Tata Nexon has posted its highest ever monthly sales – First time crossing 14k sales in a month

Hard work done by Tata’s Product and Marketing teams, is finally converting into results on the National sales charts. Since the launch of Punch, Tata has been inching closer to the coveted 2nd spot on the list of largest OEMs of India (in terms of sales).

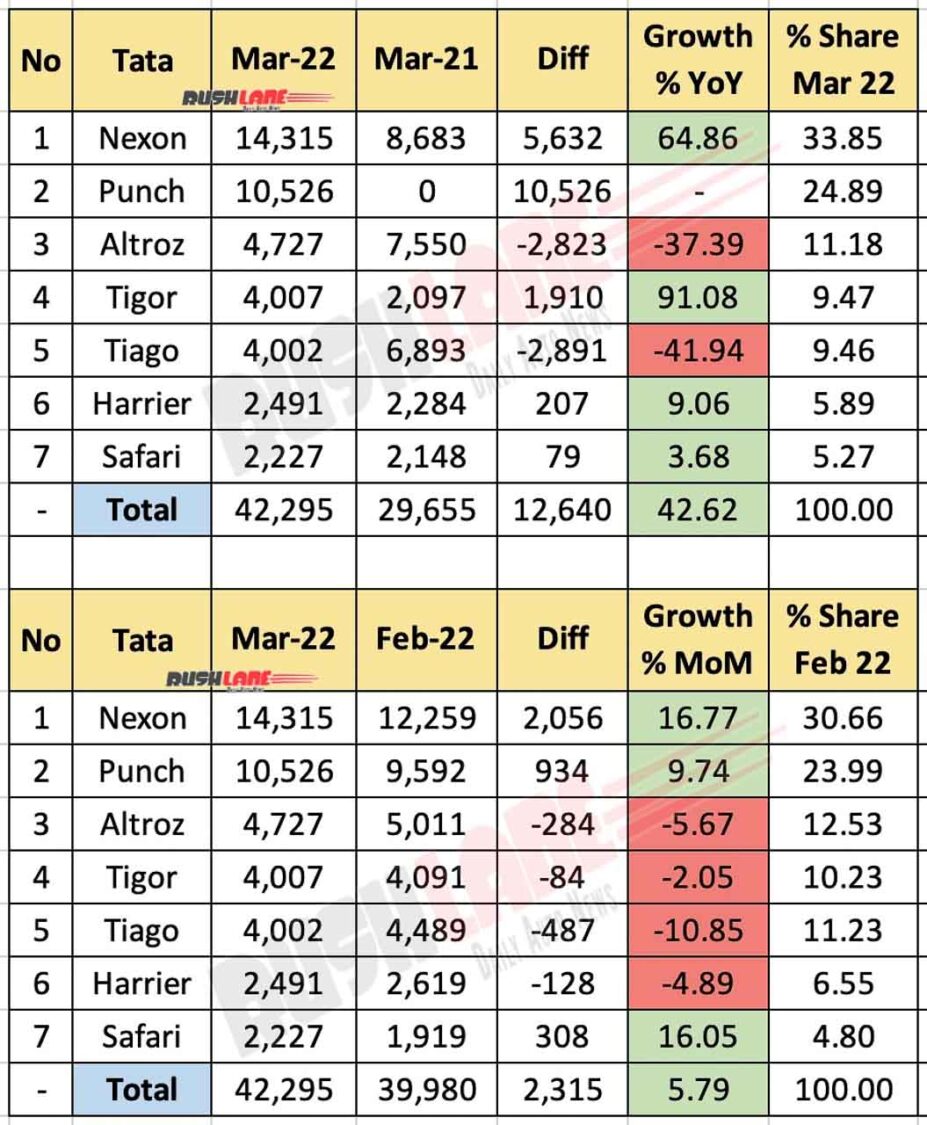

March 2022 too was a great month for Tata as the Indian OEM recorded a strong 42.6% growth in its sales numbers over last year in the same month. On a month on month basis too, Tata recorded a 5.8% growth with overall dealer dispatches of 42,295 units. For reference, it had sold 29,655 units in March 2021 and 39,980 units in February 2022.

In terms of market share, Tata Motors registered the highest increase across all OEMs. In March’21, Tata’s market share stood at 9.3% whereas in March 2022 it managed to increase its market share to 13.2%. Interestingly, the difference in Market Share of Tata and Hyundai a year ago was around 7% whereas now, it has come down to just 0.7%. Let’s look at model-wise numbers to understand more about the key drivers of growth.

Tata Car Sales Breakup March 2022 – Nexon Best Selling SUV

Tata’s best selling model in March 2022 was the Nexon, which coincidentally was also the best selling SUV of India in March 2022. Nexon recorded a 65% increase in its sales, as dealer dispatches went up from 8,683 units in Mar’21 to 14,315 units in Mar’22. When compared with Feb’22 numbers too, Nexon registered a 17% increase in its sales.

Tata’s latest launch, Punch too continued to bring in additional volumes for the OEM. Punch recorded sales of 10,526 units and didn’t have any base in Mar’21, as the model was launched in H2’21. Incremental numbers of around 10K from Punch have helped Tata to break into the aspirational 40K+ monthly sales segment.

Tigor Overtakes Tiago

Tiago recorded a decline in its sales as dealer dispatches dropped from 6,893 units in Mar’21 to 4,002 units in Mar’22. On a month over month basis too, Tiago recorded a 11% decline in volumes. Altroz, too, registered de-growth as sales went down from 7,550 units in Mar’21 to 4,727 units in Mar’22. Partial sales loss could also be because of cannibalization due to Punch, as both models have a similar price range.

Tigor recorded a fantastic increase in its sales numbers as the sub 4 metre sedan registered a 91% increase in its sales volumes over last year in the same month. Tata managed to ship 4,007 units of Tigor in Mar’22, up from 2,097 units in Mar’21.

Harrier + Safari = 4,718

Harrier and Safari duo recorded slight increase in their sales volumes, however broadly both the models maintained their respective sales averages. Harrier registered dealer dispatches of 2,491 units in Mar’22 whereas Safari managed 2,227 units. During the same month last year, Harrier’s sales stood at 2,284 units while Safari had clocked sales of 2,148 units.

Tata’s strategy of keeping its line-up ‘Forever New’ seems to be working in its favour for now. Regular updates on its models have helped it to get required attention and interest from its customers. In related news, it had unveiled an all new Coupe EV concept recently, which it baptized as CURVV. The concept is expected to spawn into a product which could compete with the likes of MG ZS EV and Hyundai Kona.