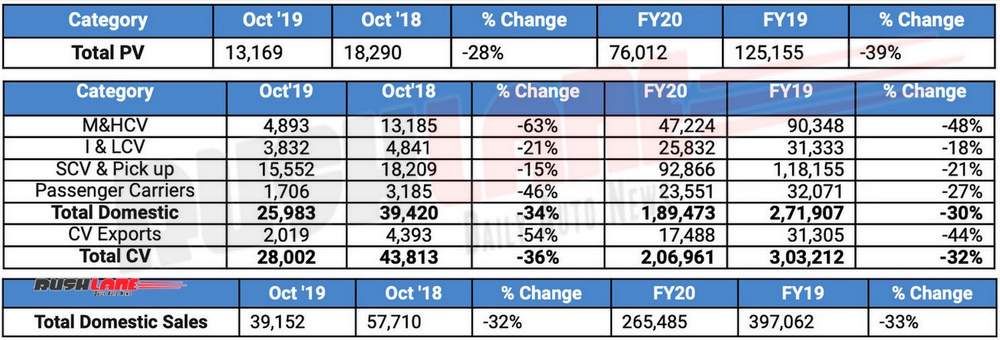

Tata Motors reports domestic sales of 39,152 units in October 2019. Of this, passenger car sales decline is reported at 28 percent, down to 13,169 units from 18,290 units sold in October 2018.

Though the slowdown is telling, Tata Motors has done remarkably better in MoM sales, up 62.6 percent from 8,097 units sold in September 2019. Top performers for Tata Motors in the passenger car segment continue to be the likes of Tiago, Nexon, Harrier, Tigor.

Mayank Pareek, President, Passenger Vehicles Business Unit, Tata Motors Ltd., “In line with our New Paradigm, focus was on retail. Results have been encouraging with retails at 36% more than wholesale. Customer response was positive to festive offers and our new product launches like Harrier Dark edition and Nexon Kraz+. In October retail sales were the highest in this fiscal recording a 70% increase month-on-month.

In this fiscal, network stock has been reduced by 38%. October end network stock is the lowest in last two years. This will help our network to be prepared for a smooth BS6 transition. Our endeavour is to enhance the retail capability by continuously adding new sales outlets and executives. We remain optimistic that the positive sentiments of the festive season will lead to a structural recovery in the market.”

So, while the year has been a slow one for Tata Motors, October brings something of a cheer. Commercial vehicle sales are down 34 percent at 25,983 units, down from 39,420 units sold in October 2018.

Within the CV segment, it’s thee brand’s SCV and pick-up segment that’s the biggest pusher, taking the big bite of the CV pie. Sales decline in the segment is reported at 15 percent, down to 15,552 units from 18,209 units sold in October 2018.

CV exports are reported at 20,19 units, down 54 percent from 4,393 units exported in October 2018. Total CV sales is down 36 percent at 28,002 units sold, down from 43,813 units sold in October 2018. Tata Motors was unable to report sales gain in any segment.

Girish Wagh, President, Commercial Vehicles Business Unit, Tata Motors Ltd., “With our continued focus on retail acceleration, retails in October were 24% ahead of wholesale. Additionally, wholesales improved by 7% over September. The enquiries have increased compared to last month in M&HCV and I&LCV, with fleet owners initiating discussions for replacement of older vehicles.

We will continue our focus on system stock reduction as we prepare for the BS6 transition. Overall system stock is now at a multi-quarter low, which coupled with increasing enquiries, and the government’s thrust on infrastructure investments, will help firm-up volumes and realisations in the coming months.”