 9.94% MoM growth. It holds 27.54% of market share too. Volume growth stood at 6,531 and 1,428 units YoY and MoM respectively. Nexon has been pushed back and now takes 2nd place with 13,914 units sold.

As opposed to 12,259 units sold a year ago, Nexon saw 13.50% growth YoY, but numbers fell MoM by 10.62%, losing 1,653 units in volume. Just a month before, Nexon was the highest-selling SUV in India with 15,564 units in its name. Market share has been reduced from 26.19% to 24.27%. Upcoming Nexon facelift might be a reason for some of this decline too.

At 3rd and 4th place, we have South Korean cousins Hyundai Venue and Kia Sonet with 9,997 and 9,836 units respectively. Hyundai Venue completely falls in the red with a 2.11% YoY decline and a 6.90% MoM decline. On the other hand, Kia Sonet registered 59.83% YoY growth and 6.32% MoM growth.

Venue lost 215 units YoY and 741 units MoM in volume, while Sonet gained 3,682 units YoY and 585 units MoM. Despite being platform partners, both Venue and Sonet follow completely different design languages and characters inside and out. Creating a subtle identity difference.

Kiger Gained 56.29% MoM

In 5th place, we have the Mahindra XUV300 clocking 3,809 units last month. As opposed to 4,511 units sold a year ago and 5,390 units sold a month before, Mahindra XUV300 saw a 15.56% YoY decline and a 29.33% MoM decline. In effect, Mahindra lost 702 units YoY and 1,581 units MoM in volume.

Platform partners Nissan Magnite and Renault Kiger sold 2,184 and 1,802 units respectively. While Magnite saw positive growth of 6.07% YoY, gaining 125 units in volume, there was a 22.08% decline in MoM, losing 619 units in volume. Kiger showed the opposite response with a 19.80% YoY decline, losing 445 units in volume and gaining 56.29% YoY with 649 units growth in volume.

Honda WR-V sold 0 units last month and will be discontinued from 1st April 2023. In total, sub 4m SUV sales for the month February 2023 stood at 57,329 units. The segment saw 15.64% YoY growth as opposed to 49,574 units sold in February 2022 and saw a 3.56% MoM decline as opposed to 59,444 units sold in January 2023. Volume gained YoY is 7,755 and volume lost MoM is 2,115 units.