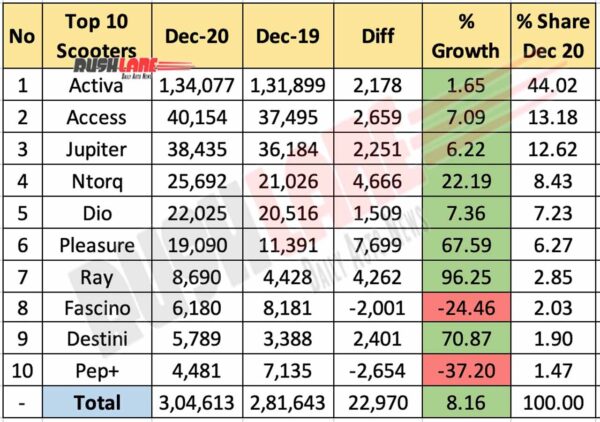

Top 10 scooter wholesales for December 2020 reported at 8.16 percent growth

Top 10 scooter wholesales in December 2020 saw Honda Activa top the charts. As usual. The scooter has been in the market for twenty years following regular updates and revisions. This ensures the top seller continues to have just what it takes to make it a top-notch value proposition.

Honda Activa market share in the top order accounted for 44 percent. Sales grew to 1,34,077 units, up from 1,31,899 units at volume gain of 2,178 units. The majority of scooters that made the list reported growth.

Though a smaller manufacturer by volume in India, Suzuki sees its Access 2nd on the list. Market share rose to 13.18 percent following 7.09 percent growth. Unit sales is reported at 40,154 units, up from 37,495 units at volume gain of 2,659 units.

This would certainly be worth a lot for Suzuki since sales in India is important. The country contributes to about 40 percent of the manufacturer’s global two-wheeler business. Suzuki Access scooter forms the core of SMIPL’s business here.

Scooter sales growth in December 2020

TVS Jupiter wholesales grew 6.22 percent. Volumes are up at 38,435 units from 36,184 units, up by 2,251 units. Market share is only just lower that Access at 12.62 percent. Next is TVS Ntorq. Wholesales were up by 22.19 percent. Volumes grew to 25,692 units, up from 21,026 units.

Honda Dio wholesales grew by about 1.5k units. Numbers are reported at just over 22k units, up from 20,516 units. Market share among the top order its reported at 7.23 percent.

Hero MotoCorp scooter sales

While Hero MotoCorp dominates the market as a top seller, its scooter sales have always been lower than motorcycle sales. And quite noticeably too. Just last month, the manufacturer’s top 2 selling motorcycles reported wholesales of just below 3.5 lakh units.

| No | Top 10 Scooters | Dec-20 | Dec-19 |

|---|---|---|---|

| 1 | Honda Activa (+2%) | 1,34,077 | 1,31,899 |

| 2 | Suzuki Access (+7%) | 40,154 | 37,495 |

| 3 | TVS Jupiter (+6%) | 38,435 | 36,184 |

| 4 | TVS Ntorq (+22%) | 25,692 | 21,026 |

| 5 | Honda Dio (+7%) | 22,025 | 20,516 |

| 6 | Hero Pleasure (+68%) | 19,090 | 11,391 |

| 7 | Yamaha Ray (+96%) | 8,690 | 4,428 |

| 8 | Yamaha Fascino (-24%) | 6,180 | 8,181 |

| 9 | Hero Destini (+71%) | 5,789 | 3,388 |

| 10 | TVS Scooty Pep+ (-37%) | 4,481 | 7,135 |

| – | Total | 3,04,613 | 2,81,643 |

However, where scooters are concerned, sales is relatively small-ish. It’s highest selling scooter being Pleasure. Wholesales hovered around 19k units. And this was a vast improvement. Compared to a year earlier, growth was reported at 67.59 percent, up from 11,391 units. So, while Hero’s scooter range isn’t small, sales continue to be low.

Yamaha gets on board with Ray. Sales almost doubled. Up at 8,690 units from 4,428 units at 96.25 percent growth. In effect, Yamaha India sales is quite limited. Given that, Ray volumes despite being small, do in fact make up for a substantial chunk of sales for Yamaha. Next on the list was Yamha Fascino. Sales fell by almost a quarter. Volumes declined to 6,180 units fro 81,80 units at volume loss of about 2k units.

Hero Destini scooter sales surpassed the 5k unit mark. Growth was reported at 70.87 percent at volume gain of 2.4k units. Wholesales grew to 5,789 units , up from 3,388 units. TVS Pep+ decline was reported at 37.20 percent. Sales fell to 4,481 units from 7,135 units. Cumulative wholesales for the top 10 scooters his reported at 3,04,613 units at 8.16 percent growth. Volumes were up from 2,81,643 units at volume gain of almost 23k units.