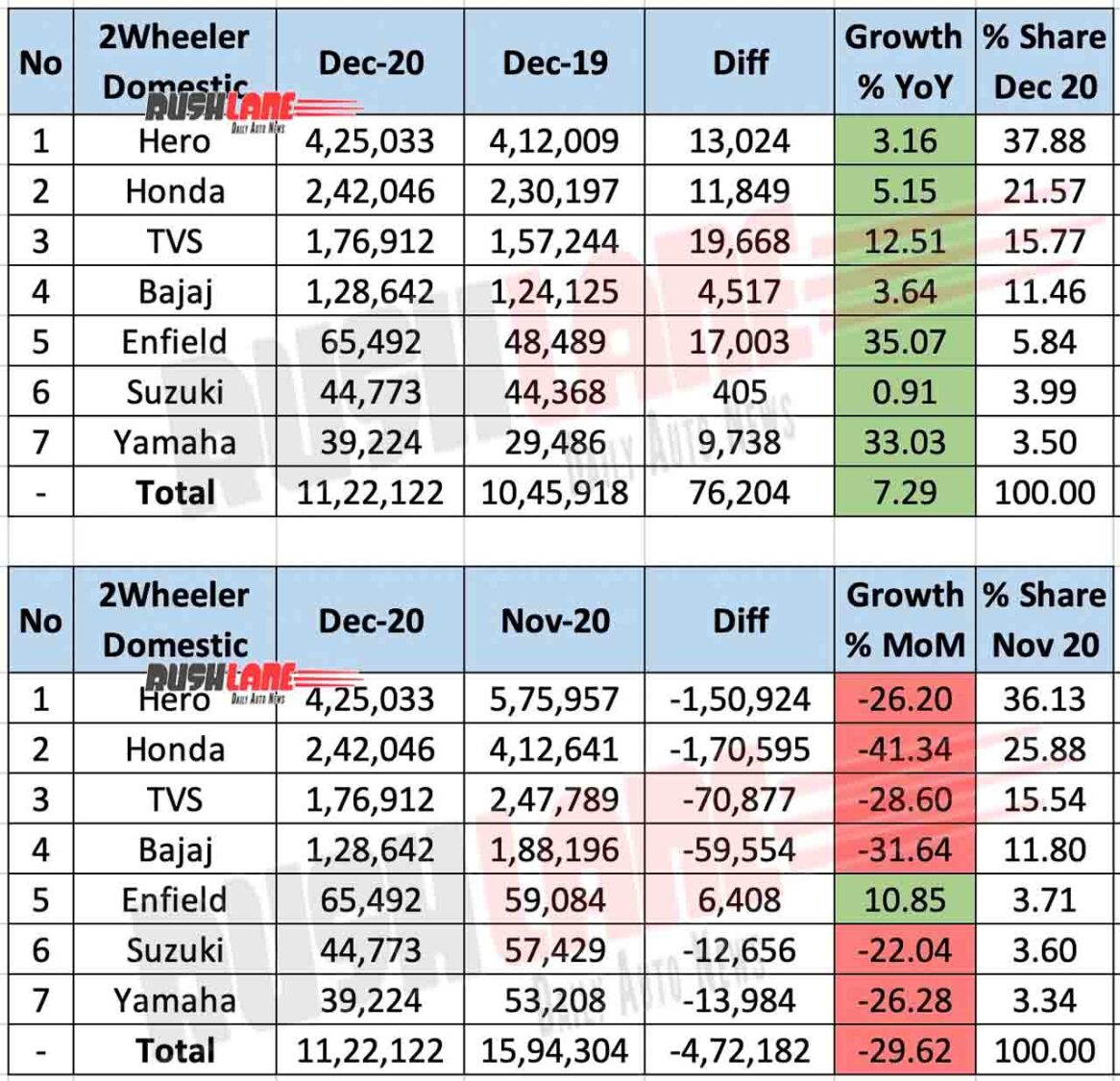

Ruling the domestic sales charts were Hero MotoCorp and Honda while Bajaj and TVS Motor claimed top spots in terms of exports.

2020 may have opened on a dismal note but ended with two and four wheeler makers noting a comeback in terms of sales. December sales indicated a change in customer sentiments especially with the urgent need for more personal means of travel as averse to public transport.

Two wheeler companies reported a 7.29 percent YoY increase in domestic sales while exports also surged 29.18 percent. Total domestic sales which had stood at 10,45,918 units in Dec 19 increased to 11,22,122 units in the past month while exports went up 29.18 percent from 2,66,864 units exported in Dec 19 to 3,44,731 units in the past month.

Hero MotoCorp and Honda

Domestic sales of Hero MotoCorp increased 3.16 percent to 4,25,033 units in Dec 20 as against 4,12,009 units. The company currently commands a market share of 37.88 percent.

However, when compared to Nov 20, sales which had stood at 5,75,957 units, sales dipped by 26.20 percent MoM. The scurry to make purchases in the last month of the year could be due to the fact that Hero announced price hike from1st Jan 2021 of almost all its motorcycles and scooters up to a maximum of Rs. 1,900.

Honda sales also noted a significant increase by 5.15 percent in the past month. Sales which had stood at 2,30,197 units in Dec 19 increased to 2,42,046 units in Dec 20. This was a 41.34 percent decline as against 4,12,641 units sold in Nov 20. Honda Activa made up for nearly 50 percent of company sales in Dec20 with the CB Shine, Dio, Unicorn, Livo, Grazia, Hornet and newly launched CB350 also adding significant numbers.

At No. 3 was TVS Motor with sales growth of 12.51 percent in Dec 20 to 1,76,912 units, up from 1,57,244 units sold in Dec 19 but a decline of 28.60 percent when compared to 2,47,789 units sold in Nov 20. Currently commanding market share of 15.77 percent TVS Motor Company has noted strong sales for its models such as the XL Super, Jupiter, Apache and Ntorq.

Bajaj Auto Limited was at No. 4 with a 3.64 percent YoY sales increase to 1,28,642 units, up from 1,24,125 units sold in Dec 19. MoM sales declined 31.64 percent as against 1,88,16 units sold in Nov 20. The Pulsar, Platina and CT range were the highest sellers in domestic markets. The company also launched the new Platina 100 Kick Start in December priced at Rs.51,667. Royal Enfield, Suzuki and Yamaha also saw increased sales in Dec 20 over sales in Dec 19 while Royal Enfield was the only two wheeler maker to note positive MoM sales which increased 10.85 percent over sales in Nov 20.

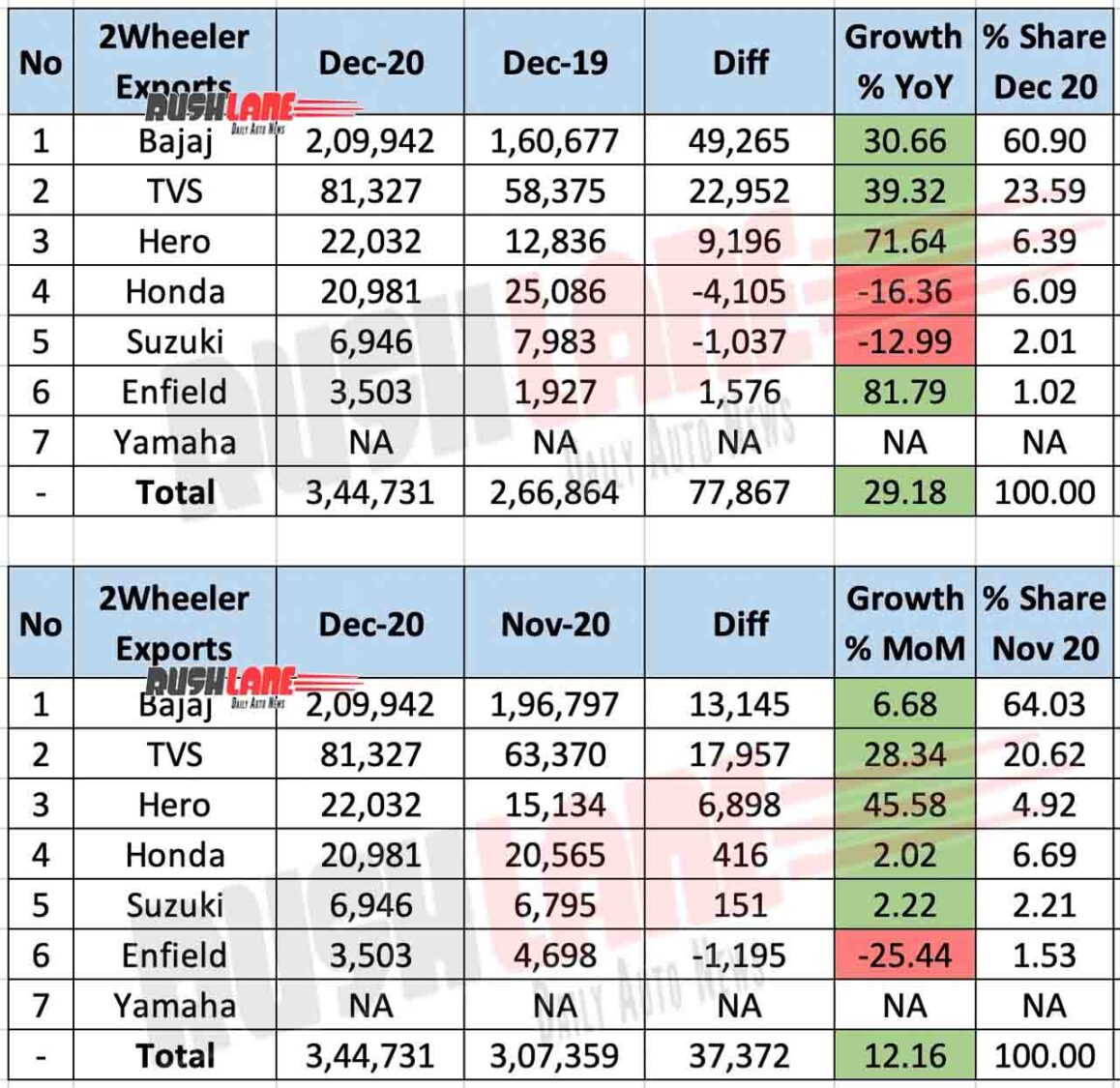

Two Wheeler Exports Dec 20

Bajaj Auto Limited command a significant proportion of total exports in December 2020. While total exports of two wheelers stood at 3,44,731 units, Bajaj Auto alone exported 2,09,942 units in the past month. The Pune based two wheeler experienced a 30.66 percent YoY growth as against 1,60,677 units exported in Dec 19 while MoM exports grew by 6.68 percent with 1,96,797 units exported in Nov 20. Leading the exports were the Boxer and Pulsar range. It may also be noted that Bajaj Auto has become the most valuable two-wheeler company in the world with a market capitalization of Rs. 1 lakh crore.

Exports of TVS Motor surged 39.32 percent in Dec 20 to 81,327 units, up from 58,375 units exported in Dec 19. MoM exports also increased significantly by 28.34 percent as against 63,370 units exported in Nov 20. Exports of Honda dipped 16.36 percent YoY from 25,086 units exported in Dec 19 to 20,981 units exported in the past month while the company experienced a marginal MoM increase by 2.02 percent with 20,565 units exported in Nov 20.

Even as Hero MotoCorp and Royal Enfield closed the past year with rising YoY exports up 71.64 percent and 81.79 percent respectively, Suzuki exports dipped 12.99 percent in terms of YoY but increased marginally by 2.22 percent MoM.