Royal Enfield looks to dominate this segment in the future with the introduction of new models such as the upcoming new-gen Classic 350

The 200cc-500cc segment has seen the advent of many motorcycles in the past few years. However, Royal Enfield continues to have a clear edge above the rest of the brands even today. As many as five of the top-selling models in this category last month have been rolled out of the Chennai-based bikemaker’s facility.

Royal Enfield- Classic, Meteor, Bullet Lead Segment

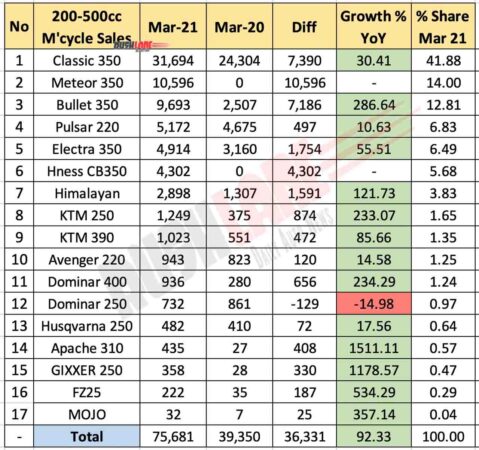

The segment is spearheaded by Royal Enfield Classic 350, as usual, with a total of 31,694 units sold in March 2021. In comparison, RE sold 24,304 units of the retro motorcycle in March last year which resulted in YoY growth of 30 percent. This was followed by the company’s latest addition to its lineup, Meteor 350.

The bikemaker dispatched 10,596 units of the cruiser to dealerships across the country last month. The company’s longest-running motorcycle in production Bullet 350 also raked in a decent amount of sales with 9693 units sold last month. Last year, the figure stood at 2507 units, therefore, witnessing a massive YoY growth of 287 percent.

Bajaj shines with Pulsar models

On the other hand, Bajaj sold 9315 units of the Pulsar duo- 180 and NS200 last month. In comparison, the Pulsar siblings outperformed themselves by 26 percent YoY since last year when they recorded 7415 units. Bajaj Auto’s flagship model in the Pulsar range- Pulsar 220F, registered a sales volume of 5172 units in comparison to 4675 units sold by the company in March last year. Therefore, it recorded a YoY growth of 11 percent.

The sixth place was occupied by Bullet’s electric start sibling, formerly known as Bullet Electra. Bullet 350 ES witnessed sales of 4914 units in March this year as opposed to 3160 units sold in March last year. Therefore, it managed to register a YoY growth of 56 percent.

The latest addition to this list is Honda’s new CB350 which is retailed in two derivatives- H’Ness and RS. Both models cumulatively recorded a sales volume of 4302 making a solid start to its India journey.

Hero MotoCorp, KTM round off list

Royal Enfield’s adventure tourer model Himalayan took the eighth spot as it registered a sales volume of 2898 units last month against 1307 units sold in March 2020. This translated to a 122 percent YoY growth.

| No | 200-500cc M’cycle Sales | Mar-21 | Mar-20 | % |

|---|---|---|---|---|

| 1 | Classic 350 | 31,694 | 24,304 | 30.41 |

| 2 | Meteor 350 | 10,596 | 0 | – |

| 3 | Bullet 350 | 9,693 | 2,507 | 286.64 |

| 4 | Pulsar 220 | 5,172 | 4,675 | 10.63 |

| 5 | Electra 350 | 4,914 | 3,160 | 55.51 |

| 6 | Hness CB350 | 4,302 | 0 | – |

| 7 | Himalayan | 2,898 | 1,307 | 121.73 |

| 8 | KTM 250 | 1,249 | 375 | 233.07 |

| 9 | KTM 390 | 1,023 | 551 | 85.66 |

| 10 | Avenger 220 | 943 | 823 | 14.58 |

| 11 | Dominar 400 | 936 | 280 | 234.29 |

| 12 | Dominar 250 | 732 | 861 | -14.98 |

| 13 | Husqvarna 250 | 482 | 410 | 17.56 |

| 14 | Apache 310 | 435 | 27 | 1511.11 |

| 15 | GIXXER 250 | 358 | 28 | 1178.57 |

| 16 | FZ25 | 222 | 35 | 534.29 |

| 17 | MOJO | 32 | 7 | 357.14 |

| – | Total | 75,681 | 39,350 | 92.33 |

Its immediate next competitor, in terms of pricing, Hero Xpulse 200, registered a sales volume of 2485 units last month. Hero was able to sell only 20 units of the entry-level ADV in March last year. This results in YoY growth of 12325 percent.

The list was rounded off by KTM Duke 200 at tenth place with 2226 units sold in March this year. Last year, the Austrian bikemaker was able to sell only 1549 of the naked streetfighter thus resulting in YoY growth of 44 percent.