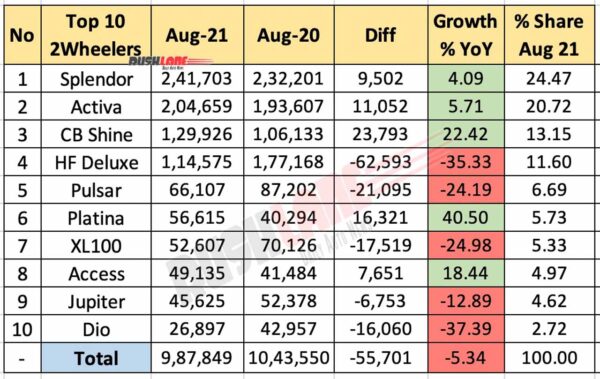

Top 10 two wheeler wholesales reported a 5.34 percent sales decline in August 2021

The auto industry has put its best foot forward to address matters that have limited performance. Current market performance continues to be tepid for the most part. The top 10 two wheelers sold have collectively reported a decline. While automakers continuously gauge customer needs to launch two wheelers across segments, it’s been a tough action plan in recent months. Hero MotoCorp continues to put in a leading performance.

Top 10 Two Wheelers Aug 2021 – Hero Splendor sales highest

Some scooter sales in the top 10 list continue to see a positive growth. The market has been going through a transition phase with a select few products/manufacturers seeing faster growth than the industry average. Hero Splendor continues to lead the table. Wholesales was reported at 2,41,703 units, up from 9,32,201 units. Sales volume gain stood at just over 9.5 k units at 4.09 percent growth. In the top 10 order, Hero Splendor claimed almost 25 percent market shared.

Honda continues to strategically position it as a lifestyle brand through new segments.Honda has been promising new products for a while now, and it would be interesting to see what product launch it plans next. A popular notion points to a small cc mass market motorcycle.

Just over 2 lakh units of Honda Activa were sold, up from 1,93,607 units. Volume gain stood at over 11k units at 5.71 percent growth. Honda CB Shine, the automaker’s bestselling motorcycle saw sales just under 1.3 lakhs. Sales grew from 1,06,133 units at volume gain of 23,793 units. Volume growth stood at 22.42 percent.

Hero HF Deluxe sales fell noticeably at 35.33 percent decline. Sales is down at 1,14,575 units from 1,77,168 units. Volume loss stood at 62,593 units. Bajaj Pulsar series sales fell by almost a quarter, down to just over 66k units. Sales fell from 87,202 units. Volume loss stood at 21,095 units. Bajaj Platina sales growth was the highest in the top 10 two-wheelers sold. Sales grew from about 40k units to 56,615 units at 40.50 percent. Sales volume growth stood at 16,321 units.

TVS top-sellers volume decline

TVS XL100 moped sales fell by almost a quarter. Sales was down to 52,607 units, down from just over 70k units. Volume loss stood at 17,519 units. Suzuki Access scooter sales grew to almost 50k units. Volume gain stood at 7,651 units, up from 41,484 units at sales growth of 18.44 percent.

TVS Jupiter sales fell by almost 13 percent, down to just over 45k units. Sales fell from 52,378 units at volume loss of 6,753 units. Honda Did scooter sales decline was the steepest in the top 10 two-wheelers list. Sales fell to 26,897 units, down from 42,957 units. Volume loss stood at just over 16k units at sales decline of 37.39 percent. Total sales of the top order is reported ay 9,87,849 units, down from 10,43,550 units. Volume loss stood at over 55k units at 5.34 percent decline.

| Top 10 Two Wheelers | Aug-21 | Aug-20 | % |

|---|---|---|---|

| 1. Hero Splendor | 2,41,703 | 2,32,201 | 4.09 |

| 2. Honda Activa | 2,04,659 | 1,93,607 | 5.71 |

| 3. Honda CB Shine | 1,29,926 | 1,06,133 | 22.42 |

| 4. Hero HF Deluxe | 1,14,575 | 1,77,168 | -35.33 |

| 5. Bajaj Pulsar | 66,107 | 87,202 | -24.19 |

| 6. Bajaj Platina | 56,615 | 40,294 | 40.50 |

| 7. TVS XL100 | 52,607 | 70,126 | -24.98 |

| 8. Suzuki Access | 49,135 | 41,484 | 18.44 |

| 9. TVS Jupiter | 45,625 | 52,378 | -12.89 |

| 10. Honda Dio | 26,897 | 42,957 | -37.39 |

| Total | 9,87,849 | 10,43,550 | -5.34 |

In select segments, sales continues to grow faster than market. So, while overall market growth was negative for the top order, some growth was positive, which is not an an easy task in a sceptic market. We have also seen faster growth than average market numbers for a band of electric two wheeler manufacturers. Of course, one should remember volumes for such products remains small compared to the full market size.

In certain scenarios, It is evident there is latent demand for big bikes, given their higher performance, and longer lifecycle among rural and urban customers. A company can be said to have innovated if its products are seen as offering new features to meet consumer needs. But in recent months, new product launches have been select, and few and far in between.