Overview of Indian Electric Vehicle Industry in FY 22-23

In its recent fiscal year report, Society of Manufacturers of Electric Vehicles (SMEV) stated that India witnessed growth. Sales growth of electric vehicles (EVs) during the FY22-23, including electric buses, cars, three-wheelers, and two-wheelers.

Total number of EVs sold was 1,152,021. Indicating a significant milestone for the Indian EV industry, which is striving to achieve the Government-mandated EV goals. This trend is expected to continue in the future. Concerns have been raised regarding the slow adoption of high-speed electric two-wheelers (E2W).

Slow Adoption of High-Speed E2Ws: Challenges, Solutions, Opportunities

According to industry experts and stakeholders, slow adoption of high-speed electric two-wheelers (E2Ws) in India isn’t due to a lack of consumer demand. But due to issues related to subsidies and compliance with government norms. Many original equipment manufacturers (OEMs) have already passed on over Rs. 1200 crore in subsidies to their customers.

However, the pretext of delays in localization has led to the withholding of subsidies. Allegations of under-invoicing by premium OEMs for FAME subsidy have resulted in a shortage of working capital. This amounts to Rs 400 crore of OEM money. And Likewise, it affects business operations and the growth of the industry.

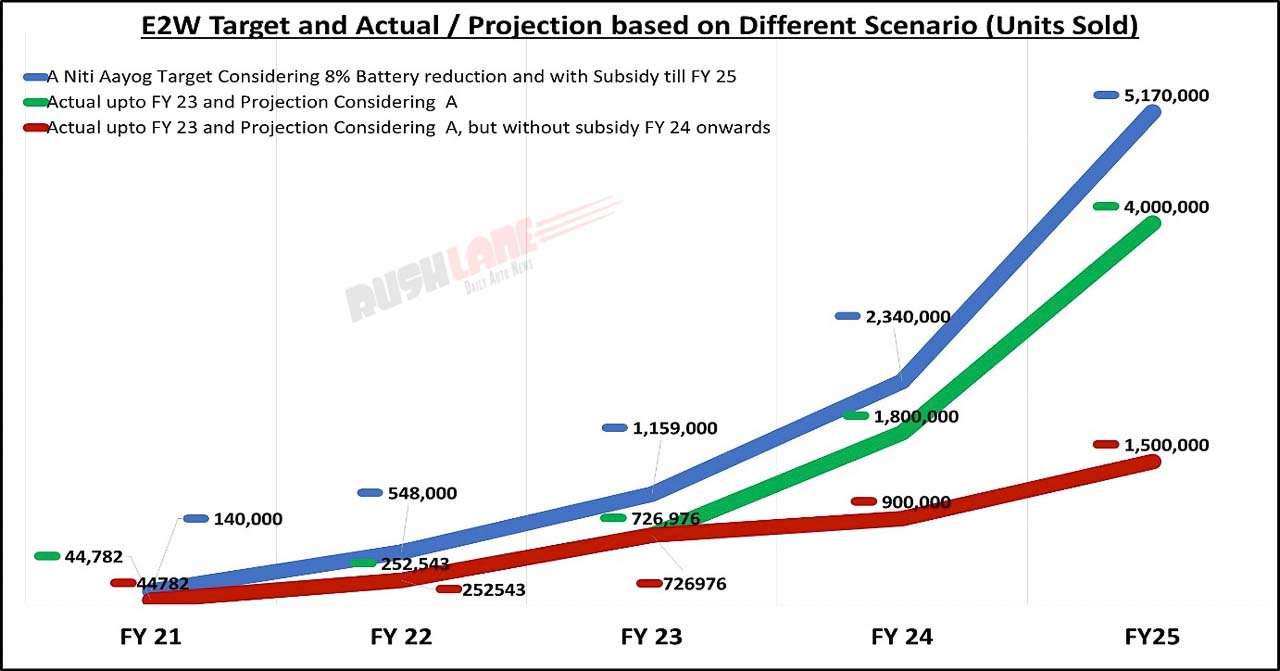

Key factors that can strengthen the EV ecosystem in India include improving the supply chain for essential components such as motors and batteries. There must be clarity on the continuation of the FAME scheme. A direct subsidy mechanism can be implemented to avoid discrepancies. Moreover, phasing out subsidies gradually after achieving a certain threshold and promoting local manufacturing of EV components can reduce dependence on imports. Together, this can make the EV ecosystem self-sustaining.

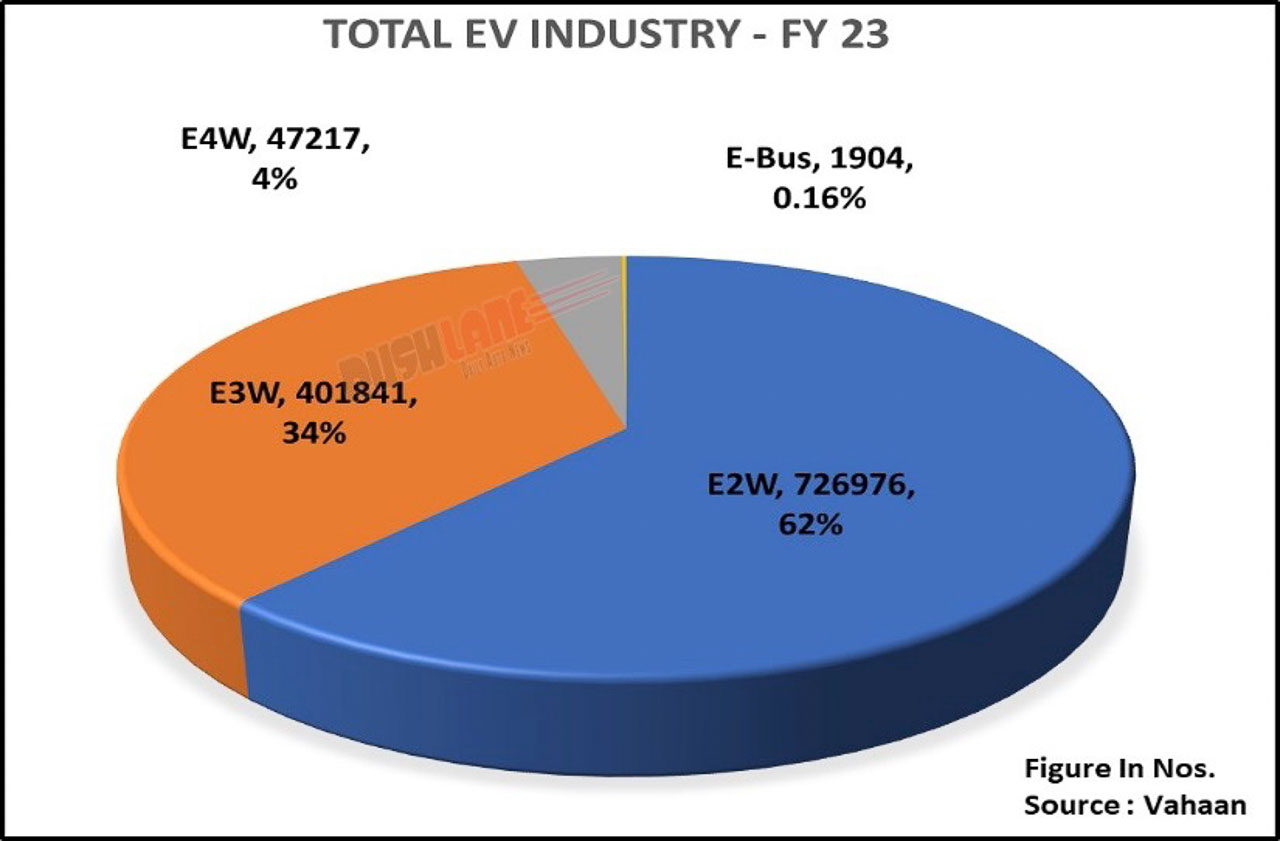

Growth of Electric Two-Wheeler Sales in India – Strengthening the EV Ecosystem in India

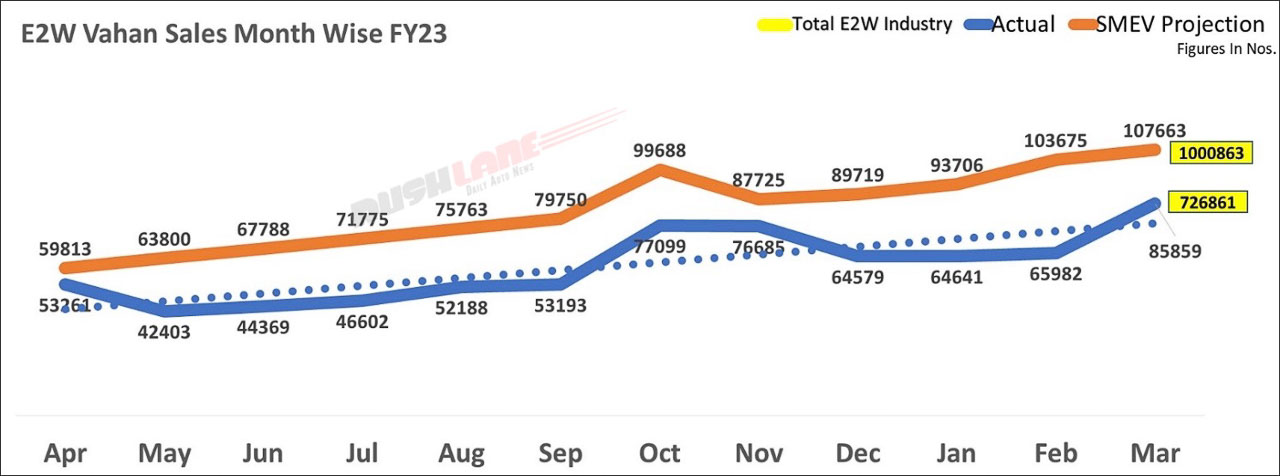

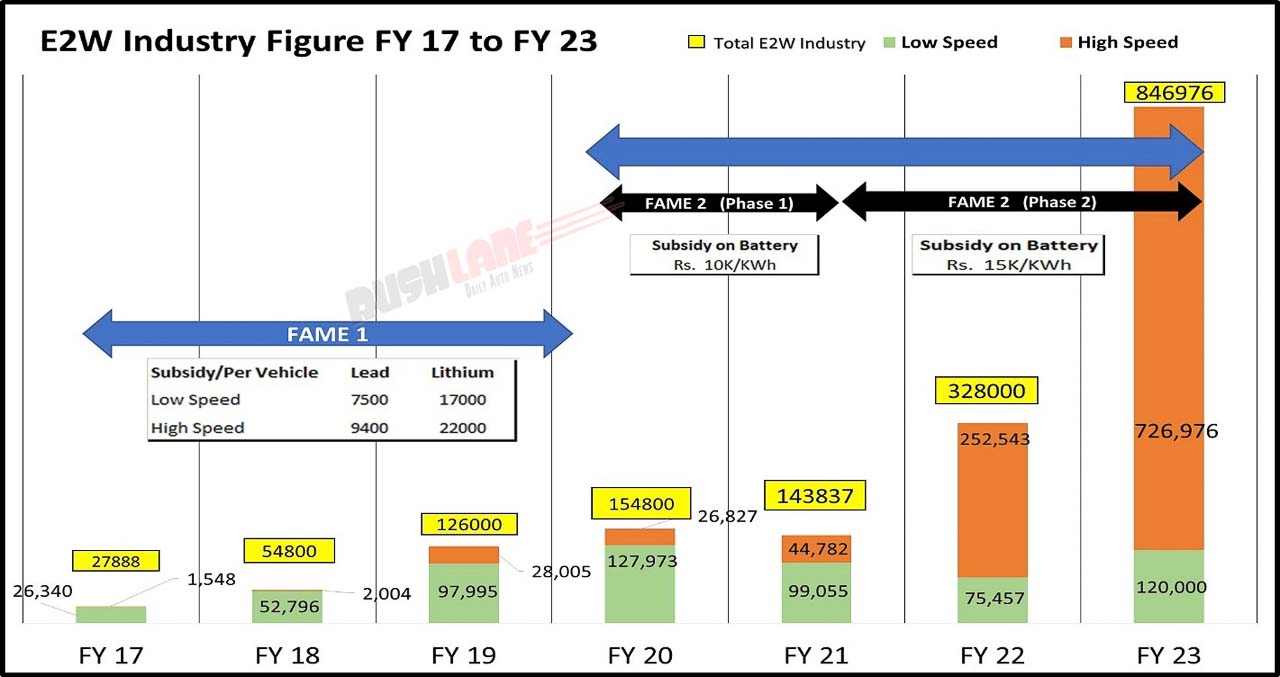

Despite challenges, growth of electric two-wheeler sales in India is noteworthy. In FY23, 7,26,976 high-speed e-scooters and 1,20,000 low-speed e-scooters were sold. As were 50k units of e-cycles and 2,85,443 units of low-speed e-rickshaws. Total e3W sales are reported at 4,01,841 units. Electric 4W (E4W/electric car) sales is reported at 47,217 units. E-Bus sales are reported at 1,904 units. Total e2W sales stood at 8,46,976 units.

In FY22, this number stood at 3,38,000 units – 2,52,543 units for high speed e-scooters, and 75,457 units for low speed e-scooters. However, it’s worth noting that growth rate in the High Speed electric two-wheeler segment slowed down in the latter part of the fiscal year. Consequently, it resulted in annual estimates being in the red by over a quarter (25 percent shortfall) as per research organisations and Niti Aayog. Estimates stood at 10,00,863 units.

EV Industry in India Grows Exponentially: Challenges Remain for High-Speed E2Ws

Sohinder Gill, DG SMEV, said, “While all the earlier schemes since 2015 had negligible effect on the EV adoption, the revised FAME2 in late 2021 had a dramatic effect on E2W adoption as it decreased their prices by around 35%.

This started attracting the component supply chain that had earlier shunned anything to do with E2WS because of extremely low volumes and it is only in the late 2021, suppliers started queuing up to OEMS to show their eagerness of developing EV components. It took most of these suppliers 12 to 18 months, the usual time that it takes to localise and now most of them have started setting up sufficient capacities.”