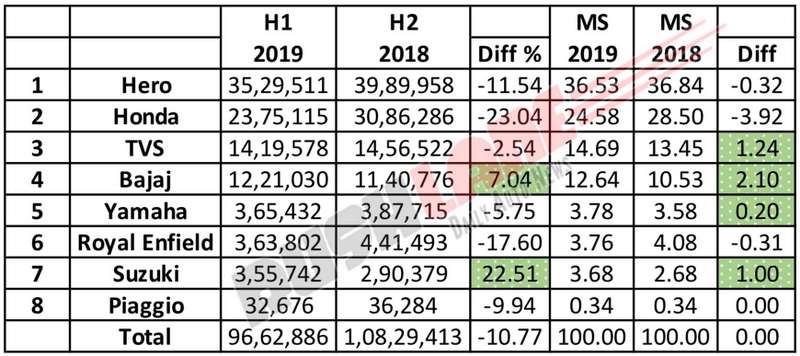

Two wheeler sales in India have declined for the 9th consecutive month. Hero MotoCorp sales dipped 11.54 percent to 35,29,511 units in the H1 2019 period as against 39,89,958 units sold in the same period of the previous year. Market share of the company dipped 0.32 percent to 36.53 percent in 2019 as compared to 36.84 percent in the 2018 period.

Honda Motorcycle and Scooter India have also witnessed a slowdown in sales in H1 2019 by 23.04 percent. Sales in this period stood at 23,75,115 units as against 30,86,286 units sold in H1 2018. Market share fell by 3.92 percent to 24.58 percent as compared to a market share of 28.50 percent in H1 2018. Honda registered the highest decline in market share as well as sales percentage. This was because of the decline in sales of their best selling product – Activa.

TVS Motors, India’s third largest two wheeler manufacturer, saw sales dip 2.54 percent in H1 2019 to 14,19,578 units as against sales of 14,56,522 units sold in H1 2018. Market share increased 1.24 percent to 14.69 percent in the H1 2019 period. This was as compared to a market share of 13.45 percent in the same period of the previous year.

Bajaj Auto Limited posted positive sales in H1 2019. Sales which had stood at 11,40,776 units in H1 2018 increased 7.04 percent to 12,21,030 units in the H1 2019 period. Market share of the company also increased 2.10 percent to 12.64 percent in H1 2019 as against 10.53 percent in H1 2018 period.

Yamaha Motor India, actively gearing up to introduce BS VI bikes from November this year, well ahead of the April 2020 deadline has noted diminishing sales in H1 2019 by 5.75 percent. Sales in the H1 2019 period stood at 3,65,432 units as against sales of 3,87,715 units in the H1 2018 period. However, market share increased marginally by 0.20 percent from 3.58 percent to 3.78 percent respectively in the two periods in question.

Royal Enfield sales also fell 17.60 percent in the H1 2019 period to 3,63,802 units as compared to 4,41,493 units sold in H1 2018. Market share also dipped 0.31 percent to 3.76 percent from 4.08 percent in the H1 2019 and H1 2018 periods respectively. Following the recent launch of the Bullet 350X, the company has announced a reduction in maintenance charges for its range of bikes which will now be 40 percent cheaper to maintain.

Suzuki Motorcycle India has reported an increase in sales in H1 2019 period by 22.51 percent. Sales in this period stood at 3,55,742 units, as against sales of 2,90,379 units in the H1 2018 period. Market share also increased by 1 percent to 3.68 percent in H1 2019, as compared to 2.68 percent in H1 2018. Piaggio India sales dipped 10.77 percent in H1 2019 to 32,676 units as against 36,284 units sold in the H1 2018 period while there was no difference in market share.

Total two wheeler sales in the H1 2019 stood at 96,62,886 units, down 10.77 percent as compared to sales of 1,08,29,413 units in the H1 2018 period. The scenario is likely to remain unchanged in view of the abnormal monsoon pattern seen throughout the country, rural distress and poor consumer sentiments.