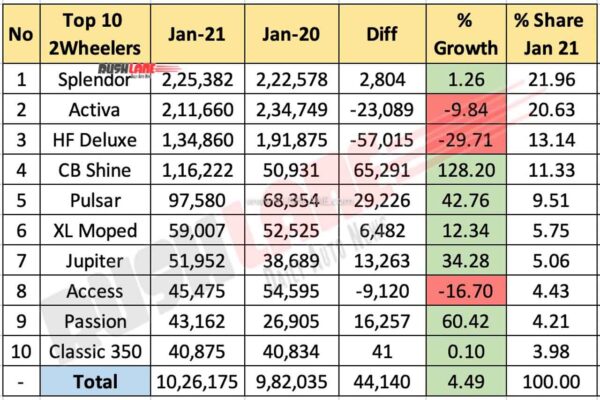

Top 10 two-wheeler wholesales reported at 4.49 percent growth in January 2021

Two wheeler wholesales for the top 10 entries improved 4.49 percent in January 2021. Total wholesales grew to 10,26,175 units, up from 9,82,035 units at volume gain of just over 44k units.

As always Hero Splendor tops the chart at 2,25,382 units at 1.26 percent growth. Volumes grew by just under 3k units, up from 2,22,578 units. This ensured that in the top order, Splendor accounts for 21.96 percent market share. While the motorcycle remains an all time high seller, as always

Honda Activa sales decline

Honda Activa scooter maintains its top-selling scooter position. Wholesales last month were reported at 2,11,382 units. Not only did volumes decline by about 10 percent, the contraction meant Honda lost its top of the chart position from a year earlier.

It’s not always the the scooter is able to pip Splendor to the post. Sales fell from 2,34,749 units, down by 23k units for a market share of 20.63 percent. The leading duo comfortably claims over 40 percent of this table.

Hero HF Deluxe sales fell noticeably at about 30 percent. Volumes dwindled to 1,34,860 units from 1,91,875 units at volume loss of 57k units. Honda CB Shine sales for than doubled having gained the most last month. Wholesales grew to 1,16,222 units, up from 50,931 units at volume gain of 65,291 units. Growth was reported at 128.20 percent.

Bajaj Pulsar sales growth

Bajaj Pulsar series sales maxed out at juts under a lakh units. The voluminous data totals to 97,580 units, up from 68,354 units at volume gain of over 29k units. This took its market share to a gainful territory of just below 10 percent.

While mopeds have long being axed by leading manufacturers, TVS XL continues to buck the trend. Being a one of its kind two-wheels is its value proposition. Wholesales are reported at 59k units at 12.84 percent growth. Sales grew from 52,525 units at volume gain of 6,482 units.

| No | Top 10 2Wheelers | Jan-21 | Jan-20 | % Growth |

|---|---|---|---|---|

| 1 | Splendor | 2,25,382 | 2,22,578 | 1.26 |

| 2 | Activa | 2,11,660 | 2,34,749 | -9.84 |

| 3 | HF Deluxe | 1,34,860 | 1,91,875 | -29.71 |

| 4 | CB Shine | 1,16,222 | 50,931 | 128.20 |

| 5 | Pulsar | 97,580 | 68,354 | 42.76 |

| 6 | XL Moped | 59,007 | 52,525 | 12.34 |

| 7 | Jupiter | 51,952 | 38,689 | 34.28 |

| 8 | Access | 45,475 | 54,595 | -16.70 |

| 9 | Passion | 43,162 | 26,905 | 60.42 |

| 10 | Classic 350 | 40,875 | 40,834 | 0.10 |

| – | Total | 10,26,175 | 9,82,035 | 4.49 |

TVS’ bestselling scooter, Jupiter sits 7th on the list. Wholesales is reported at 51,952 units, up from 38,689 units at volume gain of 13,263 units. Growth stood at over a third.

Suzuki Access scooter sales decline is at 16.70 percent. Wholesales fell to 45,475 units, down from 54,595 units at volume loss of 9,120 units. Hero Passion motorcycle sales grew significantly at the tail-end. Wholesales are reported at 43,162 units, up from 26,905 units at volume gain of over 16k units. Classic 350, Royal Enfield’s sole entry in the top order saw wholesales remain flat at 40,875 units. A year earlier that number was reported at 40,834 units.