Two wheeler retail sales dipped 10.67 percent in February 2022 with Hero MotoCorp and Honda leading the segment

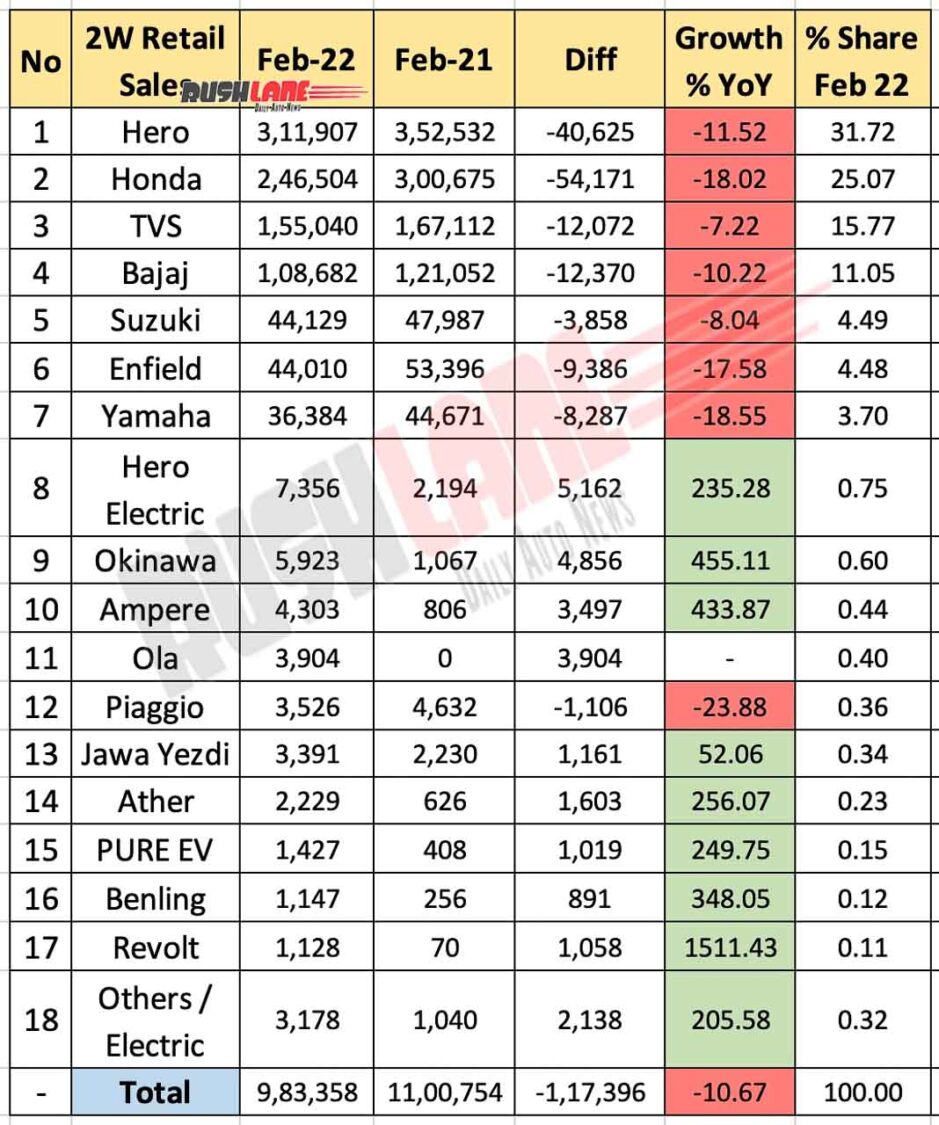

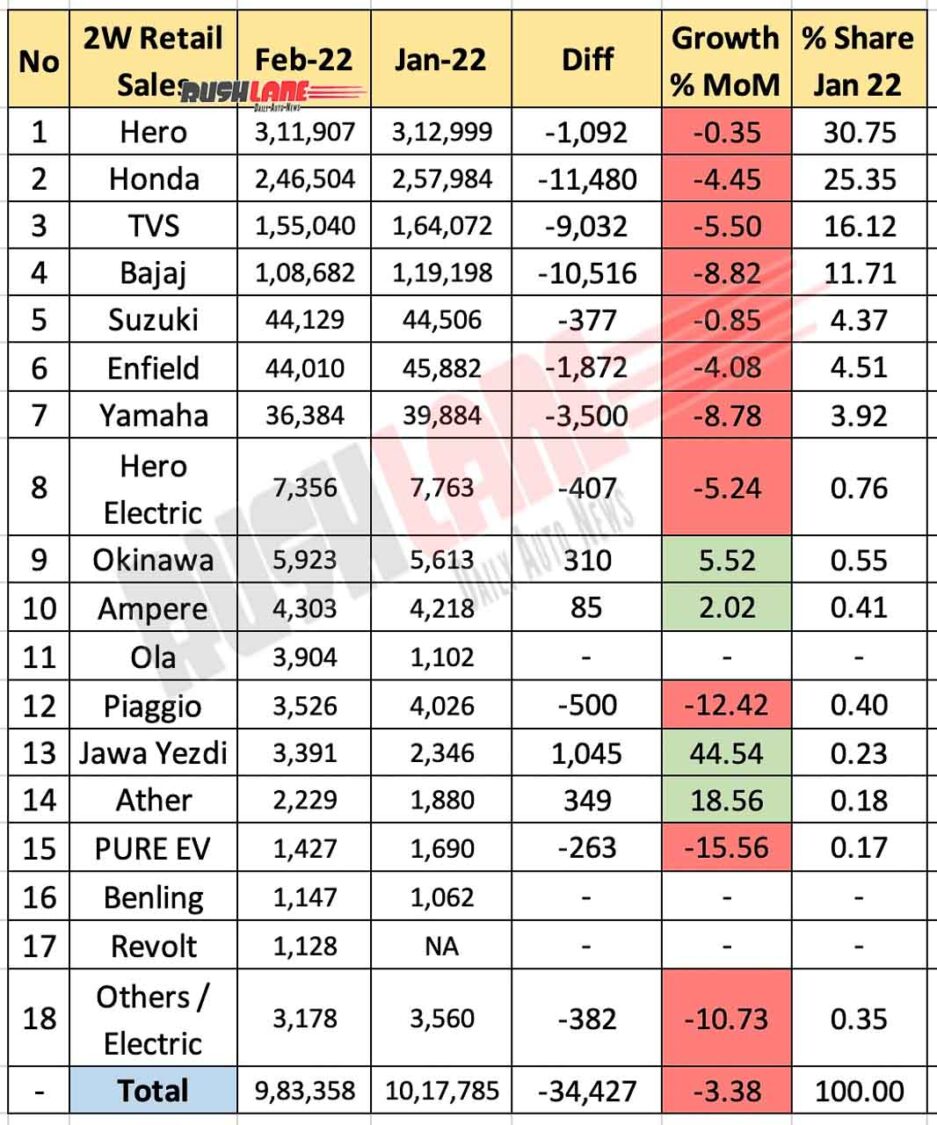

As per data sourced by Federation of Automobile Dealers Associations (FADA), two wheeler retail sales in February 2022 dipped to 9,83,358 units, down 10.67 percent from 11,00,754 units sold in February 2021. It was also a de-growth of 24.39 percent as against 13,00,588 units sold in February 2020, which was the last pre-Covid month.

There are several factors that brought about this de-growth. Rising fuel prices have played a major part in decreased sales of petrol powered two wheelers while there is a definite shift in demand towards electric two wheelers as is evident from the table attached. Sales de-growth across the two wheeler segment has been compounded by the continued work-from-home corporate culture and the fact that several educational institutions are yet to open up after two yearlong closure due to the pandemic.

Two Wheeler Retail Sales Feb 2022 – Hero Leads

Hero MotoCorp led the segment with sales of 3,11,097 units in February 2022, down from 3,52,532 units sold in February 2021. Market share dipped from 32.03 percent held in February 2021 to 41.64 percent last month. Hero MotoCorp continued to see good demand for its Glamour, Splendor, Passion and HF Deluxe but has now announced its entry into the electric two wheeler segment and has unveiled its new brand ‘Vida’ with its first initiative will be the launch of an electric vehicle on July 1.

Honda Motorcycle and Scooter India (HMSI) saw its retail sales at 2,46,504 units in February 2022 with market share at 25.07 percent. This was against 3,00,675 units sold in February 2021 when market share was higher at 27.32 percent. HMSI also plans to launch multiple new products. The Honda Activa electric will be launched in India by 2023 and will be seen as a rival to the likes of Ola S1, Bajaj Chetak, TVS iQube and upcoming Suzuki Burgman Electric.

At No. 3 was TVS Motor Company with retail sales de-growth at 1,55,040 units in the past month, down from 1,67,112 units sold in February 2021. Market share increased from 15.18 percent to 15.77 percent YoY.

Bajaj Auto posted retail sales at 1,08,682 units, down from 1,21,,052 units sold in February 2021. Apart from these 4 two wheeler OEMs, none of the others were able to surpass the 50,000 unit mark in terms of retail sales. Suzuki (44,129 units), Royal Enfield (44,010 units) and India Yamaha Motors (36,384 units) posted YoY de-growth in retail sales.

Electric two wheeler OEMs Post Growth

Two wheeler OEMs, such as Hero Electric, Okinawa and Ampere have seen significant increase in demand in recent months. Hero Ekectric retail sales increased to 7,356 units last month, up from 2,194 units retailed in February 2021. Okinawa sales stood at 5,923 units in February 2022 from 1,067 units sold in the same month of the previous year while Ampere sales were at 4,303 units from 806 units retailed in February 2021. Each of these electric two wheeler OEMs have also seen a significant increase in market share.

Ola Electric, a newcomer to this segment registered retail sales at 3,904 units last month. Piaggio with retail sales at 3,526 units in the past month suffered a de-growth over 4,632 units retailed in February 2021 while Classic Legends Jawa and Yezdi (3,391 units), Ather Energy (2,229 units), Pur Energy (1,427 units) and Benling (1,147 units) each posted significant YoY growth in retail sales. Revolt sales also increased from 70 units in February 2021 to 1,128 units in the past month while there were other OEMs in the electric vehicle segment that have reported retails at 3,178 units, up from 1,040 units retailed in February 2021.