Taking note of the large number of uninsured two and four wheelers on the road today, the Supreme Court has passed a new order. From 1st September 2018, all vehicles running on Indian roads will have three and five years third party insurance cover.

A circular issued on August 28 by Insurance Regulatory and Development Authority of India (IRDAI), follows a Supreme Court order dated 20th July 2018, wherein insurers have been directed to offer 3 year motor third party cover for all new cars and 5 year policies for all new two wheelers purchased after the 1st September period.

Third party motor insurance cover being made mandatory for 5 years on all two wheelers in India will see prices of these products increase substantially. Premiums for bikes purchased after this period will rise 2.45-5.16 times. While currently motor insurance premiums have to be paid on policies on a yearly basis. This means, all two wheelers in India – from entry level like Honda Activa, Hero Splendor to mid range KTM Duke 390, Bajaj Dominar, Royal Enfield, to high-end sportsbikes – all will get expensive.

Third party insurance cover means a cover against liabilities if the vehicle is involved in an accident wherein injury or death is caused to a third party. In this case, the insurance company will be liable to pay claim to the third party if the accident is deemed to be the fault of the owner of the insured two wheeler. As per the new regulation, premium will be collected for the entire period of 5 years at the time of sale of the two wheeler itself.

The new order, coming into effect from 1st September 2018, will offer the insured two wheeler owner two options – A long term package cover offering both motor third party insurance and own damage insurance for 5 years or a bundle cover with a 5 year term for the third party component and 1 year term for own damage. In the case of own damage, the motor insurance cover will protect the vehicle against physical damage. In the event of long term own damage, the two wheeler owners will not be applicable to no claims bonus on own damage vehicles but only when the police term comes to an end.

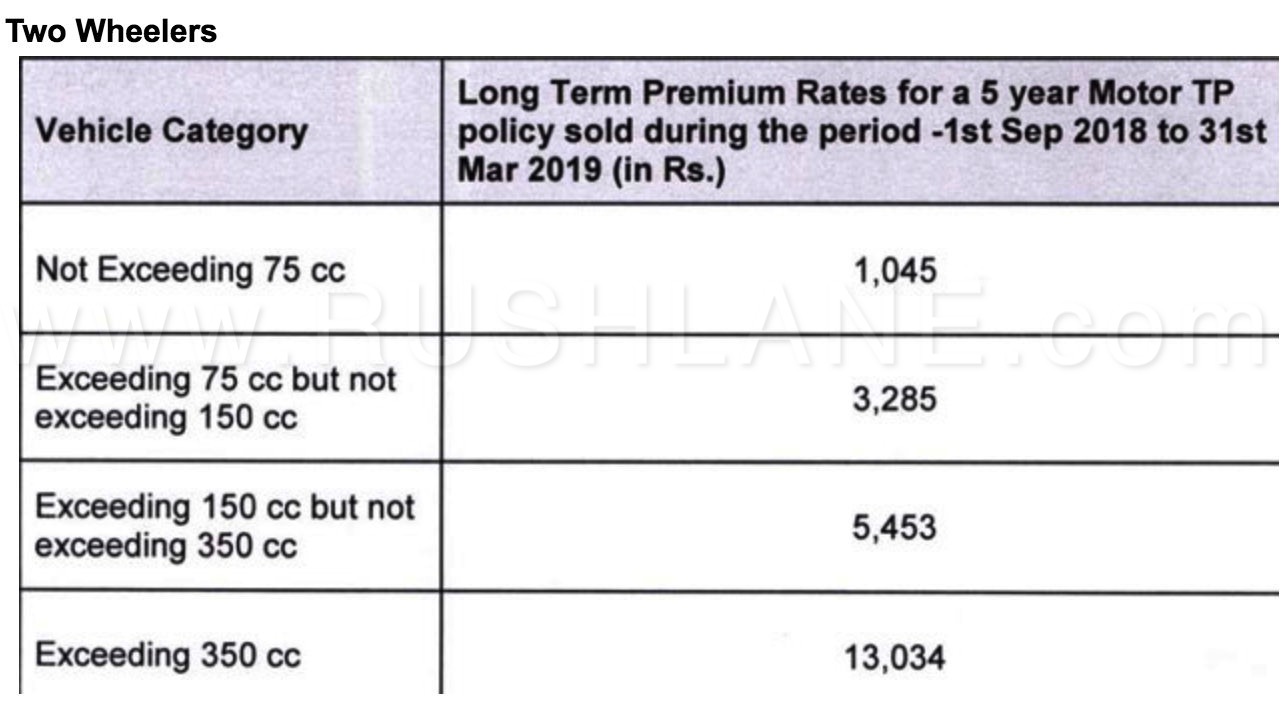

Following this new order, long term premium rates for 5 years on two wheelers sold during the period 1st September 2018 to 31st March 2019 will vary according to vehicle capacity. For two wheelers upto 75cc, the premium rate would be Rs 1,045. Two wheelers in the 75cc-150cc category will be Rs 3,285 while vehicles in the 150-350cc would stand at Rs 5,453. All two wheelers above 350cc will entail an insurance premium of Rs 13,035 for the said period.